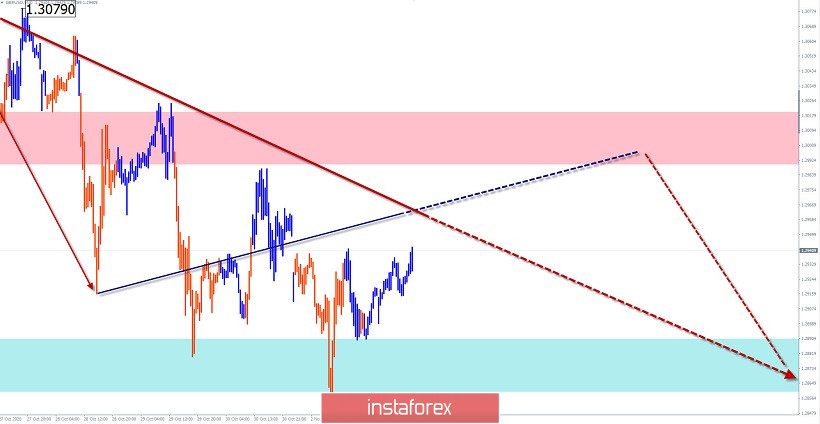

GBP/USD

Analysis:

The latest wave structure that is relevant for short-term trading on the chart of the major British pound is ascending, starting from September 10. On October 21, a corrective decline began towards the main exchange rate.

Forecast:

Today, the price is expected to move in the corridor between the opposite zones. In the first half of the day, pressure on the amount of support is likely. By the end of the day, you can expect price growth, up to the resistance zone.

Potential reversal zones

Resistance:

- 1.2990/1.3020

Support:

- 1.2890/1.2860

Recommendations:

Trading on the British pound market today can be unprofitable and is only possible during sessions. Purchases of the instrument are more promising.

USD/JPY

Analysis:

The unfinished section in the dominant downward wave of the Japanese yen counts down from October 7. In the last 2 weeks, the pair's quotes form a correction of the wrong type. The movement is nearing completion.

Forecast:

Today, we expect a general flat mood of price movement in the corridor between the nearest zones. After pressure on the support zone, the rate will continue to develop mainly with an upward vector.

Potential reversal zones

Resistance:

- 105.10/105.40

Support:

- 104.40 / 104.10

Recommendations:

In the conditions of the upcoming flat, trading on the pair's market may become risky. It is safer to buy from the area of the support zone. It is wiser to reduce the lot.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements in time!