GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed an increase to 1.3135 over the past day, after which they turned in favor of the US currency and fell to the corrective level of 38.2% (1.2985). In total, the pair's quotes went up 220 points yesterday, and down 200 points tonight. Thus, the "roller coaster" is also present here, since the presidential election in the United States concerns all pairs in which the dollar is present. Meanwhile, if you pay attention to the news that came from the UK or rather news related to Brexit, we can assume a new drop in the British dollar in the coming days. So far, traders are trading solely based on American elections and vote counting. However, when this process is completed, they will again begin to pay attention to an equally important topic for the pair - the topic of Brexit. And in the last few days, several representatives of the European Union, in particular the European Commission, said that the parties have not yet been able to reach a common decision on key issues. Moreover, the European Commission made a statement that London did not give an official response to the claims of the European Union regarding Britain's violation of the Brexit agreement, which was concluded in 2019. Let me remind you that Boris Johnson submitted a bill "on the internal market of Great Britain", which violates some points of the agreement with the European Union. Parliament approved the bill in two readings, however, the final vote will take place later, when it becomes clear whether there will be a trade deal between London and Brussels or not. At the same time, the European Union intends to use legal pressure on Britain because of a possible violation of the Brexit agreement.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a reversal in favor of the US currency and consolidated under the corrective level of 38.2% (1.3010), which allows us to count on a further drop in quotes in the direction of the next Fibo level of 50.0% (1.2867). However, as in the case of the European, I recommend paying more attention to the hourly chart today, which shows changes in the mood of traders more quickly.

GBP/USD – Daily.

On the daily chart, the pair's quotes have consolidated below the corrective level of 76.4% (1.3016), which now allows us to expect a fall in the direction of the next corrective level of 61.8% (1.2709).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair closed under the lower downward trend line, thus, a false breakout of this line followed earlier. However, in recent weeks, the pair has made new attempts to gain a foothold over both trend lines.

Overview of fundamentals:

There were no economic reports or other important events in the UK on Tuesday, other than data related to the trade deal negotiations. However, they were not taken into account by traders.

News calendar for the US and the UK:

UK - PMI for services (09:30 GMT).

US - change in the number of employees from ADP (13:15 GMT).

US - composite ISM index for non-manufacturing (15:00 GMT).

On November 4, the UK news calendar contains only the business activity index for the service sector. In America, more important reports will be released, as well as the counting of votes in the elections continues. And it is this information that will be most important for traders today.

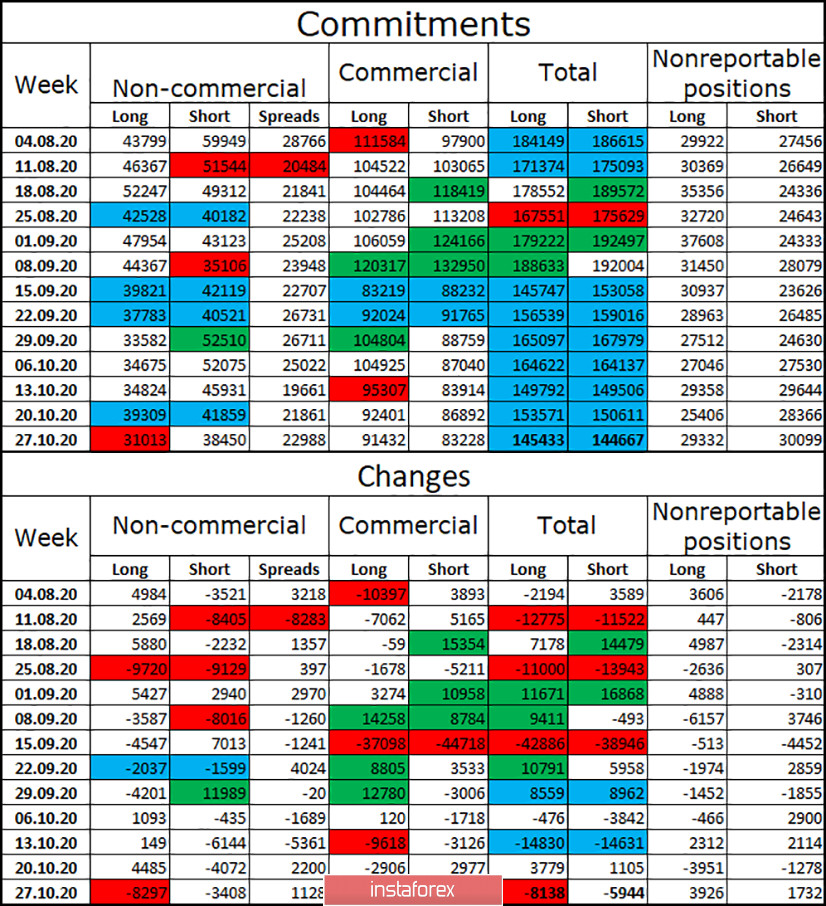

COT (Commitments of Traders) report:

The latest COT report on the British pound showed that the mood of the "Non-commercial" category of traders became more "bearish" over the reporting week. Speculators got rid of 8,297 long contracts and 3,408 short contracts. Thus, in general, speculators got rid of any contracts for the British. However, it is mostly from long-contracts. This suggests that the major players do not believe in the pound. It is extremely difficult to do this in the current conditions, as the prospects for the British economy remain extremely vague. Since August, the total number of long contracts in the hands of speculators has decreased to an absolute minimum – only 31,013. The total number of open contracts among all categories of traders has been almost the same for two months.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend selling the GBP/USD pair with targets of 1.2925 and 1.2866, if the quotes close under the Fibo level of 38.2% (1.2985) on the hourly chart. I recommend buying the British dollar with the goals of 1.3057 and 1.3135 if the rebound from the level of 1.2985 is made on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.