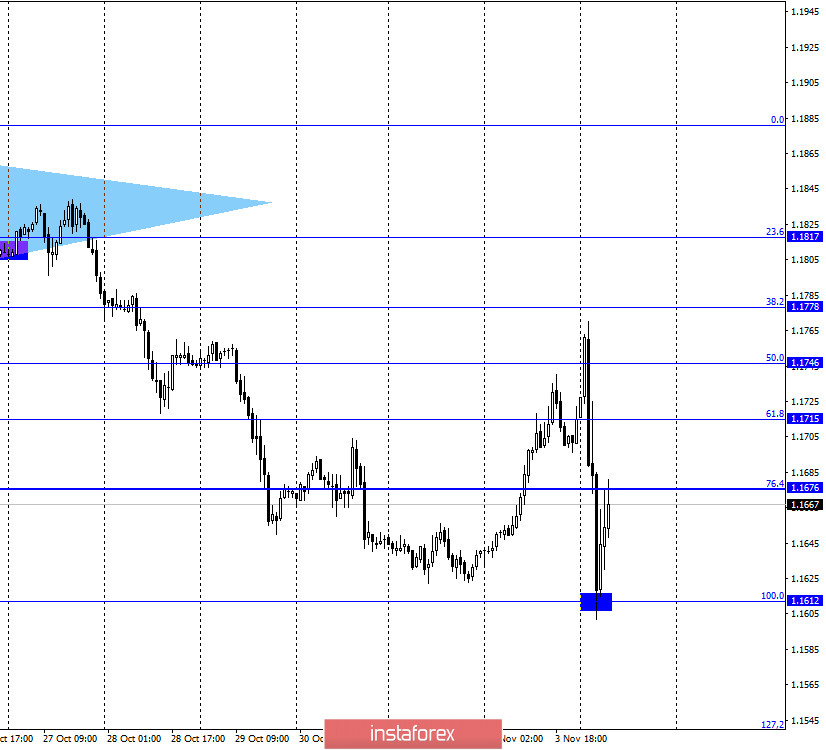

EUR/USD – 1H.

On November 3, the EUR/USD pair continued the growth process all day to the corrective level of 50.0% (1.1746). However, this night, when the polls in America closed, the voting was officially completed and the counting of votes began. The pair performed a sharp reversal in favor of the US currency and fell to the level of 100.0% (1.1612) in a matter of hours. The rebound of quotes from this level worked in favor of the European currency and growth to the corrective level of 76.4% (1.1676). And all together it can be called a "roller coaster". At the moment, about 70% of all votes have already been counted and the first data that more or less accurately reflects the picture of the election has been received. As of the morning of November 4, Joe Biden is winning the election, having already received 223 electoral college votes. However, Donald Trump also won a fairly large number of votes – 174. Let me remind you that you need to get 270 votes to win. So far, it is unclear what to do with the 100 million Americans who voted early or by mail. Are their votes taken into account in the overall rating? After all, Donald Trump has previously stated that counting votes by mail may take weeks. However, we will rely on official data provided by American sources responsible for counting votes. Today's day for the euro/dollar pair may pass again in quite active movements since there are no final voting results yet.

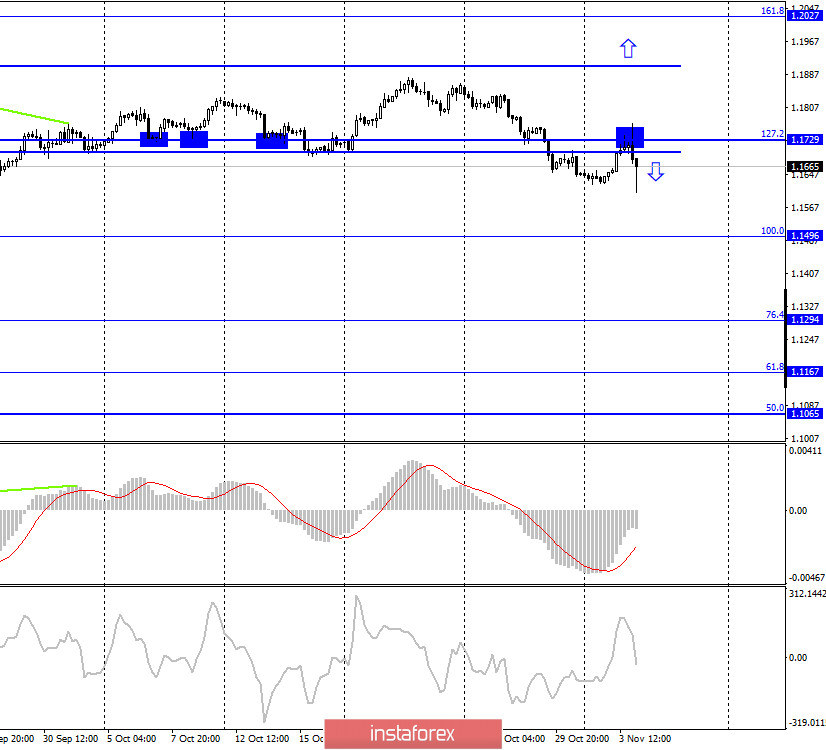

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes performed an increase this night to the corrective level of 127.2% (1.1729). The rebound of quotes from this Fibo level worked in favor of the US currency and the resumption of the fall in the direction of the corrective level of 100.0% (1.1496). At the same time, the movements of the last 24 hours cannot be fully evaluated. Traders were clearly in a state of excessive excitement, which may continue throughout the day. Thus, it is better to use an hourly chart for trading the pair, where you can track changes as quickly as possible.

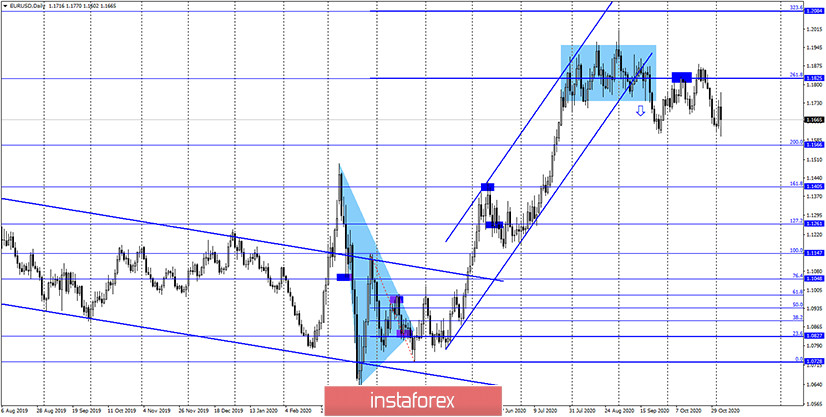

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a new rebound from the corrective level of 261.8% (1.1825), after which the quotes began and continue to fall in the direction of the Fibo level of 200.0% (1.1566). Closing the pair's rate below this level will increase the chances of a further fall towards the level of 161.8% (1.1405).

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair, but in the long term. In the short term, a drop is preferable.

Overview of fundamentals:

On November 3, the European Union and America did not have a single economic report or other events. All the attention of traders was focused exclusively on the elections in America.

News calendar for the United States and the European Union:

EU - index of business activity in the service sector (09:00 GMT).

US - change in the number of employees from ADP (13:15 GMT).

US - composite ISM index for the non-manufacturing sector (15:00 GMT).

On November 4, vote counting will continue in the United States, and quite important ADP and ISM reports will be released. In the European Union, an insignificant index of business activity in the service sector will be released today.

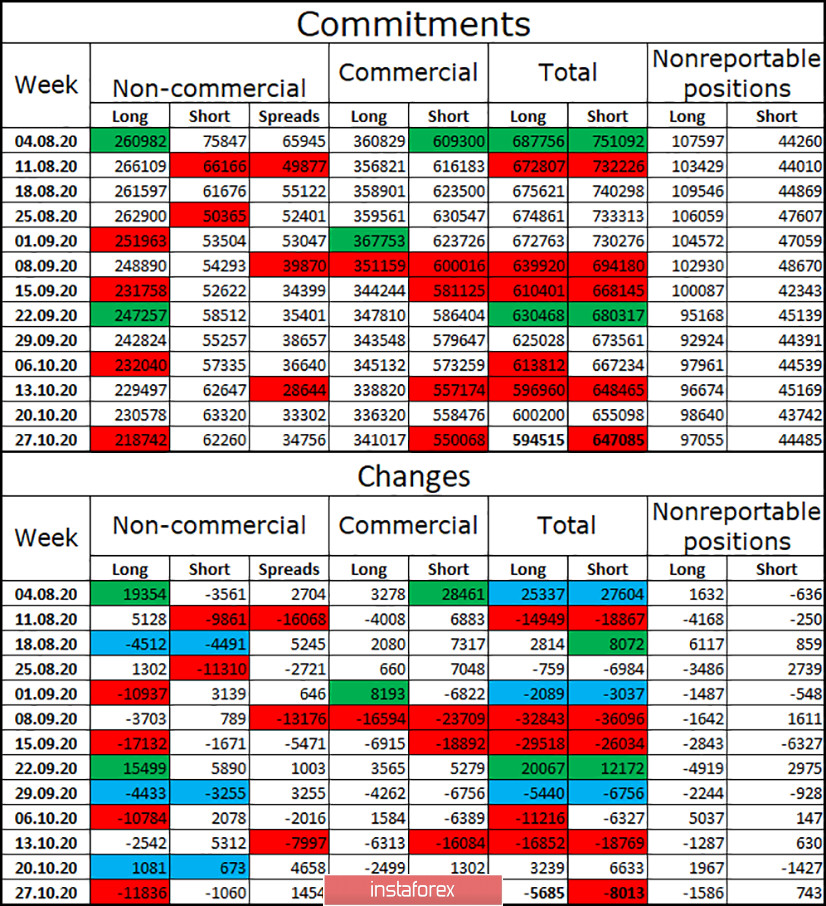

COT (Commitments of Traders) report:

The latest COT report was quite informative. The most important category of non-commercial traders got rid of 12 thousand long contracts and 1 thousand short contracts during the reporting week. Thus, speculators do not believe in the further growth of the European currency and get rid of more purchases of this currency. This process, I must say, has been going on for several weeks, so a trend is emerging. Over the past two months, the total number of long contracts in the hands of speculators has been steadily falling, while the number of short contracts has been growing slightly. Thus, I am inclined to the option with a further fall in the euro currency quotes.

Forecast for EUR/USD and recommendations to traders:

Today, I recommend opening new sales of the euro currency with a target of 1.1612, if the rebound from the Fibo level of 76.4% (1.1676) is completed. Purchases of the pair will be possible with targets of 1.1715 and 1.1746 if the quotes consolidate above the level of 76.4% on the hourly chart. Traders' activity may remain high today.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.