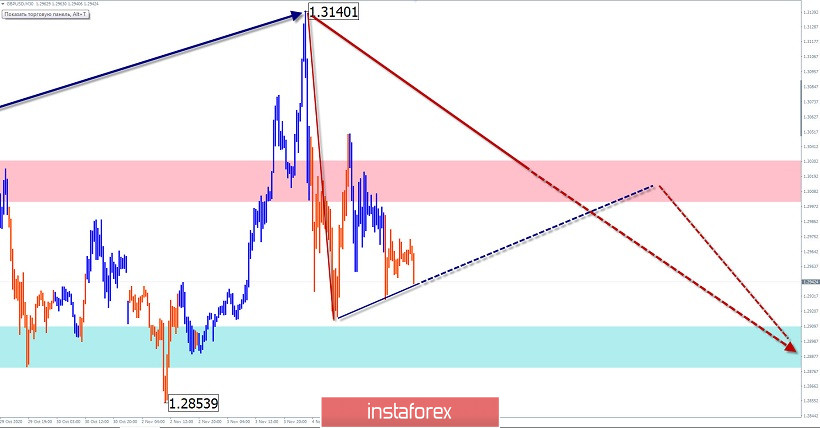

GBP/USD

Analysis:

The direction of the main movement vector of the British pound since October 21 is set by a downward wave. The wave structure completed a correction in the form of a stretched plane yesterday. The decline that has begun further has a reversal potential.

Forecast:

The most likely scenario today is the price moving sideways. At the European session, you can expect an attempt to put pressure on the calculated resistance. By the end of the day, the probability of a change of course and a decline in the support area increases.

Potential reversal zones

Resistance:

- 1.3000/1.3030

Support:

- 1.2910/1.2880

Recommendations:

In the upcoming flat, buying the pound is risky. In the resistance zone, it is recommended to track the reversal signals for selling the instrument.

USD/JPY

Analysis:

On a large scale of the Japanese yen major chart, the price moves mainly horizontally. The current wave for short-term trading is descending, starting from October 7. Its structure has completed a flat correction (B). The decline that started yesterday has a reversal potential and may be the beginning of the final part (C).

Forecast:

In the next trading session, it is most likely to move in the side plane. An upward vector, no further than the calculated resistance, is not excluded. By the end of the day, you can expect activation and a second decline down.

Potential reversal zones

Resistance:

- 104.60/104.90

Support:

- 103.90/103.60

Recommendations:

Trading on the yen market today is only possible within the intraday. There are no conditions for purchases. At the end of the upcoming pullback up, it is recommended to track the emerging signals for selling the pair.

USD/CHF

Analysis:

In the short term, the downward wave from September 25 serves as a benchmark for analysis and trading. In its structure, the first two parts (A-B) are completed. Since November 4, a downward movement has been developing, with a reversal potential. If the reversal is confirmed, this will be the beginning of the final part (C).

Forecast:

Today, the pair is expected to move in the price corridor between the opposite zones. An upward trend is likely in the European session. By the end of the day, it is expected to return to the main direction.

Potential reversal zones

Resistance:

- 0.9150/0.9180

Support:

- 0.9090/0.9060

Recommendations:

Trading on the pair's market today is possible within sessions with a reduced lot. When buying, you need to take into account the limited growth potential. After the appearance of reversal signals in the resistance zone, priority should be given to sales.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the instrument's movements in time!