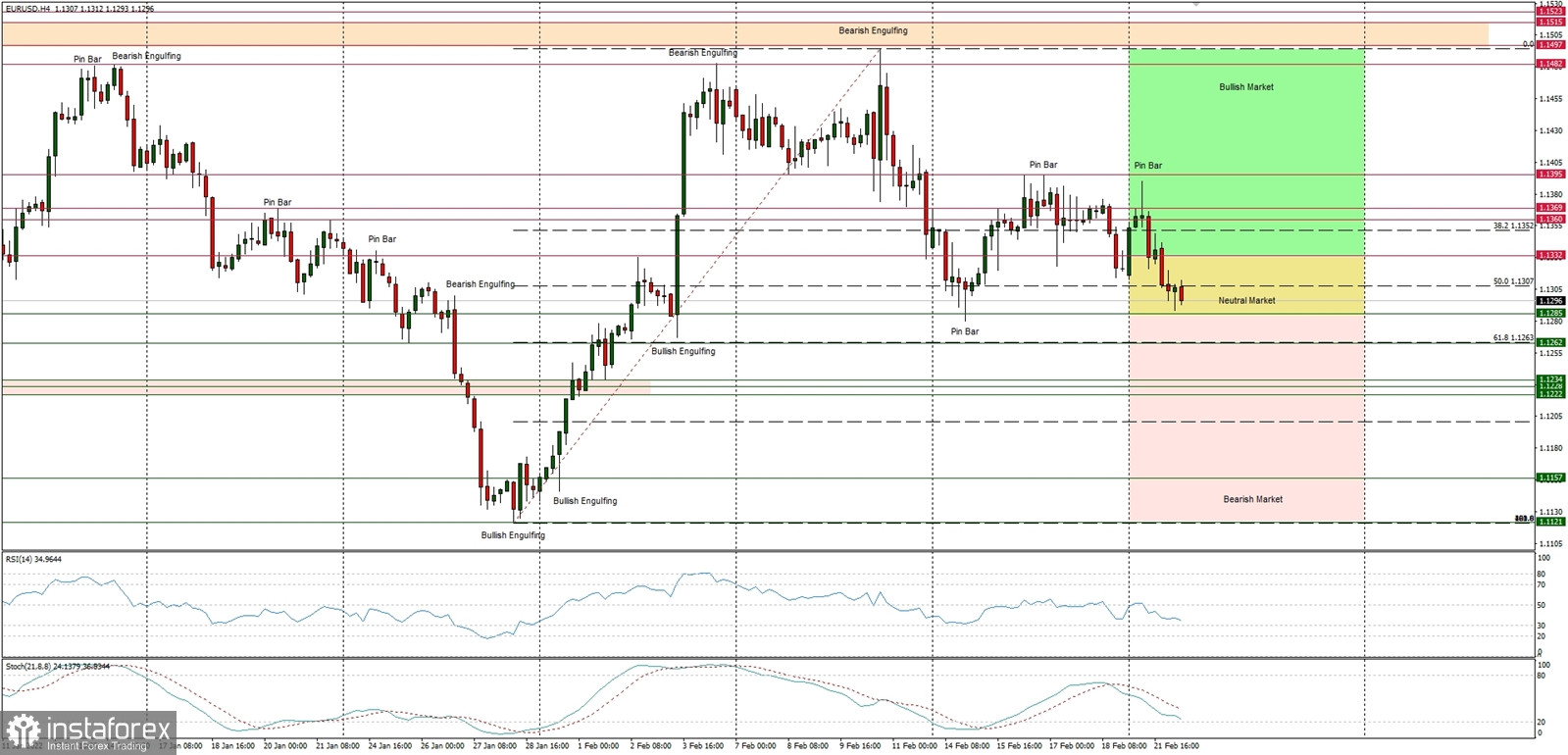

Technical Market Outlook

The EUR/USD pair has bounced from the level of 1.1307, but the bounce was very short-lived and now the market is testing the neutral zone lower level. Any violation of this level would open the road towards the next technical support seen at 1.1262 (this level is a 61% Fibonacci retracement level as well). On the other hand, the key target for EUR/USD bulls is the short-term supply zone located between the levels of 1.1497 - 1.1513 and if this zone is clearly violated, then the market might continue the up move for the longer period of time. This is why this zone is so important and bears are defending the zone quite effectively. Please notice, that the bearish zone starts with the level of 1.1285.

Weekly Pivot Points:

WR3 - 1.1488

WR2 - 1.1410

WR1 - 1.1376

Weekly Pivot - 1.1327

WS1 - 1.1259

WS2 - 1.1208

WS3 - 1.1144

Trading Outlook:

The recent big Bullish Engulfing candlestick pattern seen at the weekly time frame chart indicates a strong rebound, but the market is still in control by bears that pushed the price way below the level of 1.1501, so a breakout above this level is a must for bulls for a trend reversal. The next long-term technical support is located at 1.1167. The up trend can be continued towards the next long-term target located at the level of 1.2350 (high from 06.01.2021) only if bullish cycle scenario is confirmed by breakout above the level of 1.1501 and 1.1599, otherwise the bears will push the price lower towards the next long-term target at the level of 1.1166.