S&P500

Omicron stats for February 22

The markets have been under intense geopolitical pressure, but tensions will begin to subside.

The US market was closed on Monday for the US holiday weekend. The US market ended last week with a decline.

Markets were under heavy pressure on Monday following Putin's decision to recognise DNR and LNR. He ordered the Russian army to provide aid to the republics. The Russian market fell sharply on these reports, with the RTS and MICEX indices dropping 10-13%. The rouble fell against the dollar and the euro to 80 roubles per dollar and 90 roubles per euro.

Futures on the S&P500 index are down by 1.5% on Tuesday, indicating the US market will open lower today.

Japan's indices were down by 1.8%, while China's indices lost 1.6%.

As for the commodity market, crude remains at high levels on Russia-Ukraine tensions. Brent Crude is trading at $96.8 per barrel on Tuesday.

The S&P500 index is trading at 4,349 and is expected to be in the 4,320–4,370 range.

The US and major Western countries have condemned Russia's dramatic recognition of the DNR-LNR. They stated that there would be no real tough sanctions against Russia unless Russia attacked Ukraine outside of the DNR-LNR. This awareness could give a boost to markets today.

Analysts predict that the US could become the world's largest LNG exporter this year. Meanwhile, China was the biggest buyer last year.

As for inflation and rates of the world's main central banks, China left the rate at +3.7%. New US inflation data is expected on Friday.

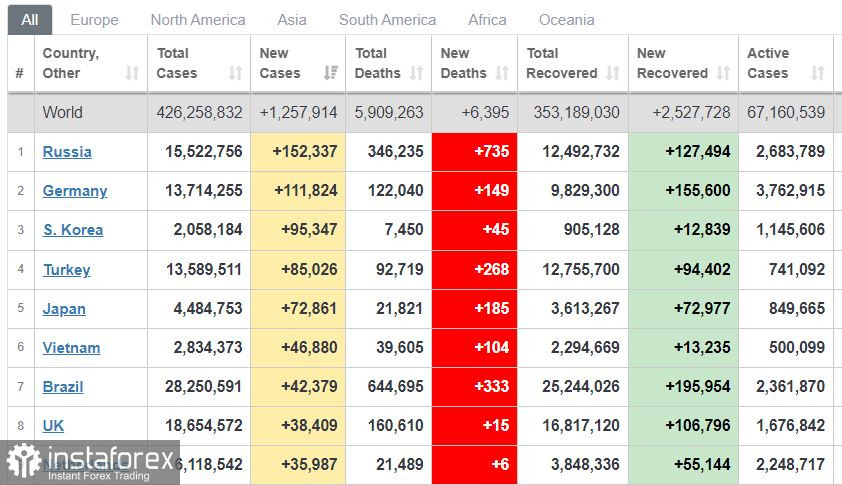

The Omicron outbreak has subdued. There are approximately 3 times fewer cases after the January highs. There were 1.2 million new cases in the world with Russia taking the lead 150,000 new cases. Germany reported 110,000 cases yesterday.

Analysts note that rising oil prices in recent months have boosted shale oil production in the US. At prices around $100, profitability has reached positive range, and some shut-in wells are back in operation.

USDX is trading at 96.10 and is expected to be in the 95.80–96.40 range.

The dollar rose moderately at a time of maximum tension around Ukraine. However, the dollar could rally again as the Fed meeting approaches, at which a 0.5% rate hike is expected.

USDCAD is trading at 1.2750 and is expected to be in the 1.2600–1.2800 range. There could be an attempt to break above 1.2800. However, high oil price is slowing down the move.

The US market is likely to open with a drop of up to 1% today, but then a rise is possible as tensions around Ukraine subside, at least for a while.