The NZD/USD pair resumed its growth as the Dollar Index erased some of its gains. Surprisingly or not, the price stays higher despite the US data coming in better than expected. Technically, the rate is located right below strong upside obstacles. It remains to see how it will react around the RBNZ statement.

As you already know, the Reserve Bank of New Zealand is expected to rise its Official Cash Rate by 0.25%, from 0.75% to 1.00%. The RBNZ Press Conference, RBNZ Rate Statement, and the RBNZ Monetary Policy Statement are likely to bring high volatility in the Asian session.

NZD/USD still bullish

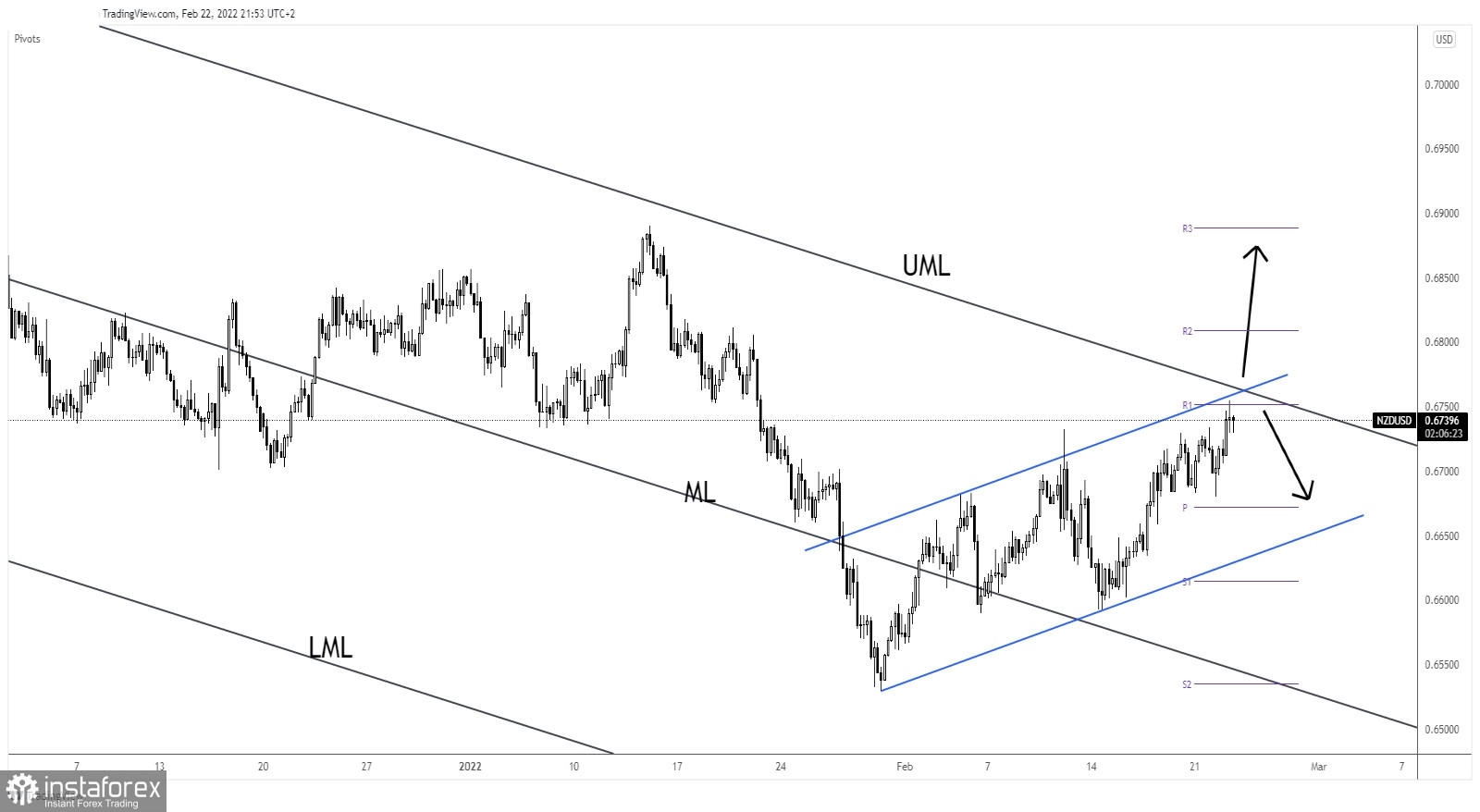

NZD/USD increased within an up channel and now is almost to reach and retest the upside line and the major descending pitchfork's upper median line (UML). The weekly R1 (0.6751) represents an upside obstacle as well.

We have a strong confluence area at the intersection between the upper median line (UML) with the channel's upside line.

NZD/USD prediction

A valid breakout through the confluence area may activate an upside continuation and bring fresh long opportunities.

A false breakout above the immediate resistance levels, through the confluence area, may announce that the swing higher ended and that the rate could come back down.