According to the forecasts by analysts at CITI, the US dollar is on track to lose 20% of its value. Market participants are agitated about this outlook. Does it make sense to believe in this viewpoint? What does it rest upon? Obviously, this forecast is sure to arouse attention among investors because of its catchy heading. Analysts seem to be longing for attention from mass media and market participants. Let's assume the US dollar will fall 20% in value. Against what currency? Speaking about the US dollar index, the US currency will lose the most against the euro.

The US Federal Reserve is determined to impose more stimulus measures. At the same time, the ECB has also come up with stimulus solutions. Perhaps, the European regulator will launch a much bigger stimulus program. The major difference is that yields of the US Treasuries are higher than the ones of the European bonds. The ongoing crisis revealed that global risk aversion sharply boosts demand for the US dollar. It is a good idea to get to know viewpoints of various experts. Nevertheless, you should mull over before you believe in the broad-based weakness of the US dollar.

The opposite viewpoint was suggested by TD Securities. Today they predicted that the US dollar would climb 2% in the nearest months. The greenback will find solid support from soaring coronavirus cases worldwide and contraction of the global economy. This is a short-term outlook. As for the long-term forecast, experts maintain their point that the greenback is doomed for weakness during 2021.

Importantly, lockdowns in European countries will certainly affect the EU gross domestic product. In this context, the euro might drop 2% against the US dollar.

Bloomberg Economics also warns of a severe downturn in the EU economy. The think tank monitors high-frequency indicators. Almost half of the top ten economies have been logging a serious slowdown.

The global death toll amid the COVID-19 pandemic reached a record peak. The level of patients admitted to hospitals is back to 50% from the previous high in some EU countries. Such events are seen as short-term bearish factors for EUR/USD.

When it comes to political prospects in the US, the last week did not clear up the case. Donald Trump does not acknowledge his defeat. However, he is not successful in court proceedings, challenging the outcome of the presidential election. Meanwhile, investors think it's a bad idea to buy the US dollar. No matter how this year ends up. The split of power in the US goes without saying. This derails a budget policy. So, monetary policy is expected to prop up the US economic growth. The US central bank aims to turn on the printing press at its full capacity to mitigate political risks. In such cases, the US dollar tends to lose ground. The COT reports disclose that open interest is in favor of selling.

Nevertheless, if the US dollar weakness comes true, this will hardly play havoc with financial markets. The Fed's cash emissions are unlikely to boost demand for the US currency which could speed up inflation. Analysts warn of financial bubbles. Therefore, some economists foresee not a decline of the US dollar but the same economic conditions in the medium term. So, the greenback is going to keep afloat.

At the same time, analysts do not rule out that the strain on the US dollar could be the main culprit of a fall of the US currency. After the US dollar index tests lows, it will rebound to the current levels.

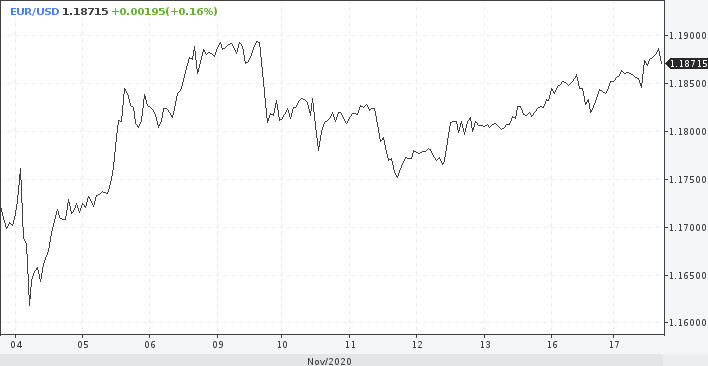

Let's apply this scenario to the EUR/USD pair. It is expected to climb over 1.21 and afterwards make a downward correction to 1.17.