USD/CAD was dropping like a rock at the time of writing. It seems unstoppable as the DXY erased its latest gains. Technically, the currency pair failed to confirm an upside continuation. Actually, the price action signaled that the leg higher is over and that the rate could develop a new leg down.

USD/CAD accelerates its sell-off after the USD was punished by the Chicago PMI. The indicator dropped unexpectedly lower, from 65.2 to 56.3 points far below 62.1 estimates. The Prelim Wholesale Inventories came in better than expected, while the Goods Trade Balance reported bad data.

On the other hand, the Canadian data came in mixed as well. The Current Account was reported at -0.8B versus 2.2B expected, while the IPPI and RMPI reported better than expected data.

USD/CAD outlook

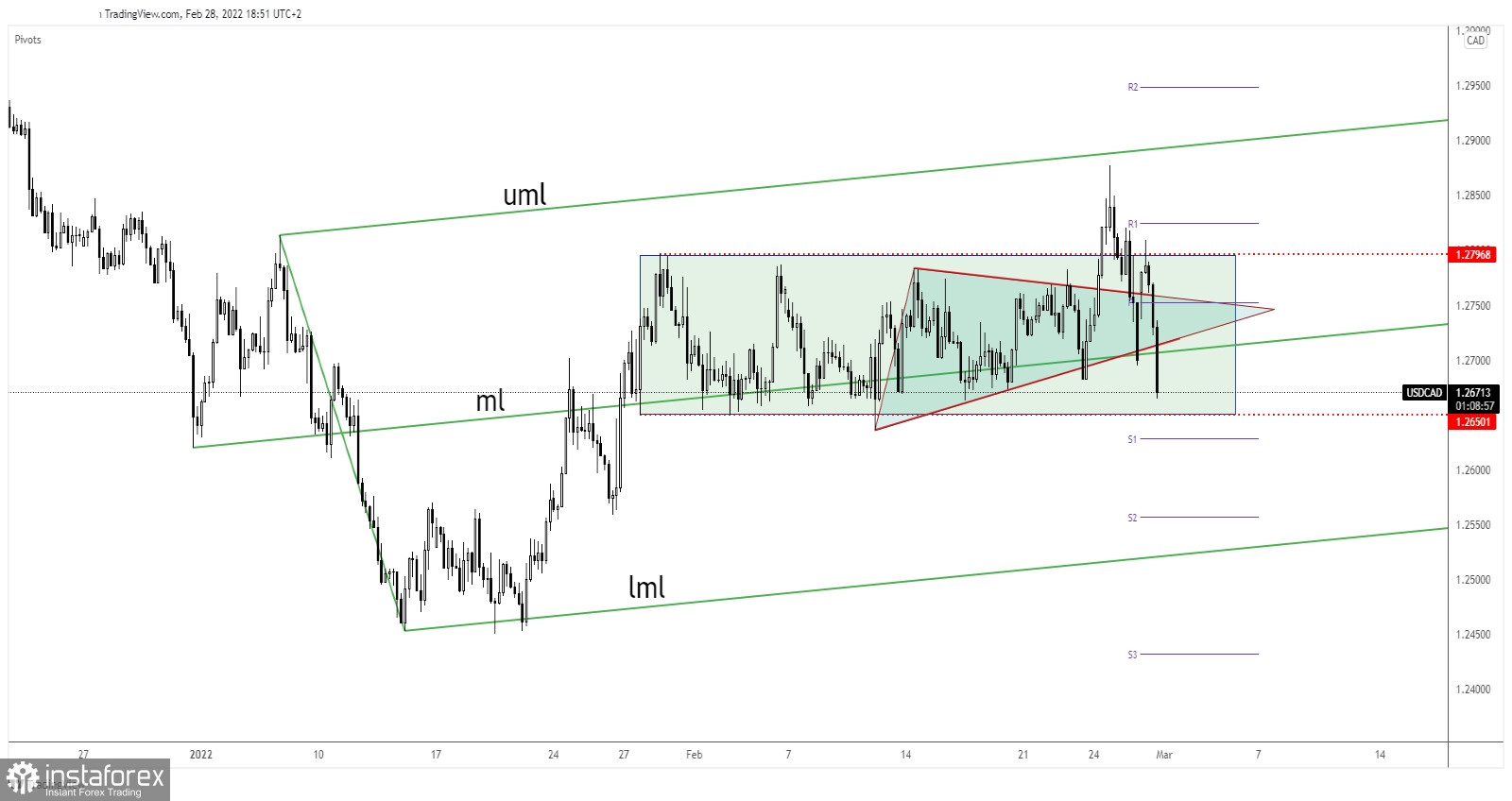

USD/CAD failed to reach the ascending pitchfork's upper median line (uml) which represented a potential upside target signaling that the upwards movement ended. Also, its failure to stay above the 1.2796 level announced a potential drop towards 1.2650 again.

1.2650 range's support stands as a downside obstacle. So, a false breakdown, a bullish pattern, or its failure to reach it could announce that the rate could rebound in the short term. Still, the median line (ml) represented dynamic support, a valid breakdown may signal more declines ahead.

USD/CAD forecast

Validating its breakdown below the median line (ml) and making a new lower low, a valid breakdown below 1.2650 could confirm a further drop and could help the sellers to go short again.