The US dollar index continued to decline towards the level of 0.91 again, after a temporary correction. The indicator was at such a low level more than two years ago, during the 2018 spring. Therefore, the inability of dollar bulls to develop more or less large-scale corrective growth suggests that the US dollar is unwelcomed in the currency market. In the context of the AUD/USD pair, this means that reaching the resistance level of 0.7430 (the upper line of the Bollinger Bands indicator on the daily chart) is only a matter of time.

On the other hand, the market is already preparing for next week's events, which will be a lot and volatile, since today's economic calendar is quite empty. The US dollar is under pressure due to a combination of fundamental factors, which it fails to cope with. For example, any more or less large-scale corrective recession is used by AUD traders as a reason to open longs. The main driving force behind the growth of the AUD/USD pair is the weakening US dollar, which may strengthen its decline throughout the market next week. The Australian currency, in turn, is preparing for RBA's last meeting this year, which will be held next Tuesday, December 1.

In terms of economic data, US Nonfarm will be published next Friday. However, the market already expects disappointing key data on the US labor market. Such conversations appeared after one of the more operational indicators of the US labor market was published – growth of initial applications for unemployment benefits. This indicator entered the red zone again, disappointing dollar bulls. This has been growing for the second week in a row, gradually approaching the 800 thousandth value and showed a stable downward trend from the end of September to the beginning of November.

The publication of data on American spending and income were also disappointing. Here, the level of personal consumer income declined to the level of -0.7%, with a forecasted decline to zero. This is the weakest result since August this year. On the other hand, personal spending showed a similar trend, dropping to 0.5% from the previous value of 1.2%. The Core PCE Price Index also dropped to zero in monthly terms, which is the worst result since April while in annual terms, it slowed to 1.4%.

These are quite alarming signals that indicate that key data on the labor market may come out in the "red zone", indicating negative trends. The above releases have reminded traders once again the consequences of the second wave of COVID-19 in the US.

The US dollar is also under pressure from the coronavirus, which continues to update anti-records in the States, forcing many governors to tighten quarantine restrictions within their regions Hence, the growth in the number of unemployed. The situation worsened significantly in October-November, when the daily cases increased from 46 thousand (October 1) to 180 thousand (November 27). Amid such disastrous tendencies, the US dollar is still managing to defend itself well. In my opinion, the market overestimates the miracle of the COVID-19 vaccine. According to various estimates, the vaccination process will take from 4 to 9 months, since it will not be possible to vaccinate the entire population of the country at once. Therefore, the coronavirus factor will continue to put pressure on the dollar in the near future. The local lockdowns and the Fed's "dovish" monetary policy will contribute to this.

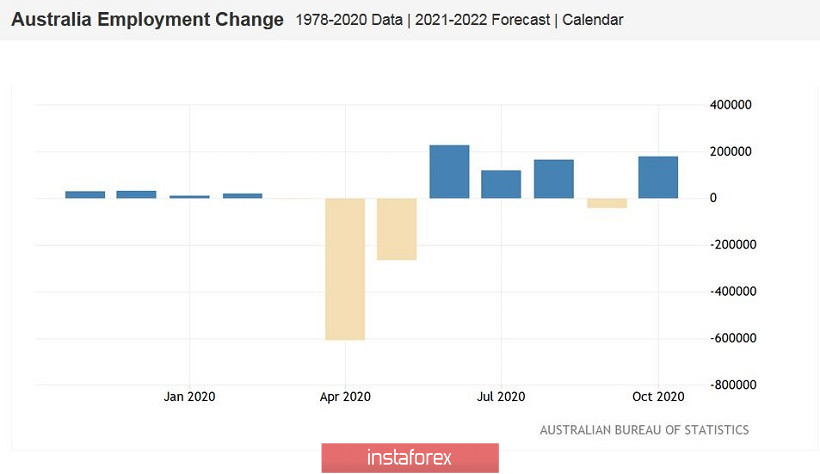

In turn, the Australian dollar feels quite optimistic with the future, at least in the medium term. Australia's latest data on the labor market suggests that RBA members will take a wait-and-see attitude next week. It should be noted that the growth rate of the number of employed in October soared, reaching 178 thousand (with a forecasted decline of 29 thousand). This is the strongest growth rate since June this year, when Australia began to lift the lockdown. This result allows us to count on optimistic assessments from the members of the Australian regulator. Another factor that contributes to the growth of the AUD is the early lifting of strict restrictive measures in South Australia, as there are almost no new cases of COVID-19 in the country.

Therefore, the AUD/USD pair in the medium-term may test another resistance, that is, the level of 0.7430 (upper line of the Bollinger Bands indicator on the daily time frame). Technically, the pair is also inclined upwards. Its price on the same time frame is still between the middle and upper lines of the Bollinger Bands indicator, and the Ichimoku indicator still shows the bullish "Parade of Lines" signal.