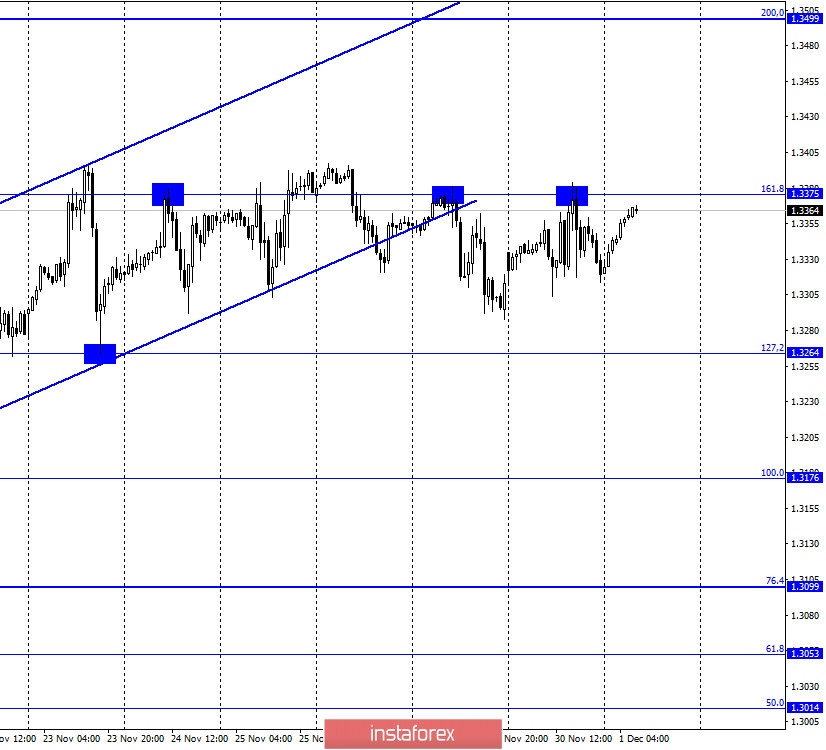

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed another reversal in favor of the British currency, but in general, the last week's trading is held in a fairly narrow side corridor. At the moment, the pair's quotes have again performed an increase to the corrective level of 161.8% (1.3375), from which it has performed a rebound twice in the last two working days alone. Thus, a new rebound of the pair from this level will again allow us to count on a slight drop in quotes to approximately the level of 1.3300. Meanwhile, negotiations on the post-2020 trade relationship between the UK and the EU are continuing. According to both sides, this week will be a key one. Although neither side has explicitly stated that negotiations will not continue if an agreement is not reached this week. It was only said that the European Parliament and the British Parliament will not have time to ratify the agreement if it is agreed in the coming days. Thus, the parties need to hurry. Although they had to hurry in the last few months when it was already clear that the transition period will not be extended. Traders, meanwhile, are openly lying low and waiting for results. The pound has risen in recent months to the level of 1.3400, which is a lot for it in the current conditions. Many analysts believe that the current quotes already take into account the trade deal, which is not even there yet. Therefore, in any case, the British dollar will fall in the near future, whatever the final result of the negotiations between London and Brussels.

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a consolidation under the ascending corridor, as well as on the hourly chart. Thus, the mood of traders should have changed to "bearish" and the pair's quotes began to fall. However, we don't see anything like this yet. The hourly chart shows more clearly that the pair is trading in a sideways corridor. Therefore, from this side of the corridor, I would recommend you to start at this time.

GBP/USD – Daily.

On the daily chart, the pair's quotes continue to grow in the direction of the corrective level of 100.0% (1.3513). However, when trading a pair, I recommend paying more attention to the lower charts. They are now more informative.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes.

Overview of fundamentals:

There were no reports or major events in the UK and the US on Monday. The information background was practically absent on this day.

News calendar for the US and the UK:

UK - PMI for the manufacturing sector (09:30 GMT).

UK - Bank of England Governor Andrew Bailey will deliver a speech (14:00 GMT).

US - ISM manufacturing index (15:00 GMT).

US - Fed Board of Governors Chairman Jerome Powell will deliver a speech (15:00 GMT).

On December 1, Central Bank presidents will speak in America and the United Kingdom. Also, indices of business activity in the manufacturing sectors of these countries will be released. Also, new data on the progress of the Brussels-London negotiations may be received.

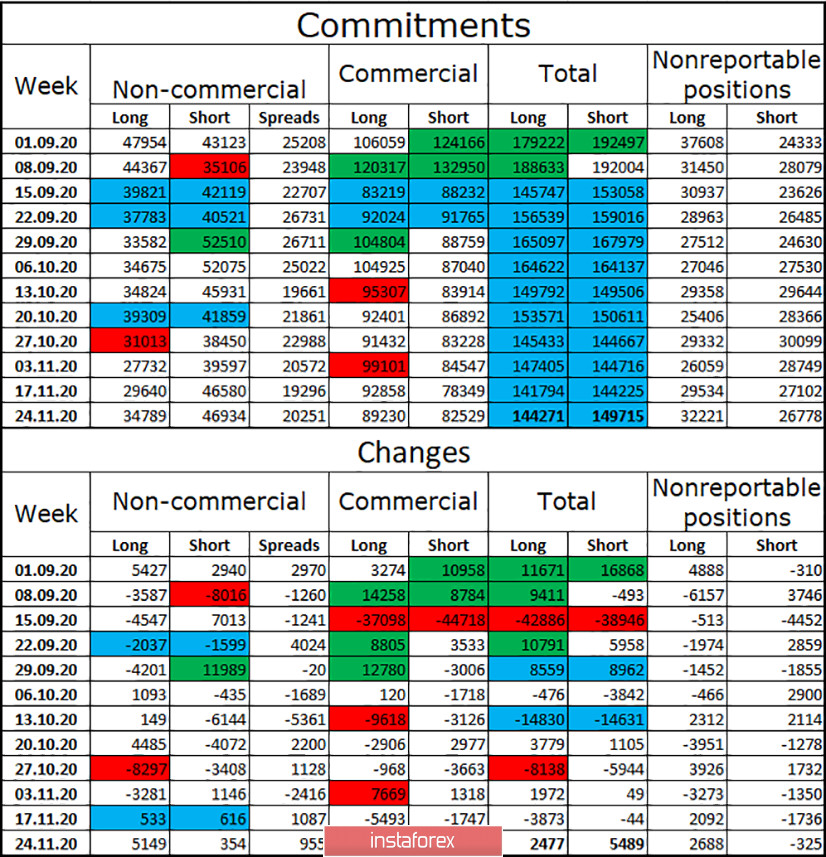

COT (Commitments of Traders) report:

The latest COT report showed a sharp increase in the number of long contracts held by speculators. Thus, the mood for the reporting week in the category of "Non-commercial" traders became more "bullish". However, before that, it became more "bearish" for several weeks, and the British did not get much cheaper. So I believe that one report can't change the mood of speculators dramatically. There were also 354 short contracts opened, which is very small. In general, I can say that the chances of growth for the British dollar have even increased slightly recently, but most other factors still suggest that this currency should start falling in the near future.

Forecast for GBP/USD and recommendations for traders:

Today, I recommend selling the GBP/USD pair with a target of 1.3264, if a new rebound is made from the corrective level of 161.8% (1.3375). I recommend being careful with purchases of the pair now, as the pair's quotes have been fixed immediately between two upward trend corridors.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.