To open long positions on EURUSD, you need:

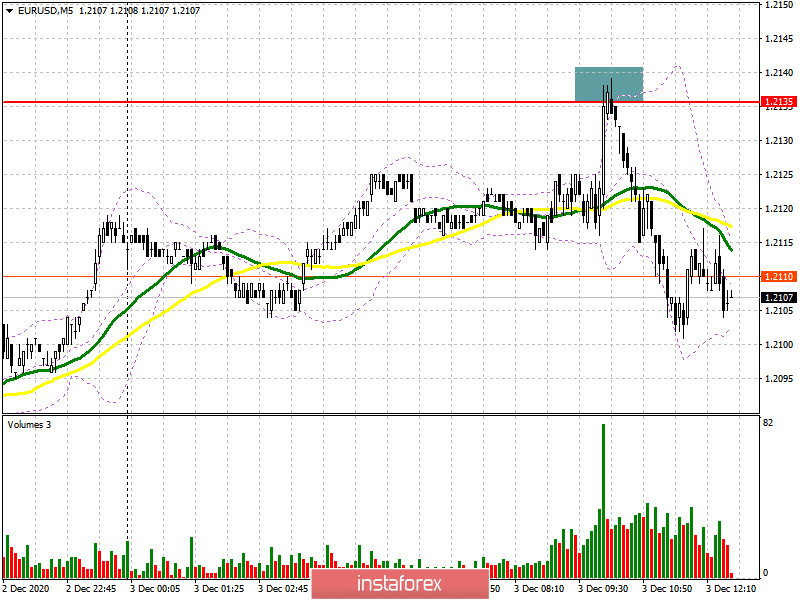

In my morning forecast, I paid attention to sales after a false breakout in the resistance area of 1.2135, which happened. If you look at the 5-minute chart, you will see how buyers make an unsuccessful attempt to consolidate above 1.21352, forming a false breakout, which became a signal to open short positions. We discussed a similar sell signal yesterday. The target of the sellers is the support of 1.2089.

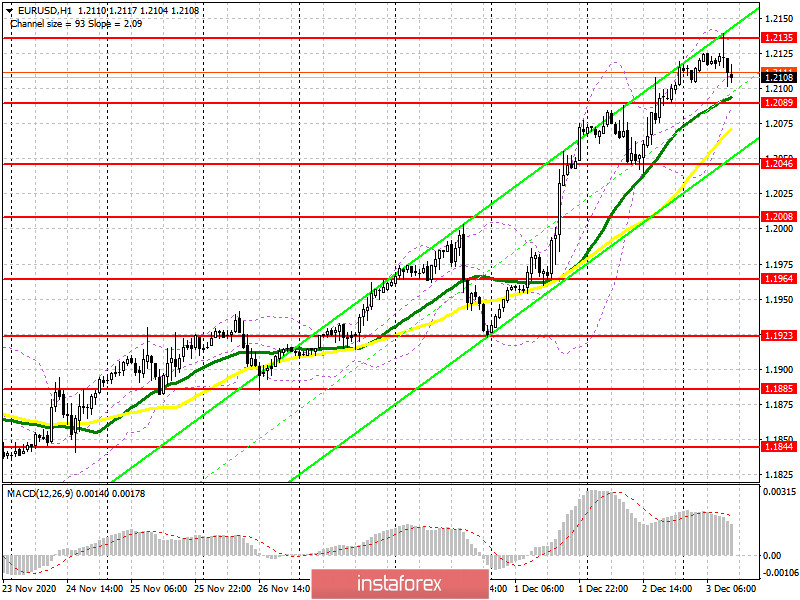

In the second half of the day, buyers of the European currency need to do their best to protect the support of 1.2089, to which the pair is now heading. But before opening long positions, I recommend waiting for the formation of a false breakout, which may occur after an unsuccessful attempt by the bear in the second half of the day to gain a foothold below 1.2089, which will be a signal to open long positions by analogy with yesterday. The euro will be helped in this by weak data on the service sector in the United States, which may sink by the end of November due to the spread of coronavirus. In this case, the initial target of the bulls will be the area of 1.2135, from where the market turned down today. Only a break and consolidation above this resistance with a top-down test will be an additional signal to open long positions in the continuation of the bull market and with the main target of updating the maximum of 1.2194, where I recommend fixing the profits. The longer-term target of the bulls at the end of the week will be the resistance of 1.2255. The lack of buyer activity in the area of 1.2089 may push the euro back to the support of 1.2046, from which you can buy EUR/USD immediately for a rebound, at least with the aim of a correction of 15-20 points within the day. There are also moving averages that play on the side of buyers.

To open short positions on EURUSD, you need to:

Weak data on the Eurozone services sector allowed euro sellers to perfectly cope with their morning task, which led to the formation of a false breakdown at the level of 1.2135 and then to a downward correction. The initial target of the bears is the support of 1.2089, for which the main fight will be conducted in the second half of the day. Fixing below this level with a test of it from the bottom up will be a good sell signal with a return of EUR/USD to the area of a large minimum of 1.2046, where I recommend fixing the profits. The bears' longer-term target will be to close the trading week around 1.2008, which will seriously affect the upward trend, but this will not lead to a complete reversal of it. In the afternoon, a report on the US services sector is expected, as well as regular speeches by representatives of the Federal Reserve System, which may return pressure on the US dollar. A bad report is sure to bring back demand for the euro. If EUR/USD recovers in the afternoon and the maximum of 1.2135 breaks, it is better not to rush into sales. In this scenario, it is better to rely on short positions only for a rebound from the resistance of 1.2194 or sell EUR/USD from the new maximum in the area of 1.2255 with the aim of a downward correction of 15-20 points within the day.

Let me remind you that the COT report (Commitment of Traders) for November 24 recorded an increase in long and a reduction in short positions. Buyers of risky assets believe in the continuation of the bull market, and in the breakout of the psychological mark in the area of the 20th figure, which was tested on November 30. Thus, long non-profit positions rose from 203,551 to 206,354, while short non-profit positions fell to 68,104 from 69,591. The total non-profit net position rose to 138,250 compared to 133,960 a week earlier. It is worth paying attention to the growth of the delta after its 8-week decline, which indicates a clear advantage for buyers and a possible resumption of the medium-term upward trend for the euro. It will be possible to talk about a larger recovery only after European leaders agree with the UK on a new trade agreement. Otherwise, we will have to wait for the lifting of restrictive measures imposed due to the second wave of coronavirus in many EU countries and expect that the European Central Bank will not introduce negative interest rates at the December meeting.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daily moving averages, which indicates the bullish nature of the market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the upper limit of the indicator in the area of 1.2135 will lead to new growth of the pair. A break in the lower limit of the indicator around 1.2089 will increase pressure on the euro.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.