Experts began to see the first signs of a significant overbought stock market, primarily in America, while most retail investors continue to actively buy shares of companies. Some even go further, believing that the value of the local stock market has reached the level observed before the 1929 collapse, which led to a long and prolonged recession.

However, the current situation is clearly different from almost 100 years ago. At that time, the local stock market was not regulated in any way, and the government was not engaged in rescuing the deteriorating economy, as has been the case over the past decade amid massive stimulus measures from the Fed and the US Treasury.

The high probability that an agreement will be reached between the Democrats and Republicans on new anti-COVID incentives in the amount of 900 billion dollars, supports the growth of demand for company shares, which puts downward pressure on the US currency at the same time. However, it should be recalled that after reaching new highs, growth of S&P 500 and DOW 30 indexes stalled, and only the NASDAQ 100 continues to grow and is firmly supported by demand for shares of companies that can conduct successful business on the wave of pandemic.

Let's consider the currency market again. Yesterday, the data of the business activity index in the services sector of the eurozone, the UK and Germany were released. The German indicator declined, the British one was still worse than the October value, although it grew above expectations and the Eurozone index also turned out to be slightly above the forecast, but still worse than the value for the previous period under review. It should be noted that all the data remains below the key 50-point mark, which signals growth that has an overwhelming impact on the European stock market.

On the contrary, the euro's rally on the currency market continues, however, it has stopped. There are two factors that can be considered: the anticipation of releasing the European Aid Fund and US new stimulus measures this month. Naturally, the first one supports the euro, while the latter only increases the pressure on the US dollar. This is the reason why the EUR/USD pair is growing sharply. But in our opinion, the rally is gradually starting to be exhausted, which may lead to the beginning of a correction.

Yesterday's release of US statistics was mixed. The risk demand was strengthened by last week's unemployment claims figures, which declined to 712,000, that is, below the forecasted value of 775,000 and the previous revised upward value of 787,000. This is the first time in recent years. At the same time, the ISM values of purchasing managers for the non-manufacturing sector in November, which declined from 56.6 to 55.9 with forecasted decline to 56.0 points, also added optimism.

The attention of the market will be focused on the publication of employment data today. The unemployment rate is expected to decline from 6.9% to 6.8%. On the other hand, the number of employment in the non-agricultural sector is expected to rise by only 460,000 in November against the October value of 638,000. We believe that if the data are not higher than expected, this could lead to a weakening of demand in the stock market and possibly, even to a short-term rise in the USD rate as safe haven currency.

Forecast of the day:

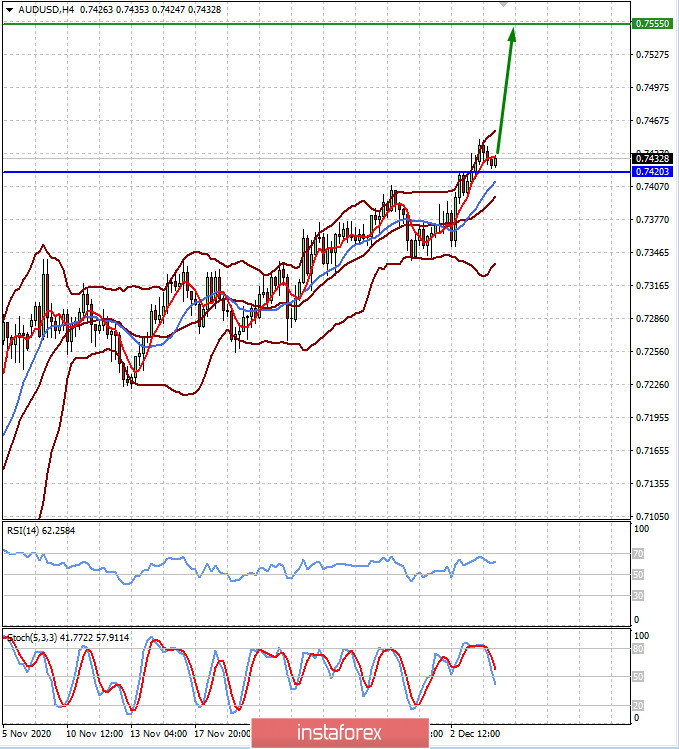

The AUD/USD pair is trading above the level of 0.7420 amid dollar's decline and recent positive data on the Chinese economy and GDP growth in Australia. If the pair holds above 0.7420, further growth can be expected to 0.7555.

The USD/CAD pair is trading below the level of 1.2865 amid updated demand for crude oil on the general weakness of the US dollar. If the pair remains below this level, further decline to 1.2775 is likely.