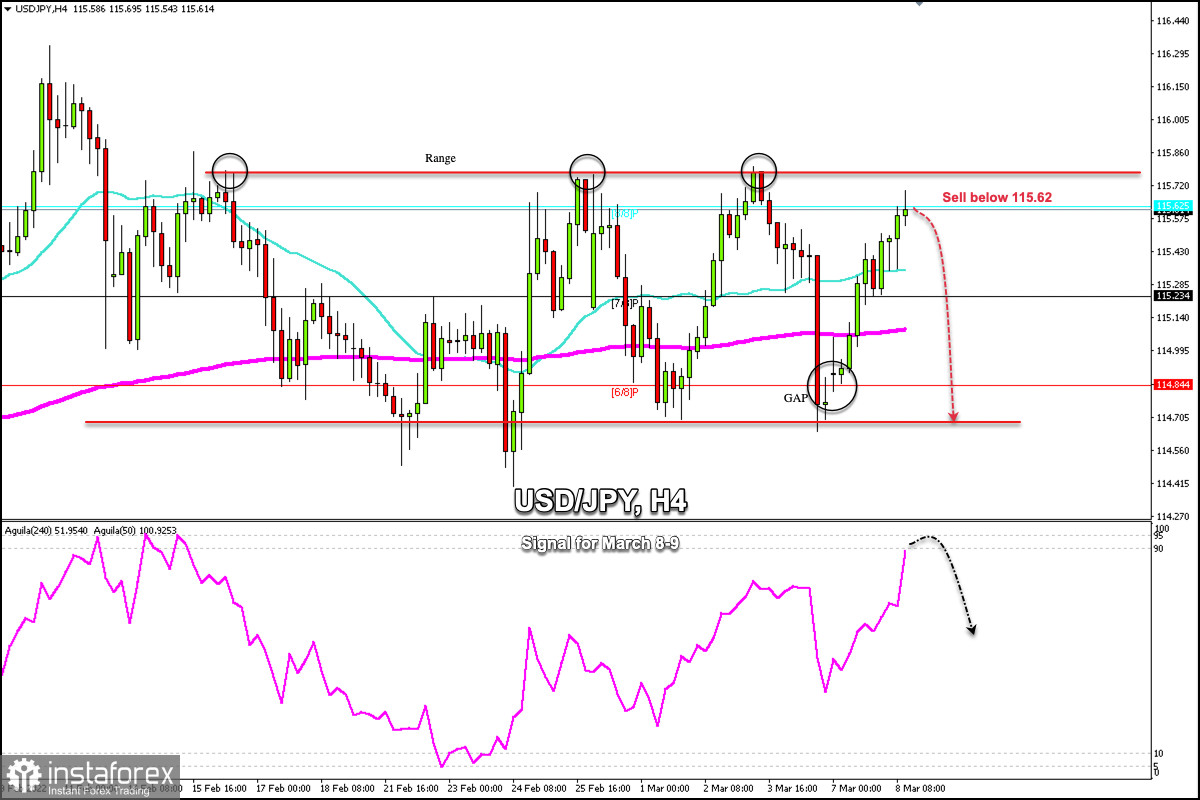

USD/JPY is bouncing as it has been since the beginning of the week, although it still remains in a range of the last few weeks between 115.80-114.50.

The Japanese yen is above the 200 EMA and above the 21 SMA and below the top range of the 115.80. This will act as a barrier. In the next few hours, the pair is likely to make a technical correction below the top of the range at 115.80 and could reach the support zone of 114.50.

In the latest developments, Russian forces intensified attacks against Ukraine. In addition, Russian President Vladimir Putin warned that the war in Ukraine would continue.

This makes investors take refuge in Gold and the Japanese Yen. In the coming hours, the Yen is likely to fall below 8/8 Murray around 115.68 with targets on the 200 EMA located at 115.00. And it could cover the gap it left earlier this week at 114.70.

Our trading plan is to sell the Japanese yen below the top of the range channel with targets at 115.23, 115.00 and 114.50. The eagle indicator supports our bearish strategy as it is giving an overbought signal.