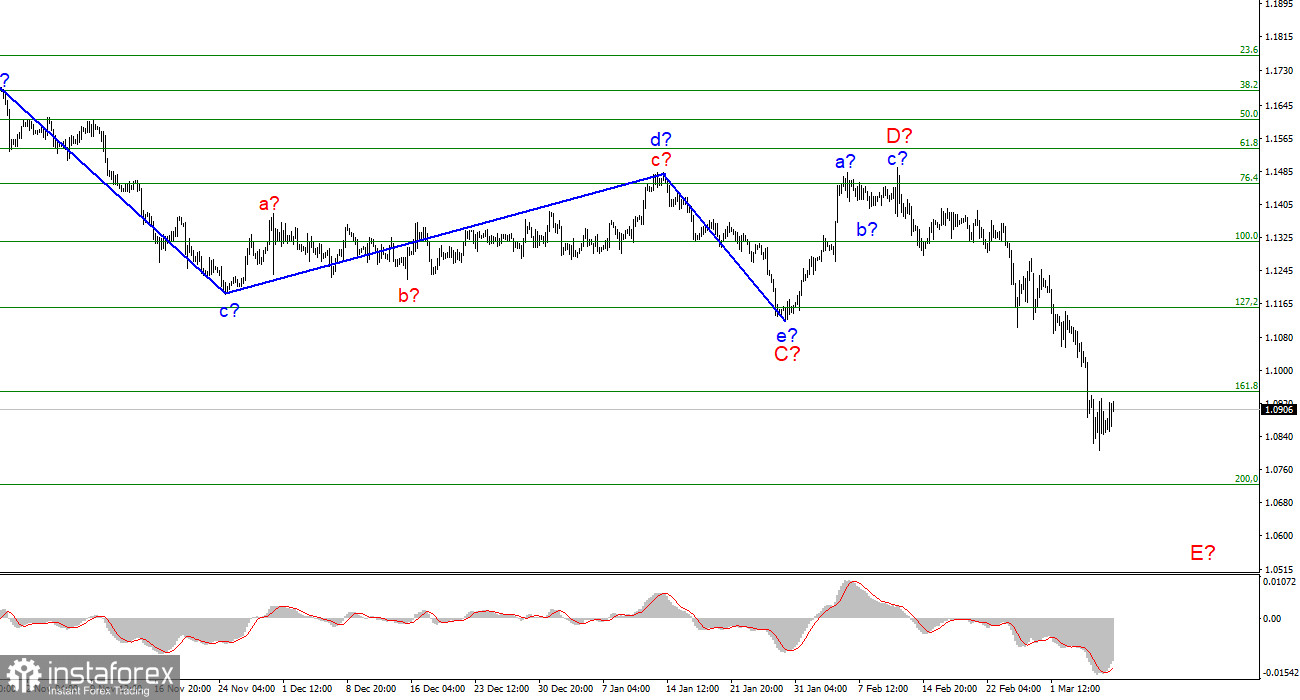

The wave marking of the 4-hour chart for the euro/dollar instrument still does not change and looks quite convincing. It has not changed for several weeks, because all this time the European currency has been doing nothing but declining. Therefore, at this time, the descending wave simply continues its construction, which fully corresponds to the current wave markup. Last week, there were weak attempts to keep from a new decline, but they stopped very quickly. The current decline in quotes is interpreted as wave E, and this wave can turn out to be very long and strong. The news background openly supports the increase in demand for the US currency, and this applies to both geopolitics and the economy. Based on this, I think that the probability that the instrument will continue to build a downward wave is 80 percent. The situation in Ukraine now is such that many other news, reports, and events are simply not perceived by the market. Wave E can be any in size. A successful attempt to break through the 1.0947 mark indicates readiness for further sales of the instrument.

GDP in the fourth quarter in the EU grew minimally

The euro/dollar instrument rose by 50 basis points on Tuesday, and this is almost the best day for the euro in recent weeks. The day when the European currency has not lost in value. The information background on Tuesday remained very weak, and this time it concerns both geopolitical and economic news. Today, the European Union released a report on the change in GDP in the fourth quarter. However, this report is published three times in each quarter, and its last two values are a correction of the first. Thus, today the value of GDP did not differ at all from the first and second values. And since there are no differences, the market did not even have theoretical grounds to work out these data. EU GDP grew by 0.3% in the fourth quarter, and this is a very weak value. It means that there was practically no growth in the 4th quarter. And it also means that the Central Bank cannot raise the interest rate. Any tightening of monetary policy leads to a cooling of the economy. And why should it be cooled if it is already barely growing?

There are much more serious problems for the European Union now. First, oil and gas prices are rising. If oil from the Russian Federation can somehow be replaced with oil from other countries, then there are big problems with gas. Second, rising energy prices automatically means that prices will rise for everything. Third, the Ukrainian-Russian conflict is hitting the European economy. At least from the point of view of refugees from Ukraine, of which there are already about 2 million. All of them need to be provided with housing, material, and social security. This is a big burden on the European economy. Therefore, I expect that the first quarter of the EU GDP will also show very weak dynamics. At the same time, inflation will continue to rise, and the ECB will not be able to raise the interest rate. That is, we get the most infertile soil for the increase of the euro currency.

General conclusions

Based on the analysis, I conclude that the construction of wave E continues. If so, now is still a good time to sell the European currency with targets located around the 1.0723 mark, which corresponds to 200.0% Fibonacci, for each MACD signal "down". A successful breakout attempt of 1.0945 indicates that the market is ready for further sales of the instrument.

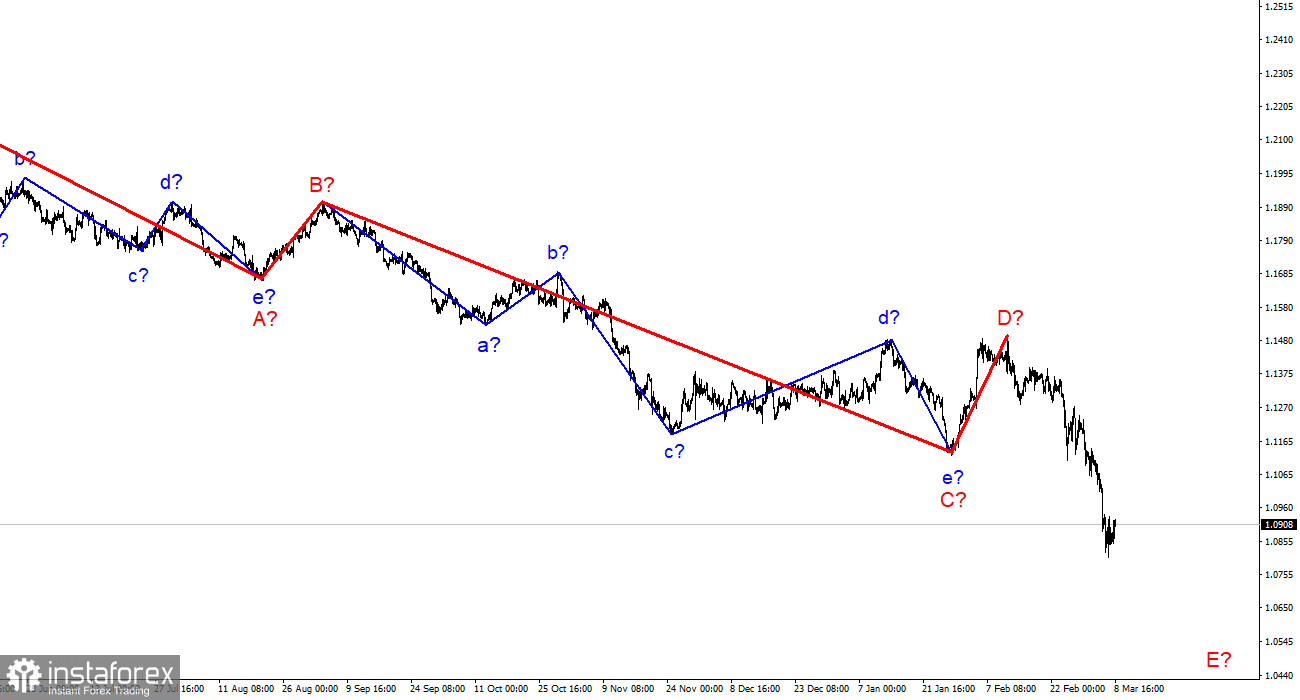

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument has already updated its low. Thus, the fifth wave of a non-pulse downward trend section is being built now, which may turn out to be as long as wave C. If this assumption is correct, the European currency will decline for a long time, although a couple of weeks ago many expected to build a new, upward trend section.