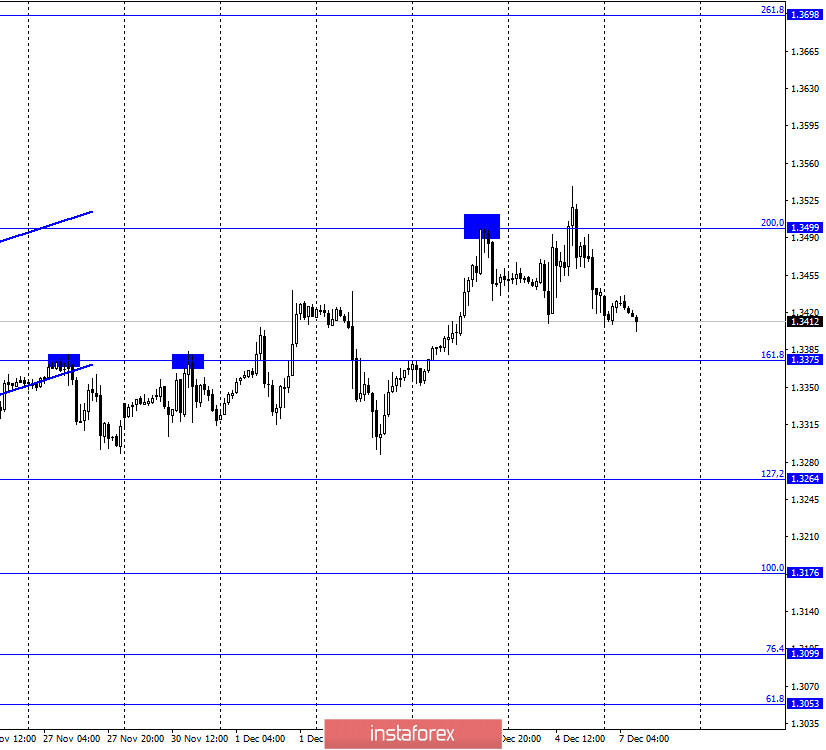

GBP/USD – 1H

Hello, dear traders! In the H1 time frame, GBP/USD advanced to 1.3499 - the 200.0% retracement level - and rebounded from it twice. Consequently, the currency pair reversed and fell to 1.3375 - the 161.8% retracement level. If the pair consolidates below this mark, the price is likely to drop to 1.3246 - the 127.2% Fibo retracement level. A rebound is likely to lead to the strengthening of the quotes to the 200.0% retracement level. Traders continue monitoring the London-Brussels negotiations. The trade talks linger on, reminding the longest-running American television soap opera Santa Barbara. It seems that these negotiations will never end. Nevertheless, nobody is concerned over the terms of the UK's withdrawal from Europe. From the very beginning, the European Union warned the UK that such a large-scale deal could not be arranged for six months. Meanwhile, Prime Minister Boris Johnson did not want to hear anything about that and refused to prolong the terms of the transition period. Around three weeks of the transition period has left and the trade agreement has not been signed yet. Both Michel Barnier and David Frost decided to continue the negotiations this weekend in order to achieve improvements in the trade talks. Nevertheless, there has been no breakthrough yet. Both parties point out fundamental differences on the issues that the negotiations have centred on. These are fishing rights, the governance of a deal, and the "level playing field" conditions aimed at preventing unfair competition.

GBP/USD – 4H

As of the 4H time frame, the GBP/USD pair pulled back from 1.3481 - the 100.0% retracement level. As a result, the price dropped to 1.3291 - the 76.4% Fibo retracement level. In case of a rebound from this mark, the quote may return to the 100.0% retracement level.

GBP/USD – Daily.

On the Daily chart, the price rebounded from 1.3513 - the 100.0% retracement level. This is the most important and clearest signal on all the charts. If this is not a false rebound, the pound sterling is likely to fall sharply. Right now, a lot depends on the information background.

GBP/USD – Weekly.

According to the Weekly time frame, the pound/dollar pair increased to the second downward trend line. A pullback from this line in the long term will lead to a prolonged drop in the pound sterling.

Information background:

Last Friday, the United Kingdom did not release a single important macroeconomic report. Anyway, traders are now fully focused on Brexit and the trade negotiations.

Macroeconomic calendar in UK and US:

On December 7, the macroeconomic calendar in the United Kingdom and the United States is completely empty. Unless there is news on the trade talks between Michel Barnier and David Frost.

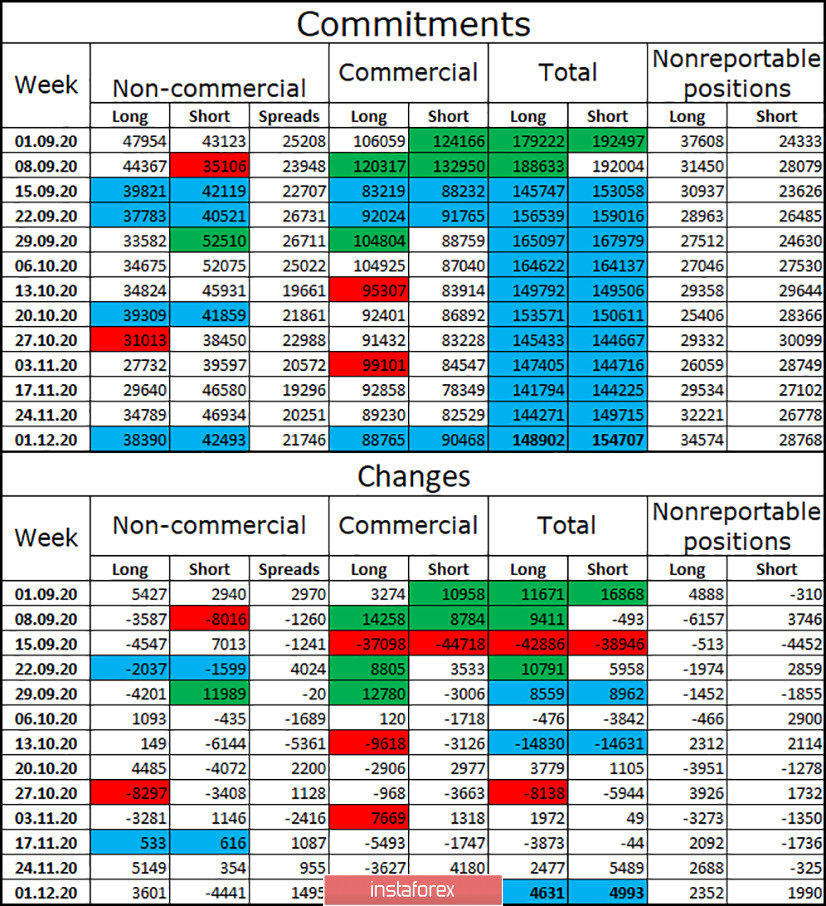

Commitments of traders (COT) report:

The latest Commitments of traders (COT) report showed an increase in the number of Long contracts among spaculators. This time, the number grew by 3,601 contracts, while the amount of Short contracts dropped by 4,441. Consequently, speculative sentiment turned bullish. At the same time, the current situation is a rather unique one. The number of Longs and Shorts is almost equal among Non-commercial and Commercial market players. Same applies to all categories of major players. Therefore, the market is in balance at the moment. However, the future of the British pound will depend on the outcome of the trade negotiations between the UK and the EU. Large traders will also adjust to these results. Thus, their sentiment can change drastically depending on the outcome of the trade talks.

Forecast for GBP/USD and trading recommendations:

Right now, market players should stay cautious if they decide to trade GBP. Firstly, it is hard to find any trade signals at the moment. Secondly, the currency pair is frequently changing direction. Those who want to buy the pound should do that after a rebound from 1.3375 - the 161.8% retracement level on the H1 chart. In such a case, the target is seen at 1.3499. Those willing to sell the pound should do so if the price closes below the 161.8% retracement level. In such a case, the target is seen at 1.3264 - the 127.2% retracement level.

Terms:

Non-commercial traders are major market players: banks, hedge funds, investment funds, private, large investors.

Commercial traders are commercial enterprises, firms, banks, corporations, companies that buy currency not to generate speculative profits, but to ensure current activities or export-import operations.

Non-reportable positions are small traders who do not have a significant impact on the price.