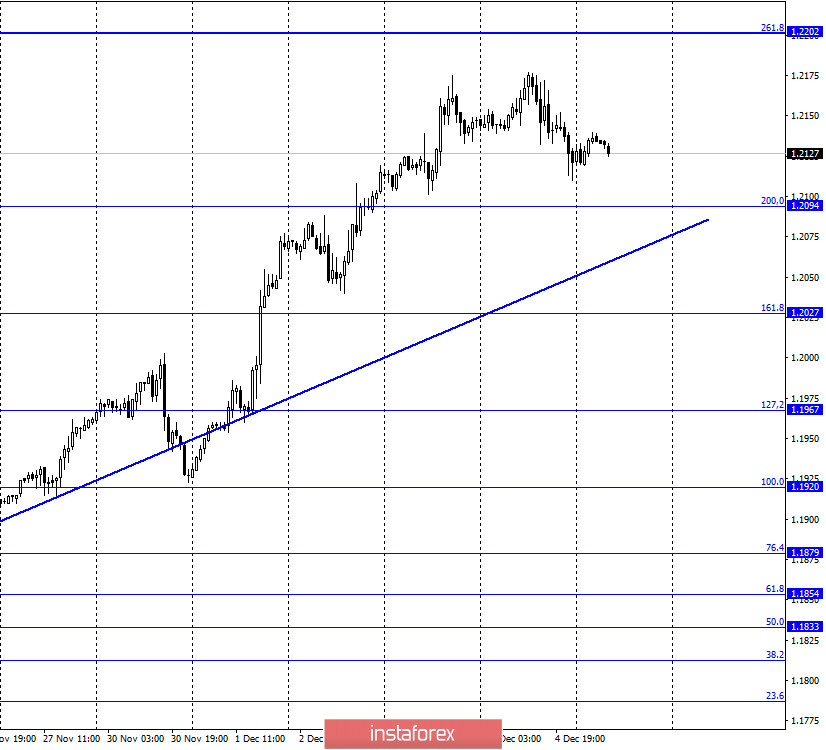

EUR/USD – 1H.

On December 4, the EUR/USD pair performed a long-awaited reversal in favor of the US currency and began the process of falling towards the corrective level of 200.0% (1.2094). As well as in the direction of the nominal upward trend line. The rebound of quotes from any of these lines will again work in favor of the EU currency and the resumption of the growth process in the direction of the corrective level of 261.8% (1.2202). For a long time, about three or four months, all the attention of traders was focused on America. Every day, Donald Trump made discouraging statements, traders were waiting for the presidential election, the situation with the coronavirus in the United States was extremely difficult, plus daily battles between Republicans and Democrats. Now the United States is completely quiet and smooth. There is no news or even just interesting topics. On Friday, the hopes of bear traders were linked to a package of economic statistics from the United States. The US currency had been falling for two weeks and was in desperate need of a correction. Therefore, good data from Nonfarm Payrolls and unemployment could lead to a rise in the dollar. The most important Nonfarm Payrolls indicator turned out to be much worse than market expectations, while the less important unemployment rate and the level of wages showed positive dynamics. Nevertheless, it was Nonfarm that came first, and they just failed. Still, the dollar started to grow on this day. Now everything will depend on whether the euro/dollar pair manages to break through the trend line. I have been saying for a long time that the euro has grown too exorbitantly, we need a pullback down.

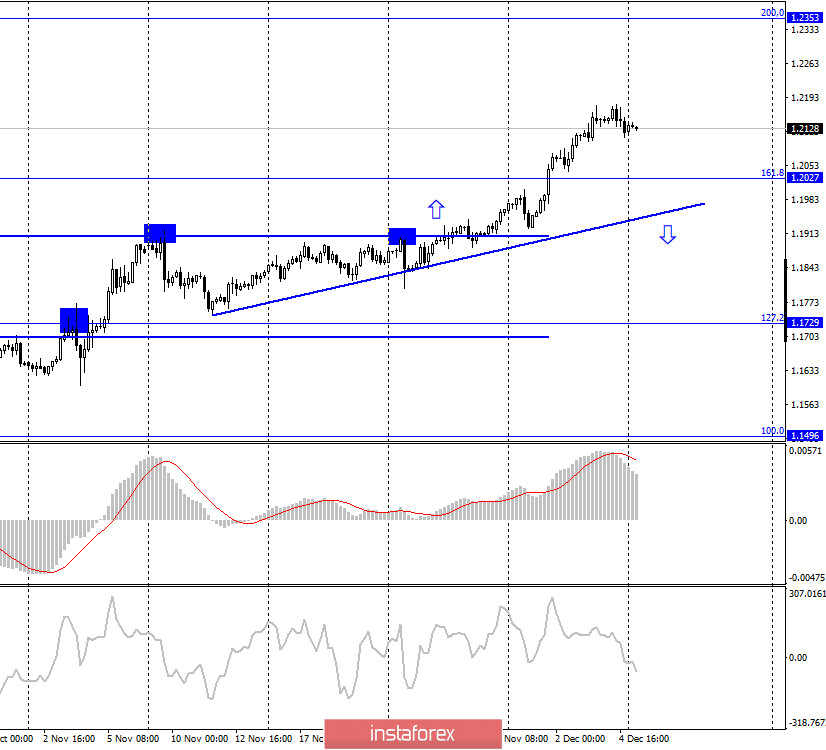

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes also performed a reversal in favor of the US currency and began the process of falling towards the corrective level of 161.8% (1.2027). There was no bearish divergence. However, now a bullish divergence is brewing in the CCI indicator, which may help the pair resume the growth process. Traders' mood remains bullish due to the rising trend line.

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed a consolidation above the Fibo level of 323.6% (1.2079). Thus, the probability of continuing growth in the direction of the next corrective level of 423.6% (1.2495) increased.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 4, there was no news in the European Union, however, the reports I mentioned above were published in America. The reaction of traders to them was unexpected. There were no other events on that day either.

News calendar for the United States and the European Union:

On December 7, the EU and American news calendars are empty, so there will be no background information on this day. The growth of the US currency may continue slowly.

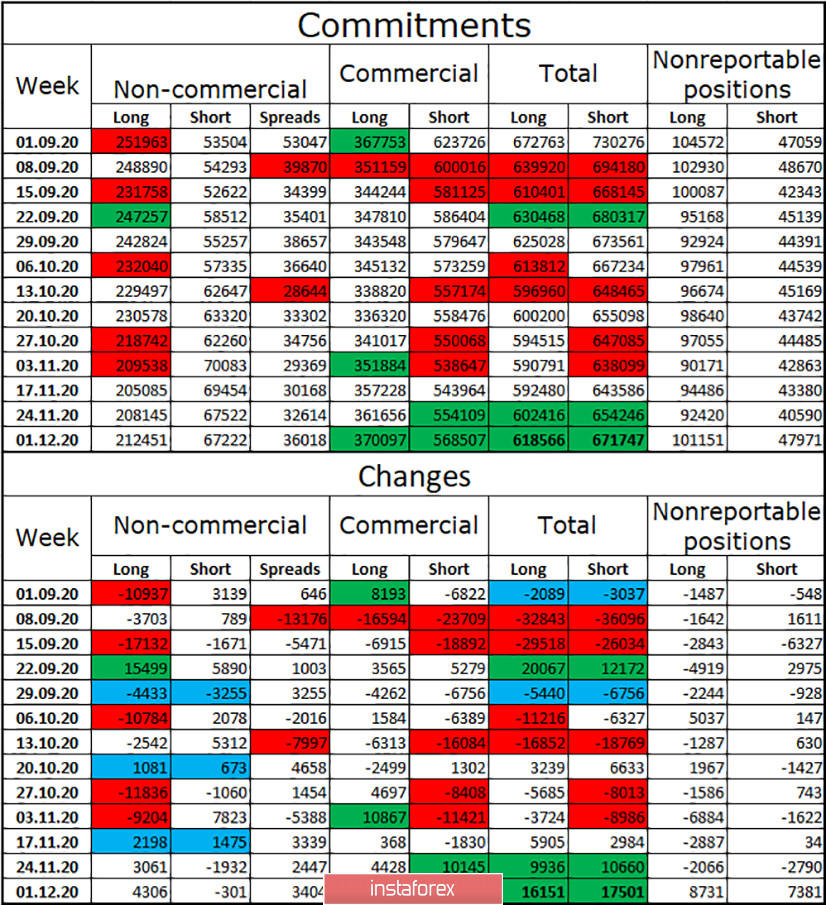

COT (Commitments of Traders) report:

For the third week in a row, the mood of the "Non-commercial" category of traders has become more "bullish". This is indicated by COT reports and it coincides with what is happening now for the euro/dollar pair. During the reporting week, speculators opened 4306 new long contracts and closed 301 short contracts. However, I would like to draw your attention to the fact that in the last two weeks, traders of the "Commercial" category have become very active, who have opened a total of 35 thousand contracts, most of which are short. But I still pay more attention to speculators. Their activity has been low in recent weeks, and purchases of the euro currency are extremely cautious as if forced. I still believe that the upward trend in the euro is nearing its end.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro with the targets of the Fibo level of 200.0% (1.2094) and the trend line, as the pair needs a pullback. New purchases of the pair can be made if there is a rebound from the level of 200.0% or the trend line on the hourly chart with the target of the correction level of 261.8% (1.2202).

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.