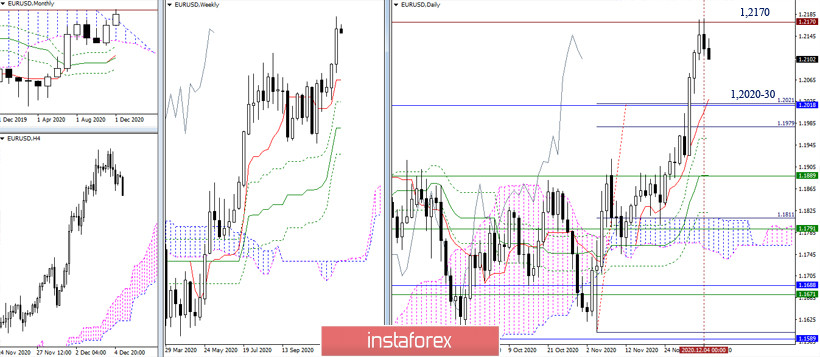

EUR / USD

The reached historical resistance level of 1.2170 continues to insist on a longer break and formation of a rebound. If the decline happens, bearish interests will be directed to the area of 1.2120-30 (limit of the monthly cloud + daily Tenkan) in the near future. Further development of the situation depends on the decline rate and the result of reaching the support levels in the area of 1.2120-30.

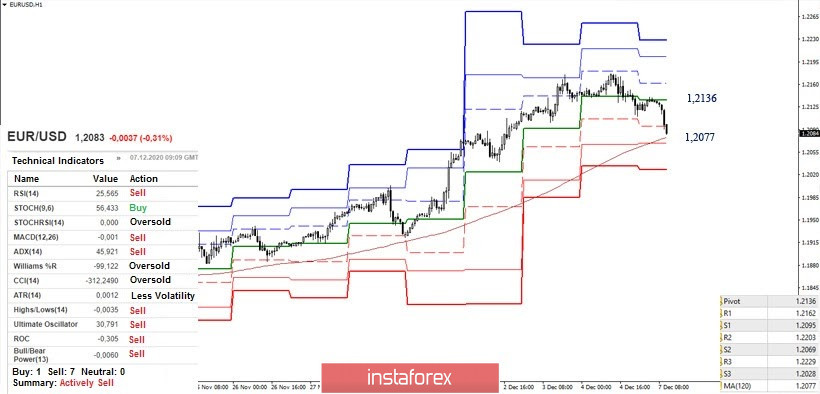

The smaller time frames are actively involved in strengthening the bearish mood. The downward correction has taken hold of the central pivot level and is now seeking to support the weekly long-term trend (1.2077). The bulls losing the moving average and its reversal will transfer all the key advantages to the bears on the hourly time frame. On the other hand, today's intraday target below can still be noted at 1.2028 (S3). In case of slowdown, the central pivot level (1.2136) will be the key resistance at hourly TF today. A consolidation above will affect the current balance of power, while bulls will have a chance to restore the upward trend (1.2177).

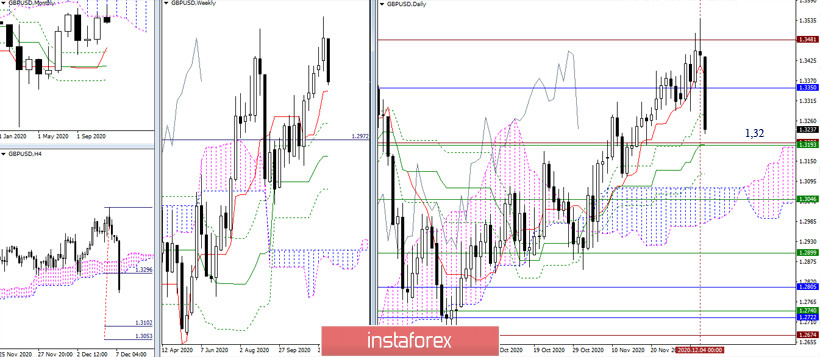

GBP / USD

It was for a reason why some weakness of the bulls and the constant opposition of the opponent were well shown during the growth. No matter how much things were tightened, the moment will surely come when it will be forced to loosen up. The activity of the bears today proved this. The further development of the situation depends on bears' ability to remain active and consolidate the result. Now, significant support can be noted around 1.32 (historical level + daily Kijun + weekly Tenkan).

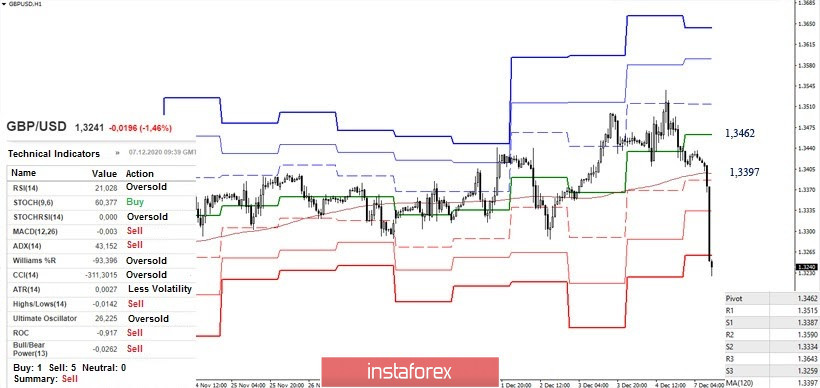

Today, the bears found themselves crowded within the limits of intraday supports of the classic pivot levels, as all support for smaller time frames has been worked out. The level of 1.32 is now the downward pivot point, where the combined supports of the bigger time frames formed their influence and attraction zone. On the other hand, the current key resistances of the smaller TFs can be noted at 1.3397 (weekly long-term trend) and 1.3462 (central pivot level).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classical), Moving Average (120)