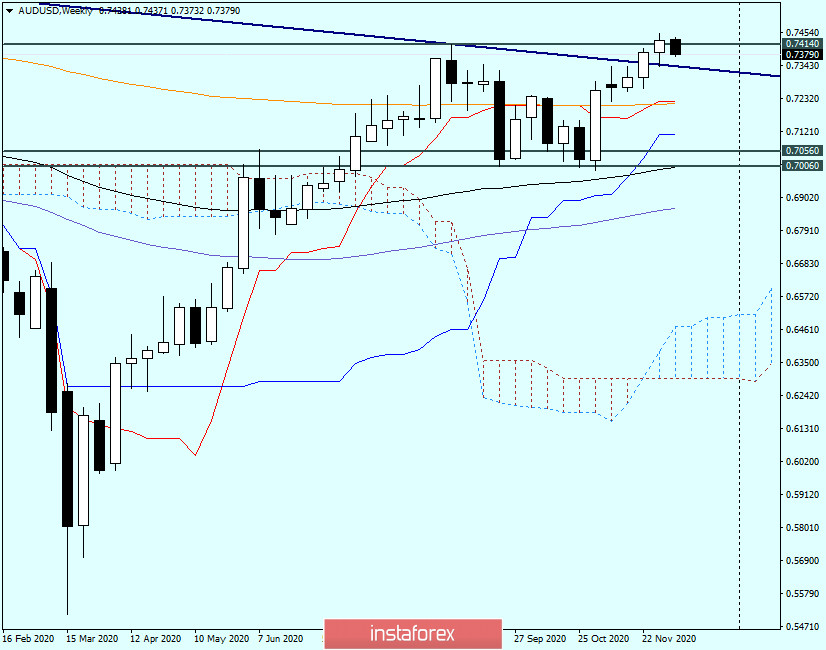

Weekly

The AUD/USD currency pair is slowly but surely moving in a northerly direction. At last week's trading, the pair added 0.74%, and although the growth was not so impressive, the players on the exchange rate increase managed to finish trading above the resistance level of 0.7414. The blue resistance line of 0.8136-0.7414 was also broken, to which a pullback may now occur, after which the quote is likely to continue moving up. However, this will be possible if the positive attitude and risk appetite of investors remain. This sentiment is dominated by Joe Biden's victory in the US presidential election, as well as expectations of vaccination against COVID-19 and the adoption of a new stimulus program to support the world's leading economy. If the Aussie bulls continue to implement their plans, the next and very important target for the pair will be the psychological mark of 0.7500. I note that a true breakout of this level will strengthen the bullish sentiment for the "Aussie" and send the pair to the next levels at the top, among which we can distinguish 0.7700 and another important level of 0.8000. Naturally, if this happens, it will not be today or tomorrow. At the moment, we should expect a pullback to the broken blue resistance line, and then expect the resumption of upward dynamics. If trading ends under this line, then its breakdown will have to be recognized as false, which signals a change in sentiment in favor of the US currency. If you go back to Friday's data on the US labor market, the report on Nonfarm Payrolls was weak and did not meet the expectations of investors. Against this background, the US Federal Reserve (FRS) may resort to an even more lenient monetary policy, which will not bode well for the US dollar. As for the Australian currency, the recovery of the Chinese economy is supporting the AUD. Let me remind you that China is Australia's main trading partner, and the economic success of China supports the Australian currency. This week will be extremely important for the AUD/USD currency pair. After the slight growth shown in the last trading week, it is time to draw a large bullish candle on the weekly chart, so that there is no doubt about the subsequent strengthening of the exchange rate.

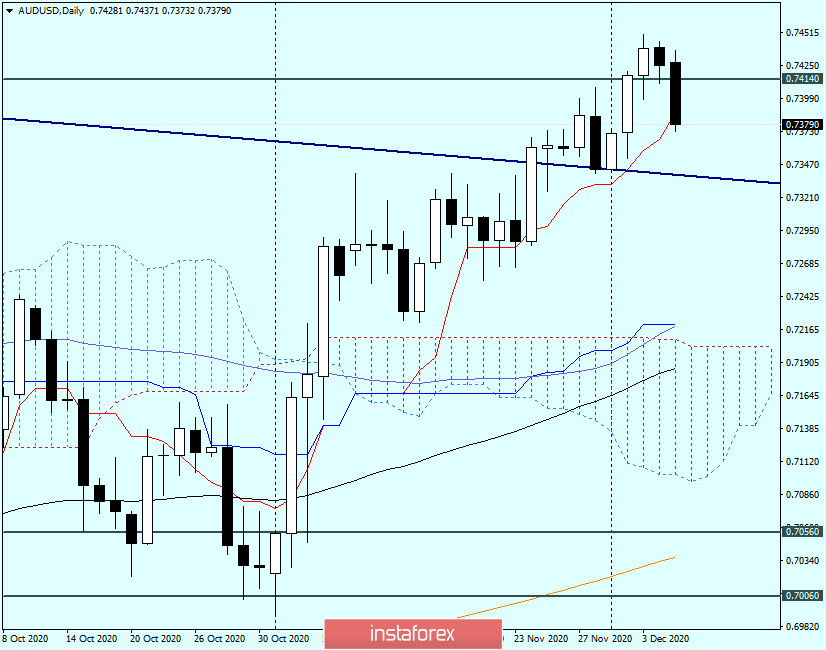

Daily

But on the daily chart, the correction scenario comes into force. After Friday's mixed data on the US labor market, a bearish candle appeared on the daily chart, which can most likely be considered a reversal. The auction that started today so far confirms this assumption. The pair is trading lower near one of the key levels of 0.7400. If the course correction continues, its nearest target will be the red Tenkan line of the Ichimoku indicator, which runs at 0.7388. The longer-term correction target will be the broken weekly resistance line (blue), which runs near 0.7340. In my subjective opinion, the main trading recommendation is to buy the AUD/USD pair after its decline to the prices indicated above.