At last week's auction, the single European currency significantly strengthened its position against the US dollar, and the final weekly growth of the main currency pair EUR/USD was 1.33%. To be fair, the US dollar has fallen against all major competitors except the Japanese yen. This has already happened more than once, thus, we can safely state the fact that history repeats itself.

As noted earlier, there was a risky mood in the market, mainly caused by the imminent start of mass vaccination of the population against the COVID-19 epidemic. Risk appetite was also fueled by expectations of the imminent adoption of a new fiscal stimulus package in the United States, which should help the world's leading economy overcome the negative consequences of the coronavirus pandemic in the least painless way. As for macroeconomic statistics, the main event of the past week was the data on the labor market of the United States of America. According to the US Department of Employment, the unemployment rate in November fell to 6.7% (forecast 6.8%), the creation of new jobs in non-agricultural sectors of the economy amounted to 245 thousand (forecast 469 thousand), and the growth of average hourly wages increased by 0.3%, although expectations were for an increase of 0.1%. Even though the data was very mixed, positive releases on unemployment and wage growth supported the US currency. Also, on the eve of the weekend, investors actively closed positions, which led to some adjustment of the main currency pair.

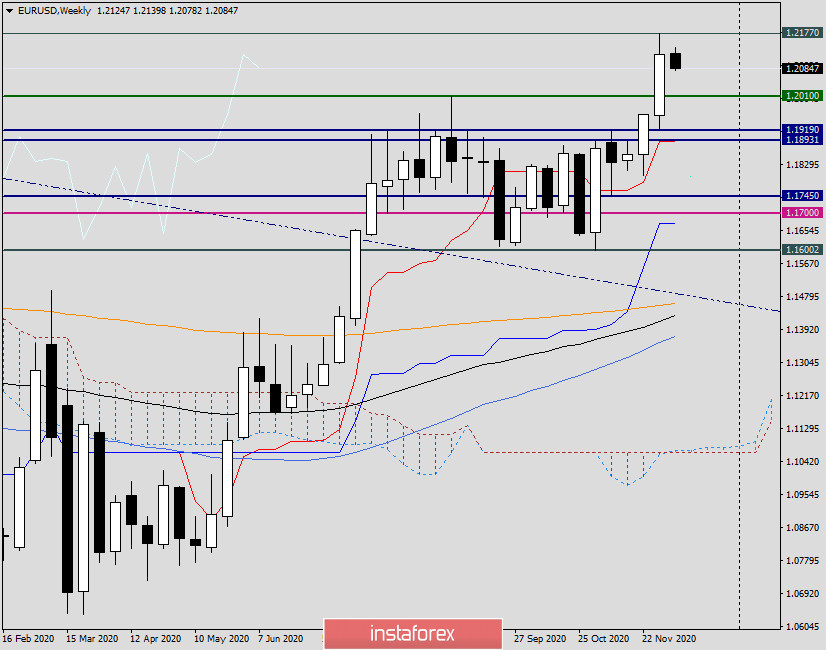

Weekly

So, the maximum trading values of the last five-day trading period were shown at 1.2177, and the closing price of the last weekly candle was 1.2121. Well, for euro bulls, this can be considered a fairly good result. However, given the rather long consolidation in the price range of 1.1600-1.1900, such an upward exit is not out of the ordinary. It is reasonable to assume that the further direction of EUR/USD will depend mainly on market sentiment. If investors remain optimistic about the imminent start of vaccination against COVID-19, as well as the adoption of a new program to support the world's leading economy, risk sentiment will continue to prevail on global financial markets and may even increase. Also, the ECB's decision on interest rates and the press conference of the head of this department, Christine Lagarde, may have an impact on the course of trading in the euro/dollar, and from the US data, investors will pay special attention to the publication of the consumer price index. I believe that these events will be the main ones for the euro/dollar currency pair at the auction on December 7-11.

As noted earlier, looking at the weekly and daily price charts, it is clear that the next resistance for the euro/dollar will start to appear starting from 1.2400. However, this does not mean that the bears will not try to build a barrier earlier. In my opinion, it will be very important to pass the resistance zone of 1.2175-1.2200, and only a true breakdown of the last mark will allow us to count on subsequent growth, where the resistances will be 1.2300,1.2360, 1.2413, 1.2476, the psychological level of 1.2500 and the mark of 1.2555, where the maximum trading values were shown on February 16, 2018. For market sentiment to change in favor of the US dollar, players on the downside need to return the pair below 1.2000 and close trading under this important level. Looking at the weekly timeframe, we can conclude that the long-term consolidation is over and market participants have chosen a further route in the north direction. If so, the growth of the main currency pair is likely to continue, and this implies a search for points for purchases of the single European currency.

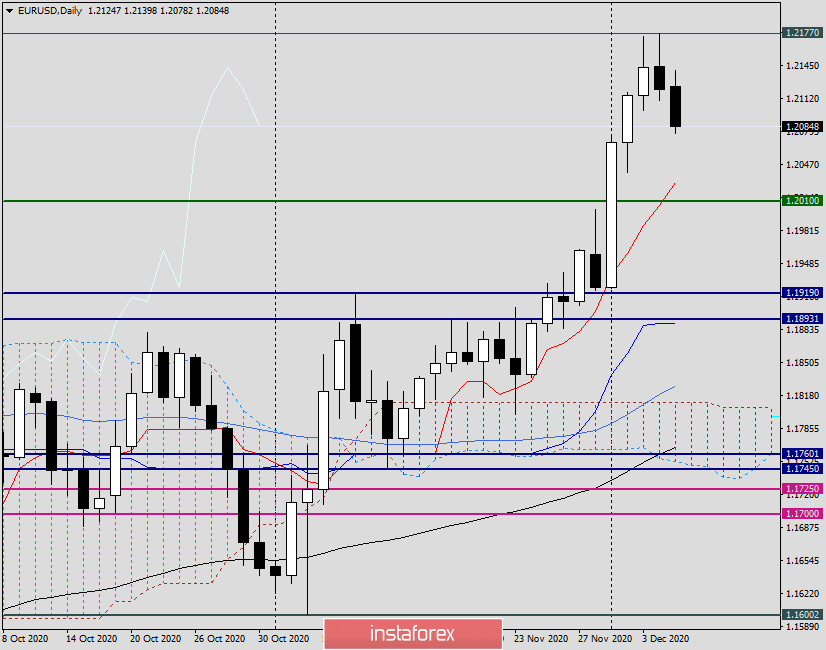

Daily

On Friday, after mixed data on the US labor market, investors still preferred a decrease in the unemployment rate and an increase in average hourly wages. Let me remind you that both indicators were stronger than the forecast values. This led to purchases of the US currency and some adjustment of the US dollar. As a result, the daily EUR/USD chart has a reversal model of the "shooting star" candle analysis. Now the question is whether the market will work out this model. I would venture to assume that such attempts will take place, however, they will be short-lived and the pair will not go deep down. At the very least, I think it is unlikely to leave and consolidate under 1.2000. Much more realistic will be a decline to the levels of 1.2100, 1.2075, 1.2050, and 1.2030, after which the rate will turn to continue the upward trend. Thus, in the case of such a course of trading, I recommend taking a closer look at opening long positions near the listed levels. Smaller timeframes and possibly additional trading recommendations will be presented in tomorrow's review of the main Forex currency pair.