At the last five-day trading session, the pound/dollar currency pair showed growth, strengthening by 0.94%. Nevertheless, the British currency is still dominated by the issue of concluding a deal for the UK's exit from the European Union. Issues of fishing, state regulation, and common conditions for trade remain unresolved, and time is already running out for days. Let me remind you that the final decision on whether the UK will leave the EU with or without a deal should take place before the end of this year.

If you go back to Friday's data on the US labor market, investors preferred a stronger-than-expected increase in average hourly wages, as well as a decrease in unemployment to the level of 6.7%, although forecasts assumed 6.8%. As a result, the US dollar slightly corrected the losses incurred before, and a rather interesting picture was formed on the charts of the GBP/USD currency pair.

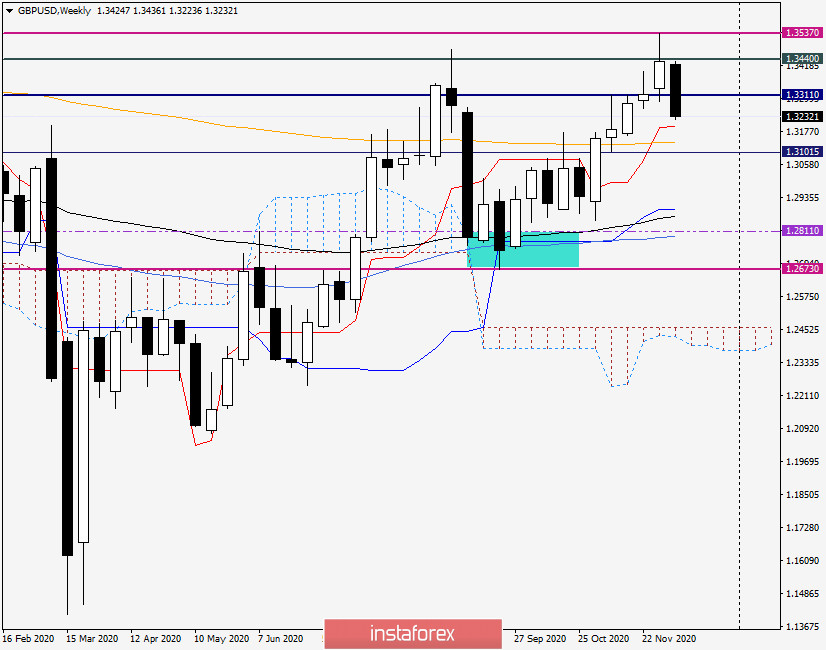

Weekly

As you can see, as a result of the upward momentum, the pair reached the level of 1.3537, however, it could not stay near the highs and ended the weekly trading significantly lower at 1.3434. Thus, a strong resistance area of 1.3440-1.3480 limited the rise, and the week was closed with the formation of a bullish candle with a fairly long upper shadow. Given this fact, as well as the inability to overcome the resistance of sellers in the designated area, the prospects of the British currency remain in question. Despite the risk sentiment caused by expectations of the imminent start of mass vaccination against the COVID-19 pandemic and the adoption of a stimulus program in the United States, the lack of progress in reaching a Brexit deal can turn the pair in a southerly direction. If a miracle happens and an agreement is reached, the pound will soar, despite the strong resistance that is located above current prices.

If we look at the technical picture in more detail, then the true breakdown of the strong resistance of sellers at 1.3310 should be included in the asset of the bulls for the pound. It was this level that kept the quote higher for three weeks in a row, and now it has been passed. The nearest target at the top will be the highs of the previous weekly trading at 1.3537, if they are reached, the pair will rush to the strong technical zone of 1.3600-1.3620. A change in sentiment and the resumption of the downward scenario will signal the departure of the rate under 1.3200 and the end of weekly trading below this mark.

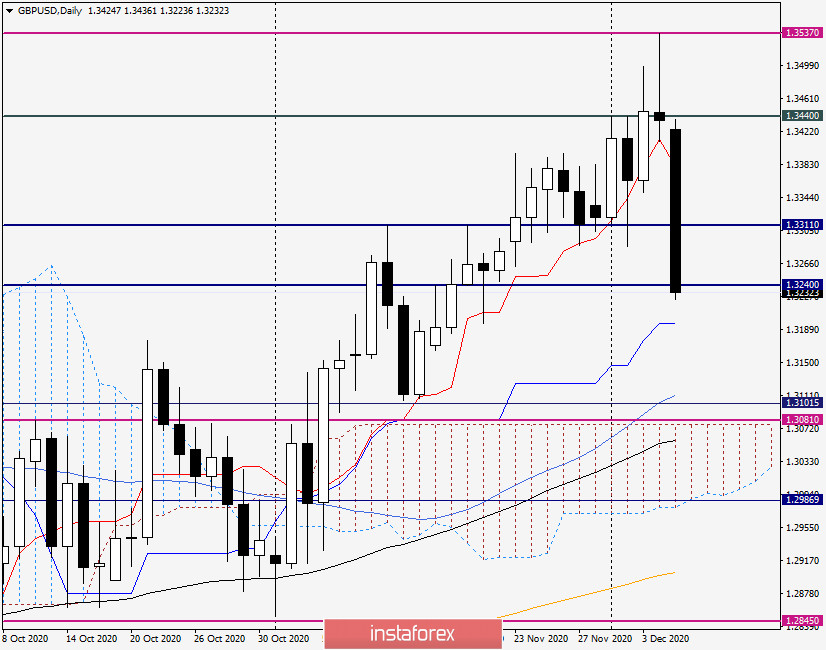

Daily

The candle that appeared last Friday can rightly be considered a reversal model of "shooting star" or even "tombstone". It is characteristic that the second model is stronger and is much more often practiced by market participants. This reversal pattern will be considered broken if the pound bulls manage to absorb its growth, that is, close trading above Friday's highs at 1.3537. Given the continuing differences between the EU and the UK, and given the long upper shadow of the candle, this will be very difficult to do. Much more realistic is the initial downward scenario in which the pair will fall into the price zone of 1.3315-1.3285. If this happens, this is where the future direction of the British currency will be decided. A consolidation below 1.3300 will indicate a false breakout of the resistance of 1.3310 and increase the pressure on the quote. If the pair finds support in the area of 1.3350-1.3310 and turns north, we should expect a rise to 1.3400, 1.3440, 1.3480, and 1.3500. At the same time, only a true breakdown of the sellers' resistance at 1.3537 will indicate the pair's ability to further grow towards a significant level of 1.3600.

Another option for the development of trading will be initial attempts to strengthen, followed by a reversal to a downward trend. Taking into account the indicated options for the possible price movement of GBP/USD, I can recommend positioning in both directions. You should look closely at the pair's sales if reversal patterns of Japanese candlesticks start appearing in the price zone of 1.3440-1.3480 on the daily, four-hour, and hourly charts.