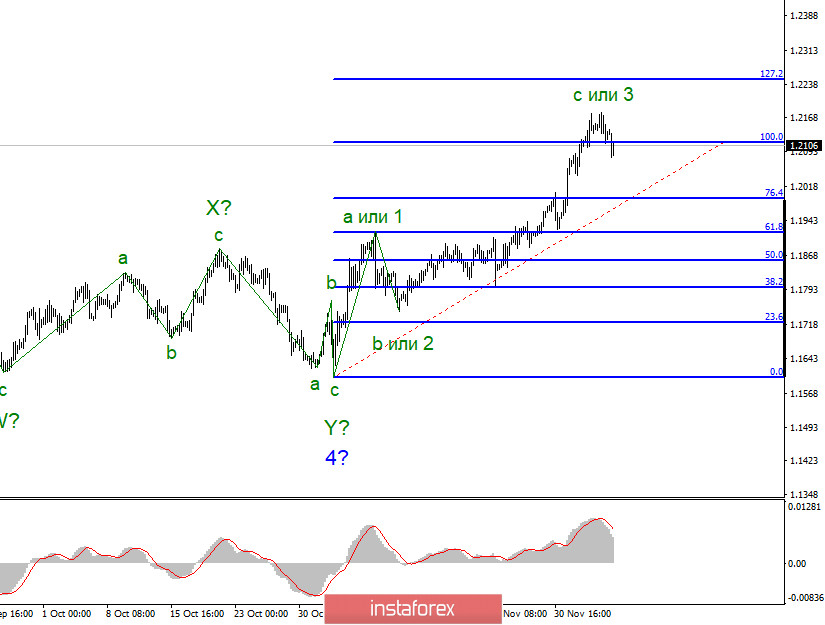

The wave pattern for the EUR/USD pair looks quite confusing due to the three distinctive sections of the trend. The upward wave, which is now identified as C, continues its formation and has made a successful attempt to break above the peak of the wave 3 or C. Thus, the formation of the next three ascending waves will continue. Also, the current ascending section can now be identified as a new major wave 5.

The wave pattern on a smaller time frame also indicates that the next three-wave section of the trend will continue to form. It is also possible that the price has resumed an uptrend within the global wave 5, which began to form on March 20. A successful attempt to break above the high of the supposed wave 3 or C indicates the bullish trend on the euro. At the same time, the trend can end with the formation of the C wave that will be followed by a new three-section descending wave.

A pullback of 100 pips from the early highs may signal that the formation of both an upward wave C and an upward wave 3 in the supposed wave 5 is completed. The same is true for the entire uptrend section. At the same time, a lot still depends on the news background. For example, on Friday markets evaluated several quite important reports from the United States. While the unemployment rate and a change in average hourly earnings encouraged US dollar bulls, the Nonfarm Payrolls report was certainly disappointing. It turned out that only 245,000 new jobs were created in November, well below markets expectations. Therefore, the demand for the US currency should have remained low even despite positive reports on unemployment and wages. Surprisingly, the US dollar advanced on Friday and it is still holding at this level today. Of course, this could be a phase of correction, that is, a wave 4 in 5, for example. Whether this is true or not, we will see in the coming days.

At the moment, the global background is quite ambiguous. On the one hand, there are some important issues being discussed both in the United States and the European Union. However, they have a long-term effect. For example, both the US and the EU are facing serious economic challenges. The US lawmaker will address them with a new aid package. Hopefully, Democrats and Republicans will finally reach an agreement on that. In the meantime, some of the EU members have blocked a seven-year budget and a recovery fund. The recovery fund will not be available until Poland and Hungary lift their veto. The EU countries may try to bypass the veto, but this may lead to a conflict within the European Union.

Conclusions and trading tips

Supposedly, the euro/dollar pair continues the formation of a three-wave uptrend section. However, it may have already completed the trend. Thus, I recommend being extremely cautious when buying the pair. It is better to consider selling the instrument now. Even if wave 5 is being formed at the moment, it is very likely to complete the trend soon. Nevertheless, it is still possible to buy the pair following each of the new MACD buy signals with the targets set near 1.2250, which corresponds to 127.2% Fibonacci.