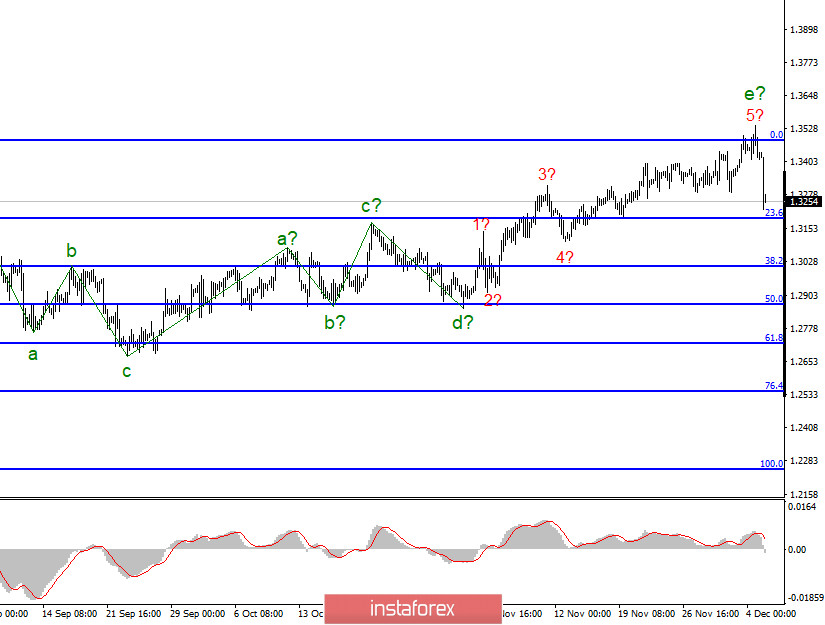

In the most global terms, the construction of an upward section of the trend continues, even despite the departure of quotes from the previously reached highs. Moreover, at the moment, the wave pattern looks convincing enough to be considered complete. Five waves are built up as part of a non-impulse section of the trend. The attempt to break the maximum of the previous global wave Z was unsuccessful. Thus, now the markets can start selling the British dollar, which has been brewing for a long time.

The lower chart clearly shows the a-b-c-d-e waves of the upward trend section. The assumed wave e took a five-wave form, which is also visible on the chart. However, even with this complication, it is nearing completion. As I expected, the tool started building a minimum correction, a three-wave section of the trend. A decrease in quotes may also mean the end of the ascending section and that it will no longer be complicated. Much of this time depends on the news background. And it remains not too favorable for the British.

Friday's reports from America should not have caused any increase in demand for the US currency. The most important report on Nonfarm Payrolls was weaker than market expectations. However, the decline in the British dollar on Monday is logical. First, the wave marking has long been warning about the instrument's readiness to decline. Second, the negotiations on the Brexit trade deal last week ended with the parties deciding to extend the talks for a few more days. This means that there is no tangible progress. This means that the parties will not have time to ratify the agreement in any case. Or both parliaments will have to read the text of the trade agreement in a very short time, which may lead to a lot of other problems in the future. I think everyone understands that such serious documents do not like to rush. However, this is exactly what is happening now.

And even if by some miracle Michel Barnier and David Frost manage to agree on the terms of the trade deal before December 31 (although it was necessary before November 15), this does not mean that this deal will be ratified by both parliaments, whose deputies are not currently familiar with the text of the agreement. It is reasonable to assume that both parliaments will have questions and disagreements with the version of the deal that Frost and Barnier will offer them. However, there is not enough time to make adjustments. Thus, I believe that in any case, the parties will not have time to ratify the agreement before January 1. Most likely, the negotiations will simply continue next year. This is now the most logical scenario. The main thing now is for the parties to agree on extending the terms of negotiations.

General conclusions and recommendations:

The pound/dollar instrument presumably completed the construction of an upward trend section. Thus, now I recommend looking closely at the sales of the tool. The Briton will probably be aiming for the 29th figure now. I expect to build at least three wave formations for this purpose. Thus, at this time, I recommend selling the instrument for each MACD signal "down" with targets located near the calculated marks of 1.3012 and 1.2866.