The USD/JPY pair is fighting hard to resume its growth after ending its temporary retreat. At the time of writing, the pair is trading in the green at 115.80. The upside pressure remains high even if the Dollar Index plunges. The price stays higher only because the Japanese yen was punished by the Japanese Yen Futures drop.

Fundamentally, the US JOLTS Job Openings came in at 11.26M versus 10.96M estimates which could be good for the USD. On the other hand, the Japanese economic data came in mixed. The Final GDP rose by 1.1% versus 1.4% expected, the M2 Money Stock registered a 3.6% growth compared to 3.5% expected, while the Final GDP Price Index came in line with expectations.

Tomorrow, the US CPI and Core CPI data could be decisive. The volatility could be high around these high-impact figures.

USD/JPY Strong Buyers!

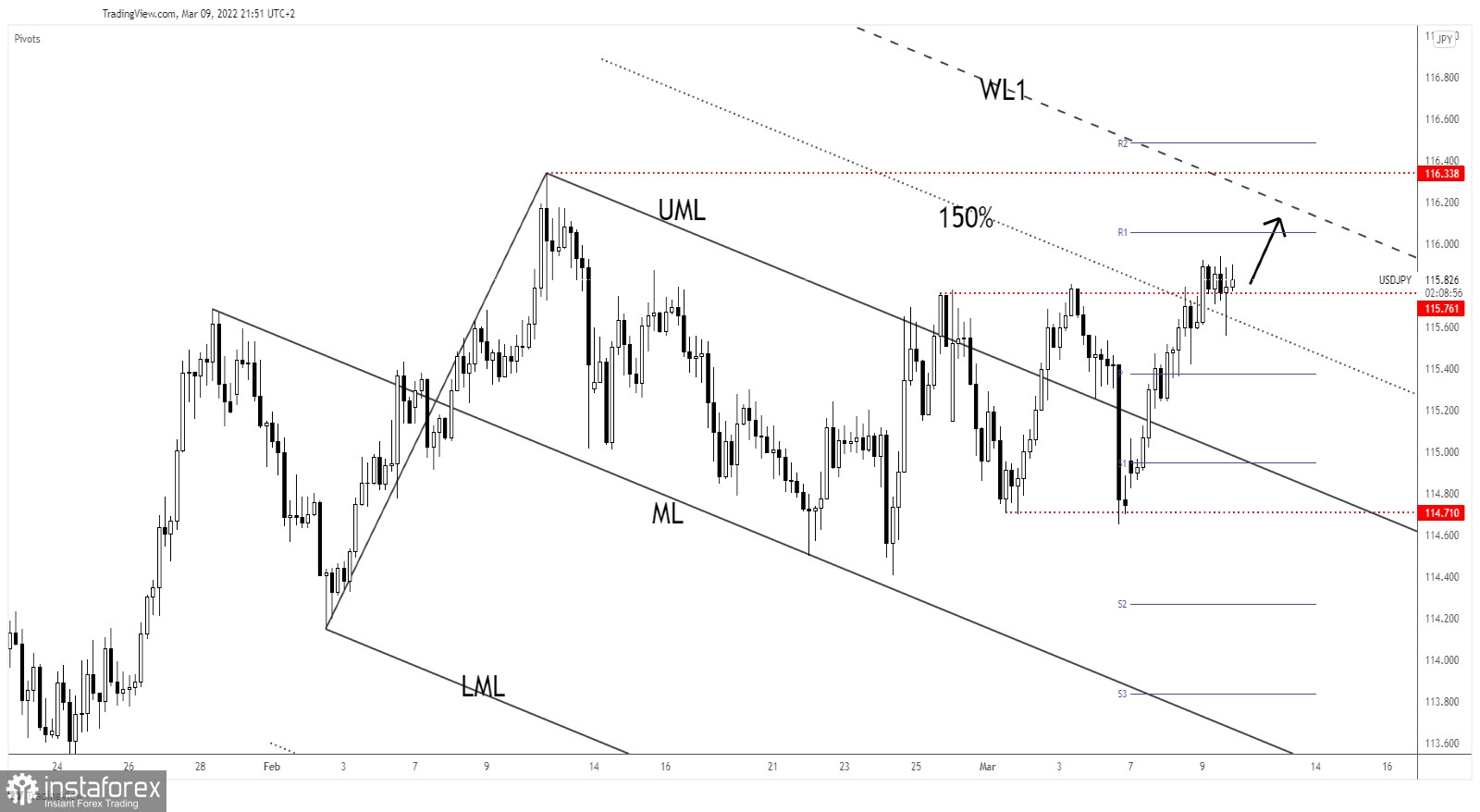

As you can see on the h4 chart, the pair has managed to jump and close above the 115.76 static resistance which represented a static resistance. In the short term, it has retreated a little after its amazing rally.

It has registered only a false breakdown with great separation below the 150% Fibonacci line signaling that the buyers are in the game. Stabilizing above 115.76 may announce potential further growth.

USD/JPY Prediction!

Escaping from the range between 115.76 and 114.71 level indicates an upside continuation. 115.92 level represents a static obstacle. A valid breakout above it may signal further growth towards the warning line (WL1).

In the short term, we cannot exclude a sideways movement. An upside continuation could be invalidated if the rate drops and closes below 115.55 level.