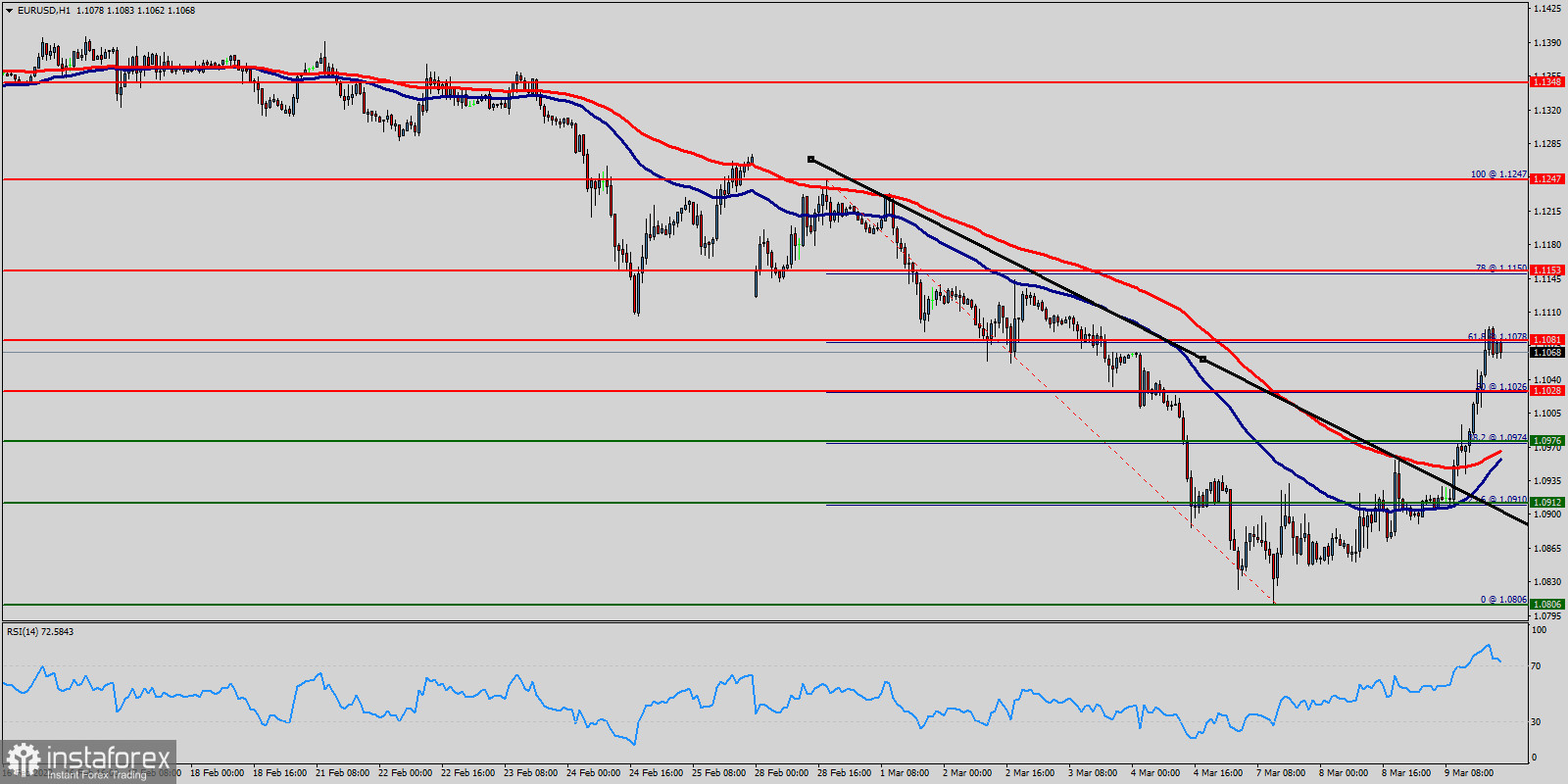

The EUR/USD pair continues to move downwards from the level of 1.1247. The pair dropped from the level of 1.1247 to the bottom around 1.0806. But the pair has rebounded from the bottom of 1.0806 to close at 1.1069.

Today, the first resistance level is seen at 1.1081, the price is moving in a bearish channel now.

Furthermore, the price has been set below the strong resistance at the level of 1.1081, which coincides with the 61.8% Fibonacci retracement level.

This resistance has been rejected several times confirming the veracity of a downtrend. Additionally, the RSI starts signaling a downward trend.

As a result, if the EUR/USD pair is able to break out the first support at 1.0976, the market will decline further to 1.0868 in order to test the weekly support 2.

Consequently, the market is likely to show signs of a bearish trend. So, it will be good to sell below the level of 1.1081 with the first target at 1.0976 and further to 1.0868.

However, stop loss is to be placed above the level of 1.1153.