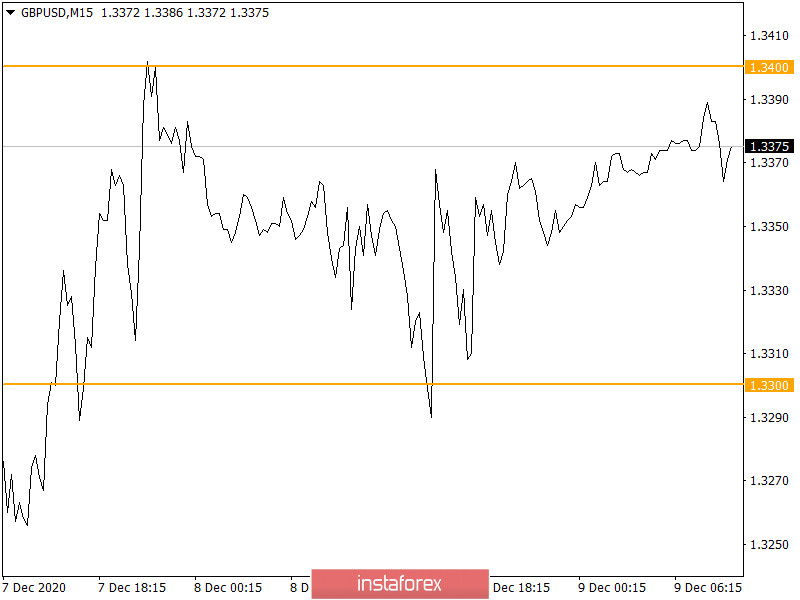

Past review of EUR/USD pair

The Euro showed low activity yesterday, only earning 38 points, as the quotes stood in one place all day.

What was published on the economic calendar?

The third estimate of GDP for the third quarter, which came out slightly better than expected, was published in Europe. There was a slowdown in the rate of economic decline from -14.8 to -4.3% against the forecasted decline of -4.4%. However, the market did not react to this, probably due to high pressure from the informational background of Brexit – trade negotiations between England and Brussels, which were stopped and are awaiting further steps.

US statistics were not released.

What happened on the trading chart?

There was literally nothing interesting. The quote focused on the range of 1.2095/1.2133, where it was impossible to trade due to extremely low activity.

Experienced traders refer to this kind of stop as a process of accumulating trading power, which can eventually lead to an acceleration in the market activity.

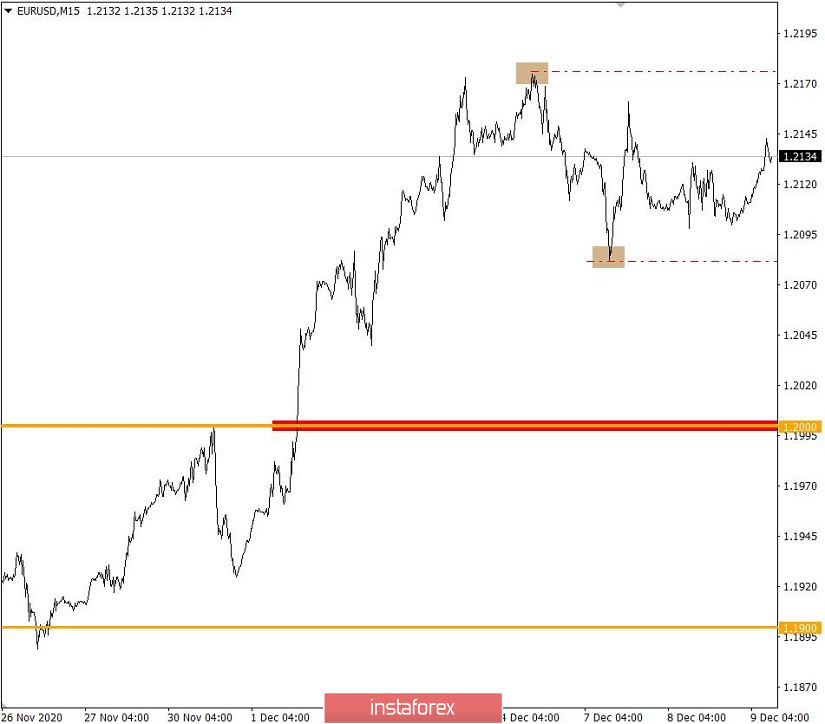

Past review of GBP/USD pair

Yesterday, the pound managed to show local activity by about 100 points, but the overall dynamics remained within the limits of a sideways price fluctuation.

What was published on the economic calendar?

No significant statistics were published in Britain, similarly in the US. As before, the market was focused on Brexit's information flow. But since the bilateral negotiations were suspended, the attention shifted to British Prime Minister, Mr. Boris Johnson and his intention to change the crisis situation in the negotiations.

What happened on the trading chart?

The pound spent the previous day within the limits of 1.3300/1.3400, where there were occasional surges of activity - as for example, at 12:15 and 14:45 Universal Time. However, it is still related to the incoming Brexit information.

Trading recommendation for EUR/USD on December 9

In terms of the economic calendar, US data on open vacancies is the only data that will be published today. Its value is expected to decline from 6 436 thousand to 6 400 thousand. But there may be no reaction to the statistics, due to the fact that US data are released during the closing period of the European session and the European Central Bank is expected to meet tomorrow.

For the technical analysis, it can be seen that the limits of the previous day's stagnation 1.2095/1.2133 were broken in the upward direction, but there was no acceleration after that. It is assumed that the stagnation has only expanded its borders, and so, we paid special attention to two values: the low of the beginning of the week is 1.2078 and the local high is 1.2177.

Trading recommendations can be made considering the available information:

- Buying a currency pair at a price above 1.2180, with the prospect of moving to the level of 1.2250 is recommended.

- Selling a currency pair at a price below 1.2070, with the prospect of moving to 1.2000 is recommended.

Trading recommendation for GBP/USD on December 9

Statistics from the UK and the US are not expected today in regards to the economic calendar. Therefore, market participants will continue to track information on Brexit trade negotiations. We will pay special attention to the meeting between Britain's Prime Minister, Mr. Boris Johnson and the European Commission's head, Ms. Ursula von der Leyen.

The market reaction to the Brexit information flow has an ordinary form. It was mentioned that positive information on trade negotiations leads to pound's strengthening, while negative news leads to its weakening.

In terms of technical analysis, the quote remains within the range of 1.3300/1.3400, but as soon as there is information about the meeting of the British Prime Minister with the head of the European Commission, further impulses will appear, where one or another border of the range will be broken depending on the nature of the information.