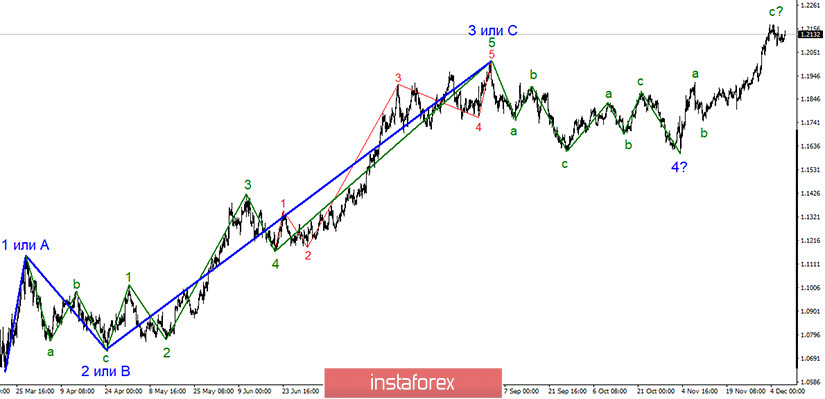

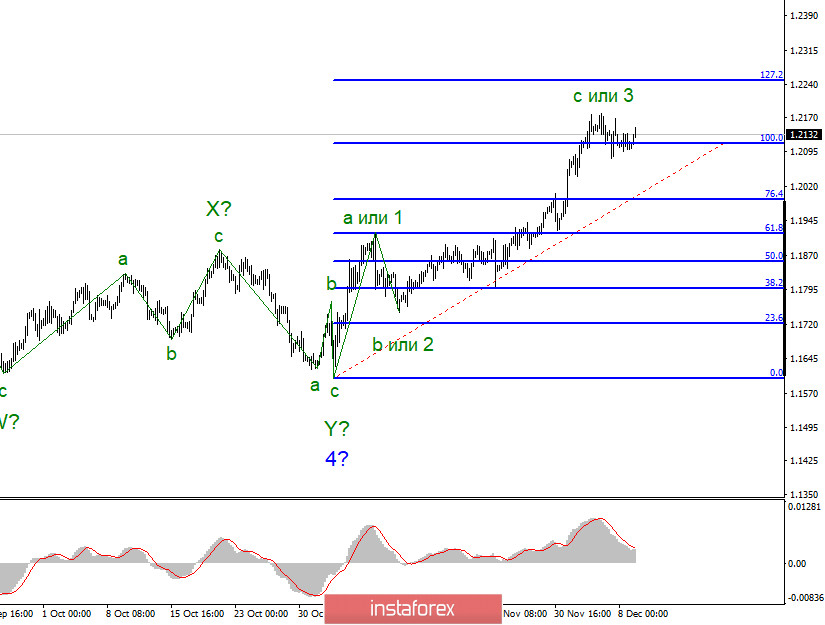

The wave pattern for the EUR/USD pair still indicates the formation of the upward trend. The upward wave C is still forming. It made a successful attempt to break through the high of the wave 3 or C. Thus, the formation of the next three ascending waves continues. Also, the current ascending section of the trend may turn into a five-wave structure.

The wave pattern in a lower time frame also indicates that the formation of the next three-wave section of the trend continues. Alternatively, the wave pattern of the trend section that started on November 4, is transforming into a five-wave structure. A successful attempt to break through the high of the wave 3, or C, indicates the bullish movement. At the same time, the trend may be completed by the formation of the wave C, followed by the formation of new three descending waves.

In yesterday's review, I mentioned two important events to take place in the eurozone this week that could have a strong influence on the EUR/USD pair. Firstly, it is the ECB meeting. During the course of the meeting, the regulator is expected to expand the stimulus package. Lastly, it is the EU summit. During the course of the summit, European partners should approve a coronavirus recovery fund and a long-term budget. Earlier, Poland and Hungary imposed a veto on both the budget and the fund. These countries managed to veto both projects at once since they had been discussed together. But if viewed separately, the fund and the budget can be adopted without the approval of Poland and Hungary. At least that's what European officials say. The European Union and Germany sent a formal request to Warsaw and Budapest demanding to overturn their veto. In addition, the EU threatened the two countries with a 'Plan B'. According to his plan, Poland and Hungary may be left without any money from the recovery fund. However, the leaders of Poland and Hungary responded with a definitive refusal. Consequently, the issue will be tackled tomorrow during the EU summit.

Market participants can only guess how things might end. Some experts suggest that Poland and Hungary may be denied access to the recovery fund. Others claim that the two countries will be denied access to both the recovery fund and the 2021-2027 budget. Meanwhile some analysts argue that it will be impossible to adopt the budget and the fund without a unanimous approval of all 27 EU countries. By the end of this week, it should be clear whether the parties will be able to find a common solution. Currently, the situation looks similar to the one with the Brexit trade deal. The sides have completely different opinions on the issue. Hungary and Poland object to a clause that links funding with adherence to the rule of law. Meanwhile, the rest of the European Union members give their approval.

General conclusion and recommendations:

The euro/dollar pair is currently trading in a three-wave upward trend. However, it is also possible that the bullish movement has already come to an end. Thus, I recommend that you be extremely careful when buying the instrument and consider opening short positions. Despite the fact that the wave 5 is currently being formed, it will be completed soon. Nevertheless, it is still possible to buy the pair following each of the new MACD buy signals with the targets set near 1.2250, which corresponds to the 127.2% Fibonacci extension level.