There was no verbal intervention, and the actions of the European Central Bank are very cautious, even despite the strong strengthening of the European currency.

There is no doubt that the COVID-19 pandemic remains one of the main risks to the eurozone economy. Therefore, the ECB, together with its President, Christine Lagarde, is working to prevent serious economic problems that have arisen against the backdrop of the pandemic.

In her speech, Christine Lagarde discussed the rate of GDP growth and inflation, and also seriously touched on the exchange rate of the European currency. Many traders, especially those who were betting on the euro's decline, expected sharper statements, given the fact that many European economies are closing amid the second pandemic wave. But since it did not happen, the desire of traders to increase the pound's price began to prevail.

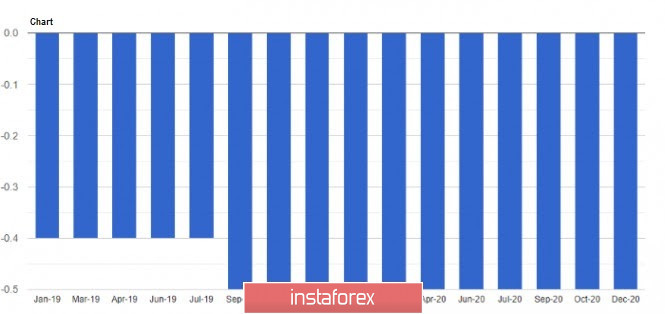

Lagarde said the latest data points to a longer period of low inflation, which will remain negative until early 2021. In her summer forecasts, she confidently stated that there are absolutely no deflationary risks, but it turned out quite the opposite. Now, ECB economists are forecasting annual inflation of 1% in 2021 and 1.1% in 2022. Only by 2023 will inflation be able to reach 1.4%. Earlier, the ECB predicted inflation at 1% in 2021 and 1.3% in 2022. The persistence of a low inflation rate will affect the rate of increase in interest rates, on which the exchange rate of the European currency will also depend.

As for the outlook of the EU economy, Lagarde expects GDP to contract by 2.2% in the 4th quarter, mainly due to the partial lockdown many EU countries were subject to. But since the long-awaited COVID-19 vaccines offer hope for a solution to the health crisis and a stronger recovery in the coming years, economists forecast the EU GDP to grow by 3.9% in 2021, by 4.2% in 2022 and by 2.1% in 2023. Earlier, the ECB forecasted GDP growth of 5% in 2021 and 3.2% in 2022.

At the end of her speech, Lagarde expressed her hope that the EU economic recovery fund will start functioning without delay, as the strengthening of the euro puts downward pressure on prices. As for the adjustment of interest rates, Lagarde only casually mentioned that they are part of the ECB's arsenal, as well as the bond purchase program.

If the euro was able to keep its position amid the recent events, the US dollar was not that lucky. Demand for the currency decreased because of the weakening state of the US labor market. The new restrictions, plus the growing number of COVID-19 cases, threatens another blow to the economy and the labor market, especially since the situation is expected to worsen further. According to some economists, at least 3-4 months will pass before economic activity begins to return to normal.

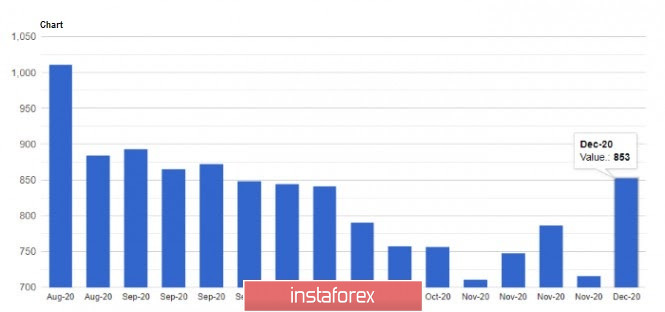

The recent data published by the US Department of Labor said jobless claims for the week of November 29 to December 5 rose by 137,000, totaling around 853,000.

US budget deficit for October also increased, however, this was not surprising given all the financial assistance and borrowing the government was implementing. According to the US Department of Treasury, the deficit between October and November 2020 increased by 25% over the same period the previous year, reaching $ 429 billion. Federal spending rose 9% y / y to $ 887 billion, while revenues were down 3% to $ 457 billion.

As for the technical picture of the EUR / USD pair, further upward leaps directly depend on the breakout of 1.2170, as only by that will the euro reach new local levels at 1.2260 and 1.2340. But if the quote drops below 1.2145, the euro will collapse to 1.2060, and then to 1.1980.

GBP / USD

Yesterday, UK Prime Minister Boris Johnson warned business and the public to prepare for a Brexit without a deal. His meeting with European Commission President Ursula von der Leyen ended without much breakthrough, but Johnson said the UK will still continue to look for a trade deal. He said it was the demands of the EU that are a serious obstacle to the conclusion of an agreement.

Meanwhile, it is expected that at the very last moment, German Chancellor Angela Merkel and French President Emmanuel Macron will join the negotiations. Both are now at the EU summit in Brussels and can play an important role as negotiators.

Judging by the market reaction, sentiment and expectations for a trade agreement are rapidly declining. And although both sides are willing to close a deal, no one is willing to make significant concessions. Yesterday, the European Commission proposed measures in case the UK and the EU fail to conclude an agreement. These measures include a fisheries agreement for a period of one year, as well as the extension of the current rules of interaction and safety in air transport. These proposals, however, did not provoke any reaction from the UK.

More than four years have passed since the UK voted to leave the EU. This year, the parties hoped that they would be able to settle all differences, but this did not happen. Most likely, on January 1, the UK will return to the general rules of the World Trade Organization and further trade relations with the EU will be conducted according to common tariffs and quotas.

As for the technical picture of the GBP/USD pair, the breakout of 1.3245 will lead to increased pressure on the British pound, as well as to its immediate decline to 1.3190, 1.3115 and 1.3030. The upward trend will only resume if the quote breaks above 1.3490. But until that moment, the bulls will have to somehow cope with the levels of 1.3340 and 1.3390.