Market volatility has significantly increased recently. The main reason for this is the uncertainty factor about how will the UK's withdrawal from the European Union end and whether the Congress will take new fiscal measures to support the US economy.

These two topics are critical to the currency markets. In addition, there was another problem in the US two days ago – Mr. D. Trump's transition to active measures to counterattack Mr. J. Biden's actual transfer of power in America, following the controversial presidential election. However, there was still no market reaction, since they already believe that Mr. Biden is already the 46th president of the United States. On Monday, electors who are believed to support Biden will vote, which should finally close the topic of the presidential election.

But the question is will Trump's supporters show acts of civil disobedience? If so, what will be the result of all of these?

In general, it is true that amid the ongoing coronavirus pandemic, events in America and Europe are heated in the financial markets, causing high volatility and as a result, the so-called "saw" effect. This is when the price of an asset, whether it is a company share or, for example, a currency pair, changes in a short period of time, generally remaining in the range.

Analyzing all that is happening, we believe that this picture will continue until it becomes clear who the US president is, whether fiscal measures will be taken to support the US economy and when the Brexit issue will be resolved. Until then, we will see high volatility in the market.

Yesterday, markets attempted to put pressure on Congress once again, namely on those people from the camps of Democrats and Republicans who are negotiating incentives. Moreover, the US financial market began to sharply rise after last week's publication of extremely weak data on the number of applications for unemployment benefits, which showed strong growth to 853,000 against the forecasted 725,000 and the previous week's value of 716,000. And although it could not generally consolidate at the levels reached, investors' actions clearly showed that they are confident that Congress will have to take stimulus measures in any case.

The Congress is expected to adopt incentives, but the only question is when? At the same time, we believe that any Brexit result will support the demand for European stocks. The main factor here may simply be the appearance of certainty, the lack of which now fully guides the currency markets.

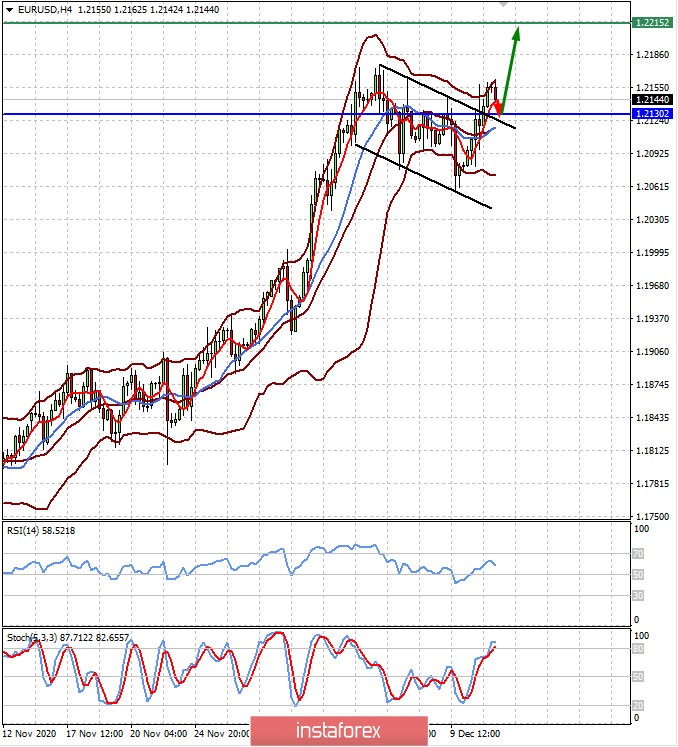

Forecast of the day:

The EUR/USD pair has formed a "bearish flag" trend continuation pattern. It may further continue to the level of 1.2215, after a downward correction to the level of 1.2130

The EUR/JPY pair seems to be forming a "megaphone" or "broadening top" continuation pattern, which is initially amid euro's correction against the US dollar. This pair may further decline to the level of 125.70.