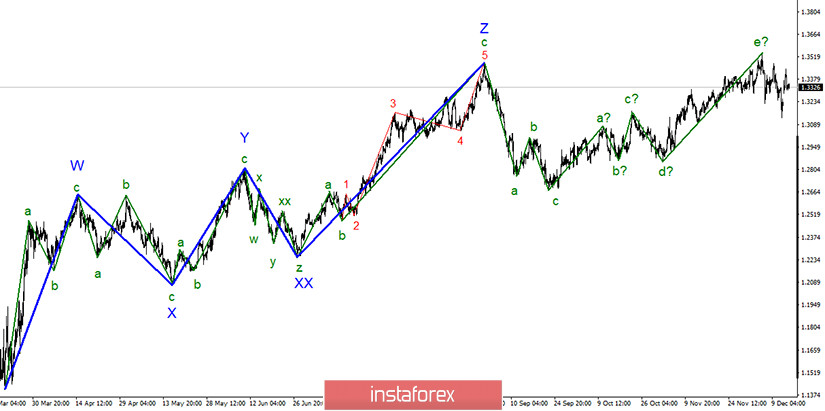

Based on the chart, it appears that the upward section of the trend is already completed. As a result, a five-wave rising structure of the trend was formed. Currently, the global descending section of the trend is expected to be built. On the other hand, the three downward waves have already been built, so the formation of the upward section of the trend may even begin from the current positions. The entire wave pattern may certainly become complicated.

The wave pattern in a lower time frame clearly shows the three-wave section of the trend, which formed after the completion of wave 'e'. Consequently, the pair continued its strong upward movement, adding almost 300 pips. This was followed by the beginning of quotes' decline so these waves can be waves d and e. In any case, the formation of the correction section of the trend continues. Now, I still expect a more convincing decline in the quotes, after the pound's fairly long growth.

Michel Barnier and his members refuse to make the markets calm down even for a while and give them a break. The European Commission's Head has reiterated the possibility of a trade deal. Same opinion was voiced out by other participants in the negotiations, as well as Ursula von der Leyen and Boris Johnson. But despite all these statements, the negotiations continue and will most likely continue until next year. However, Michel Barnier has changed his mind during the previous days. He now believes that a deal will be reached before this year ends, that is, if the negotiators can overcome their differences. It is clear that if this really happens, then the deal will be concluded. Unfortunately, the issue primarily lies on the negotiators' failure to compromise. Thus, negotiations will indeed continue as long as there is at least some sense in it, but Boris Johnson and Ursula von der Leyen will decide every week whether it still makes sense or not. At the same time, there is still a quite high demand for the pound. Meanwhile, the formation of a new downward section of the trend is not yet starting, which indirectly warns about markets' unwillingness to sell the pound.

The publication of the UK's unemployment rate, which rose by 0.1% to 4.9%, can be noted today. At the same time, the number of applications for unemployment benefits grew by 64.3 thousand, which is significantly higher than forecasts. Thus, British quotes' new downward movement is quite justified. In the afternoon, United States will release a report on industrial production.

General conclusions and recommendations:

The pound/dollar pair has supposedly completed the formation of the upward trend section. I recommend that you sell the instrument following each new MACD sell signal with targets located near the levels of 1.3190 and 1.3008, which corresponds to the 23.6% and 38.2% Fibonacci levels, before a successful attempt to break through the 0.0% Fibonacci level or the high of wave 'e'. A successful attempt to break through the 0.0% Fibonacci level will indicate another complexity in the upward trend section, which will negate the scenario of selling the instrument.