Market optimism will soon be tested for its resilience. The Fed's final meeting of the year kicked off today. Investors do not expect any changes in the monetary policy. They are curious to learn Fed's economic outlook amid vaccine optimism. Traders wonder whether the regulator thinks likewise. Even though the Fed's opinion is still unknown, many speculators are betting on economic recovery in 2021.

Investors are also worried about the recent slowdown in the US economy. So, they want to find out how the economic recovery is unfolding and whether the Fed is going to intervene.

For instance, the regulator has been discussing average inflation targeting several times in a row. No wonder, investors wish to learn more about this approach. Thus, the comments of central bank officials are sure to be in limelight.

If the regulator is also optimistic about the economic recovery next year, then the bullish trend in the forex market will ease. Such rhetoric may be perceived as a hint that the regulator will stabilize the interest rate in the near future. However, the US has not been able to avoid a second wave of the pandemic. Therefore, the Fed is unlikely to raise its key rate. It may soften its monetary policy instead of tightening it. This is why the hawkish stance on the policy looks unlikely.

Investors think that Fed officials are unlikely to deliver an unpleasant surprise. An increase in QE or a change in the monthly volume of the government Bond Buying Program will boost the bullish trend. This depends on whether the regulator considers the existing rate on ten-year treasuries of 0.92% to be appropriate for economic recovery.

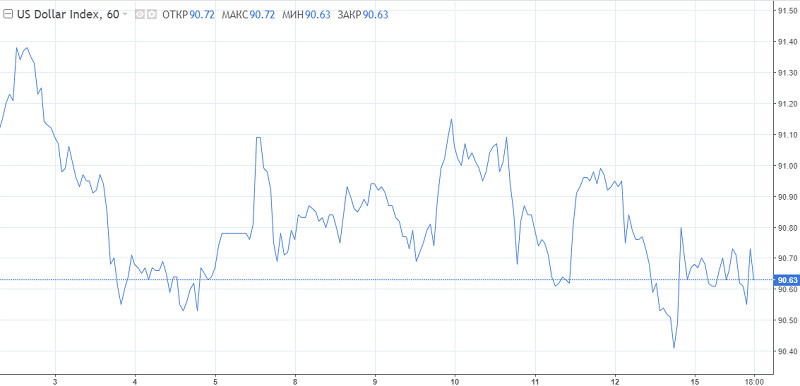

In the case of adjustments in the composition of purchases, long-term rates may decrease, which means that the flow into risky assets will increase and the dollar will be under even more pressure. Given this scenario and the expectation of incentives from Congress, breaking down the 90 level by the US currency index looks reasonable.

In the case of any changes in the Bond-Buying Program, long-term rates may decrease, which sparks demand for riskier assets. The US dollar as a safe-haven currency will drop. Given this scenario and the expectation of stimulus measures from Congress, the US dollar index may break under the 90 level.

On Tuesday, the US dollar made attempts to recover against a basket of six major currencies. Investors doubted that US lawmakers would agree to allocate $ 1.4 trillion to support the economy. The amount can be much less. However, the bipartisan $908 billion plan is likely to be split into two packages. Against this background, the US dollar is losing steam.

Westpac currency strategists assume that the economy is likely to recover next year. The US will certainly be a part of that, global reflationary trading will support riskier currencies. The US dollar will continue to lag behind.

Meanwhile, Morgan Stanley believes that the Fed is unlikely to take any action in the next meeting, although there may be a hint of an increase in asset purchases. Analysts also recommended against opening short positions on the US dollars until at least January 5. On this day, the second round of elections in the US state of Georgia will end. According to its results, it will become clear who will take control of the Senate and the Upper House of Congress. Morgan Stanley maintains a bearish outlook for the US currency.

Taking into account the current dynamics of the US dollar index, bears are likely to take the upper hand. The long-term downtrend looks possible. However, yesterday bulls broke up the medium-term trend line – 90.60. And if you look closely, the upward trend is strong. The question is who will win-buyers or sellers. If the US dollar breaks the level of 90, it may jump above 91. However, the upward movement can be short-lived.

The fight between bulls and bears is unlikely to last long as the market is bracing for important reports, including the Fed meeting. Investors are likely to refrain from active trading until the Fed unveils out economic outlook.