Today's data on the state of the UK labor market showed how much the situation with COVID-19 affects the population and income levels. Despite all the programs that the government conducts to support employers and employees, the unemployment rate itself is beginning to gradually creep up. Now we can only guess what will be the real numbers after the completion of all support programs. But one thing is objectively clear – nothing good will happen, especially if the situation with Brexit is not resolved in favor of a trade agreement.

As noted above, large-scale measures to support the labor market, implemented by the UK authorities, now only help reduce job losses, but will not prevent them in the future. It is already clear that the existing aid measures are not enough to prevent a significant increase in unemployment in the first half of next year. According to some economists, the real unemployment rate could reach 8% by mid-2021.

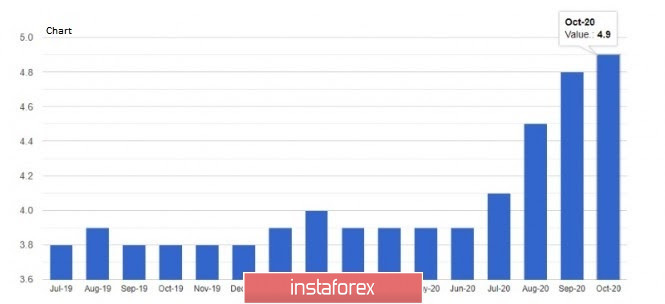

Today's report from the country's National Bureau of Statistics shows that unemployment in the UK rose to 4.9% from August to October this year. At the same time, the number of layoffs reached 370,000. Let me remind you that the support program was extended at the end of October for another six months.

As for the technical picture of the GBPUSD pair, buyers do not intend to sit on the sidelines. The protection of the level of 1.3290 and a return to the resistance of 1.3390 indicates an active desire to open long positions on the pound in any sufficient reduction based on the resumption of the bull market and a return to the annual in the area of 1.3490 and 1.3540. It will be possible to talk about the formation of a larger pressure on the pound only after the breakdown of the support of 1.3290, which will open a direct road to the lows of last week in the area of 1.3190 and 1.3135.

EURUSD: Tomorrow will be the last meeting of the Federal Reserve System this year, at which many traders may be disappointed, as the regulator may leave its bond-buying program unchanged. Such a decision will affect long-term Treasury bonds, whose 10-year yield may finally get above 1.0%. If the Fed leaves everything unchanged, it can support the US dollar, which is one step away from another fall in pair with the euro.

Given that the coronavirus vaccine has begun to spread among doctors and the US population, and another one from Moderna is on the way, the Fed can hold back changes in monetary policy and leave the bond repurchase program unchanged. There is also hope that the US Congress will be able to agree on a new package of assistance to combat the virus, which will save the Fed from the necessary intervention in the event of a deterioration of the situation. The Fed is currently buying about $ 80 billion worth of Treasury bonds a month. The regulator also buys mortgage-backed securities worth $ 40 billion a month.

Keeping the current monetary policy unchanged will have a positive impact on the US dollar, however, it is unlikely that this will lead to its serious strengthening against the euro and several other world currencies. Investors' risk appetite will prevail early next year as the coronavirus vaccine spreads in European countries.

As for the technical picture of the EUR/USD pair, the further direction of the trading instrument depends on whether buyers breakthrough above the resistance of 1.2165. Going beyond this range will easily allow you to reach a new local high of 1.2250, as well as achieve an update of a larger resistance in the area of 1.2340. It will be possible to talk about the resumption of pressure on risky assets only after a breakout and consolidation below the support level of 1.2060, which will push the pair to the lows of 1.1980 and 1.1890.

If the Federal Reserve decides to increase the volume of bond purchases tomorrow, it will seriously hit the positions of the US dollar and lead to a new wave of strengthening of the EURUSD pair in the short term. And if bipartisan negotiators also manage to find common ground on a $ 908 billion bailout package, the dollar's decline will be unstoppable, and we will see a powerful new bullish trend across all risky assets.