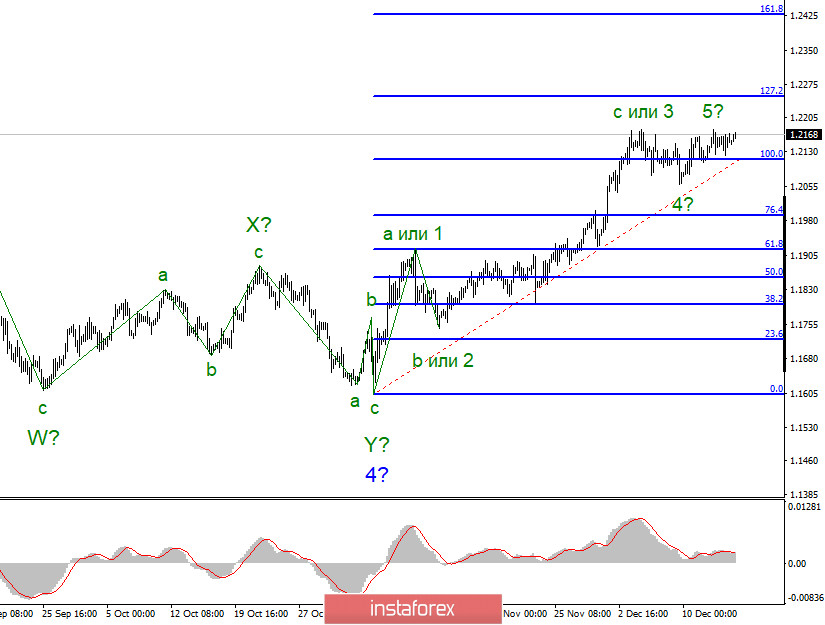

The wave layout of EUR/USD still indicates that the uptrend is underway. The upward wave labeled as c is still in progress. The wave has made a successful attempt to break the high of wave 3 or C. The ongoing section of the uptrend could evolve into a 5-wave layout because three waves have been already completed. In this case, the whole wave structure is getting a bit complicated. Nevertheless, this layout signals that the price is about to reverse downwards soon.

The wave layout of a shorter time frame also indicates a further uptrend. I also admit a scenario that the wave layout, which came into being on November 4, could turn into a 5-wave structure. Meanwhile, a minor climb from highs and the bullish outlook confirm that traders are ready to go on buying EUR/USD. So, I added waves 4 and 5 to the wave layout.

Yesterday, there were no market-moving events for EUR/USD. So, the currency pair was trading in a quiet market. Today, plenty of news is on investors' radars. Looking at technical charts, anyone can spot a cluster of upward waves which suggests the bullish outlook. You may wonder why markets maintain buoyant demand for EUR and low demand for USD. This is a rhetorical question as no one can answer it precisely and squarely. Thus, it would be better to shift focus towards the economic calendar. For example, today investors are alert to a series of PMIs on different sectors in the EU and the US. All forecasts signal nearly flat readings close to the scores in the previous month. For your reference, the eurozone's services PMI sank below the threshold mark of 50.0. Interestingly, business activity in the US service sector is firmly in the expansion territory. In contrast, the EU service sector is going through a downturn that is a precursor of serious economic headwinds. Oddly enough, EUR has been unaffected by downbeat statistics.

Today, the US Federal Reserve is going to wind up its two-day policy meeting. The policymakers will hardly spring a surprise. Most experts share the viewpoint that the Fed's final policy meeting of 2020 will not end up with crucial policy updates. What can Jerome Powell and his team actually do right now? It doesn't make sense to raise/lower interest rates. The QE program has been already swollen to an unprecedented extent. So, they will hardly expand it even more. The market is interested to find out official forecasts of economic prospects in the medium term. The policy statement will contain such forecasts. Besides, investors will take notice of Jerome Powell comments at the press conference. His remarks are to shape market sentiment.

Conclusions and trading tips

Apparently, EUR/USD is carrying on forming the uptrend section. In fact, the price is creeping upwards from earlier highs. Thus, I would recommend being cautious about buying the currency pair. Nevertheless, it is too early to say that a cluster of upwards waves has completed. In the meantime, traders still can buy the pair cautiously at every signal of the MACD indicator with the upward target at near 1.2250 which is equal 127.2% Fibonacci correction. Please beware there are the odds that the upward trend is about to complete in the nearest future.