Market participants are awaiting the results of the two-day Fed's meeting

Hi everyone!

The situation with the coronavirus can hardly be called resolved as the virus continues to spread. The United States of America, India, and Brazil are the countries with the highest rate of infection spread. They register the biggest daily number of new coronavirus cases. The epidemiological situation in Europe is also worrying. A number of European states have introduced new restrictions. For instance, in Germany, only food stores and pharmacies are open, other shops are closed. France replaced its stay-at-home order with a curfew from 8 pm to 6 am. Europe remains the world's most infected region with more than 20 million people tested positive with the coronavirus since the outbreak of the pandemic.

Market participants are waiting for the results of the two-day meeting of the US Federal Reserve System. Today, at 22:00 (Moscow time), the Federal Reserve will announce its policy decision, new economic forecasts. At 22:30 Moscow time, Fed Chairman Jerome Powell will deliver a speech at a press conference. As expected, the Fed will not change the benchmark rate. It will keep the key rate at current values. At the same time, the central bank will once again confirm that rates will remain near zero for a long period of time. Besides, the Fed is likely to confirm the continuation of its large-scale bond-buying program.

Weekly analysis

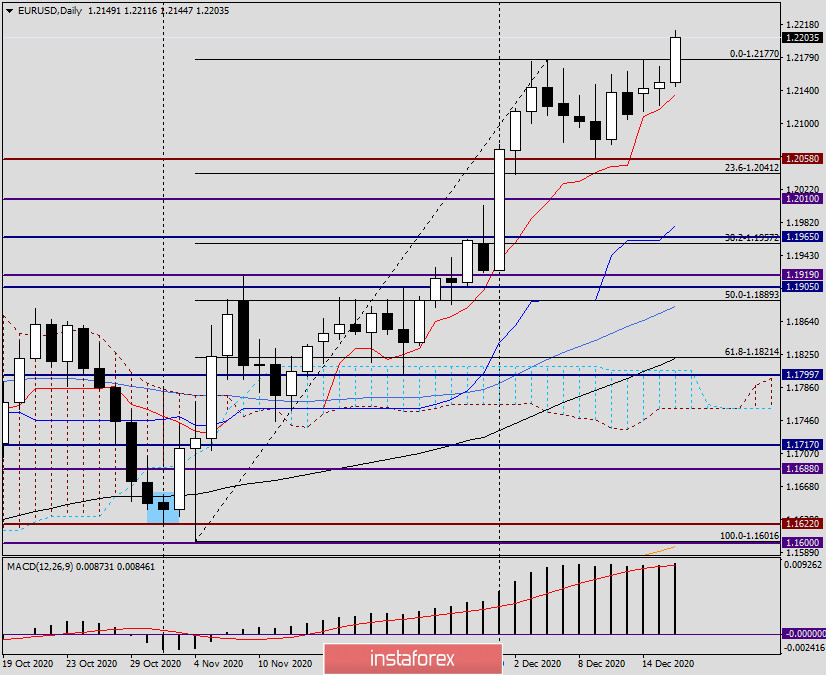

Let us look at the technical analysis of the EUR/USD pair on the daily timeframe. It is clearly seen that after a strong upward momentum, starting from December 3, the EUR/USD pair was trading in a relatively narrow range of 1.2058-1.2177. As a rule, when the pair trades in such ranges, it enters the consolidation phase preparing for a new robust increase. Usually, such a hike coincides with the previous direction. Today, the euro/dollar pair began to move up from the designated range, thereby confirming its previous growth and signaling its continuation. At the moment of writing this analysis, EUR/USD broke the upper trend line, which is the level of 1.2177. If today's trading ends with the formation of a large white candle with a closing price significantly higher than this level, the pair is likely to break above this level. When the pair rollbacks to 1.2180-1.2160, it is recommended to open long deals.

H4

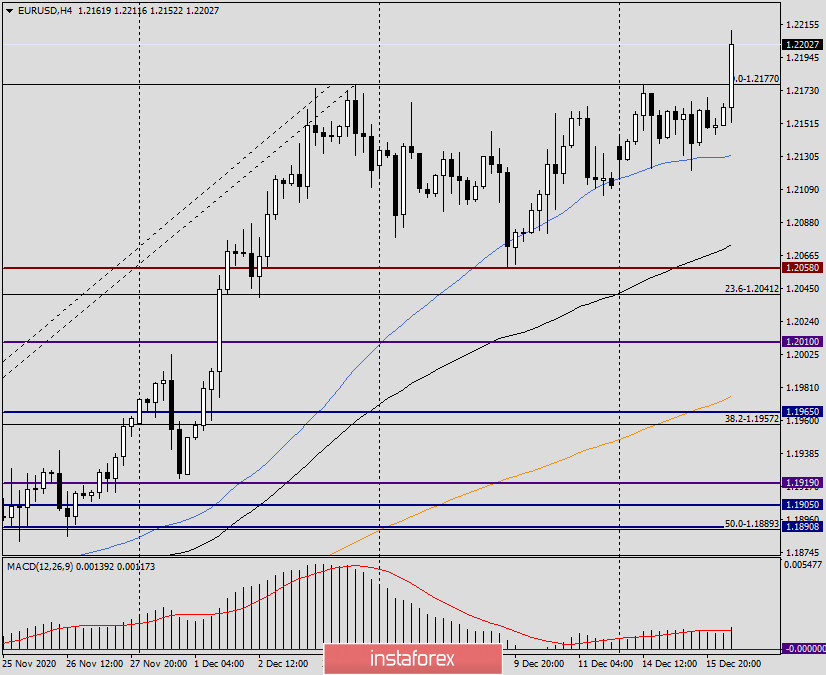

On the H4 chart, we can clearly the range of 1.2058-1.2177 and the breakdown of its upper trend line. In my opinion, long deals on the pair should be opened after a pullback to the area of the broken upper border of 1.2177. If the pair with three candles in a row consolidates above the level of 1.2200, it is recommended to open long deals near 1.2200. The man risks for today's trading are associated with the results of the two-day Fed's meeting. Experts are uncertain what decision the Fed will make and most importantly, how traders will react to it. It is better to remain cautious.