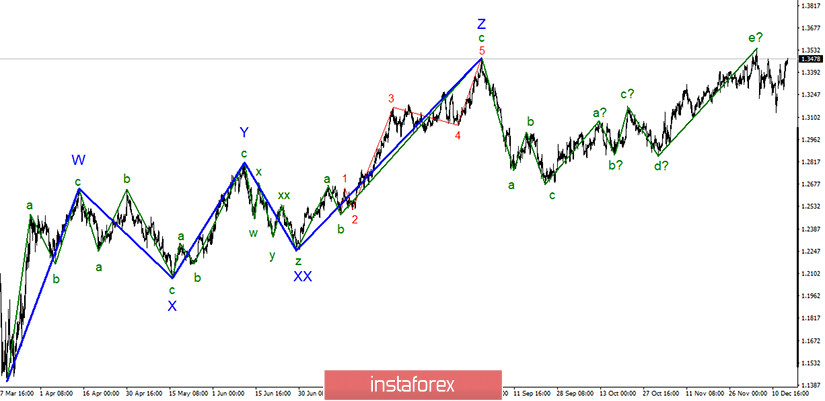

The wave pattern seems to indicate that the upward trend is already completed. As a result, a five-wave ascending structure of the trend was formed. At the same time, the global descending section of the trend already completed its formation, so the upward section of the trend can resume its formation from the current positions. A successful attempt to break the high of the supposed wave e will indicate the readiness of the instrument for further growth.

The wave pattern in a lower time frame clearly shows the three-wave section of the trend, which formed after the completion of wave "e". Consequently, the pair continued its strong upward movement, adding almost 400 pips. On the other hand, it is unlikely that waves d and e will form, but there are high chances of building a new upward trend or complicating the old one. Thus, a successful attempt to break the high of wave e is likely to complicate the upward set of waves again.

We are fast approaching the upcoming year, which makes the current year a history in two weeks. However, there has been no progress on the trade agreement between the EU and the UK. The time is already running out and so, it is very possible that the parties will not have time to either agree or ratify the agreement. But another option is still available, that is, the parties will be able to sign a "raw" deal before this year ends and just somehow accept it, bypassing the approval of all EU member states. However, the likelihood of this option is also disappearing every day. Yesterday, Boris Johnson reiterated that the most possible result of the trade deal is "no-deal". Government officials say the Prime Minister wants an agreement, but not at any cost. He said a dozen times that the future agreement must respect the interests and independence of the UK. Here, nothing still changed even in the rhetoric of the negotiators.

Tonight marks the end of the Fed meeting, and its results may affect all instruments with the dollar. Perhaps, its influence already begun, since the euro and the pound simultaneously quickly rose this morning. Thus, the markets may not expect any optimistic information from the FOMC or maybe they don't need this information at all. The pound and euro are rising without any problems and without the news background. Yesterday's UK reports had no impact on the markets. The same case is likely with today's UK and US statistics.

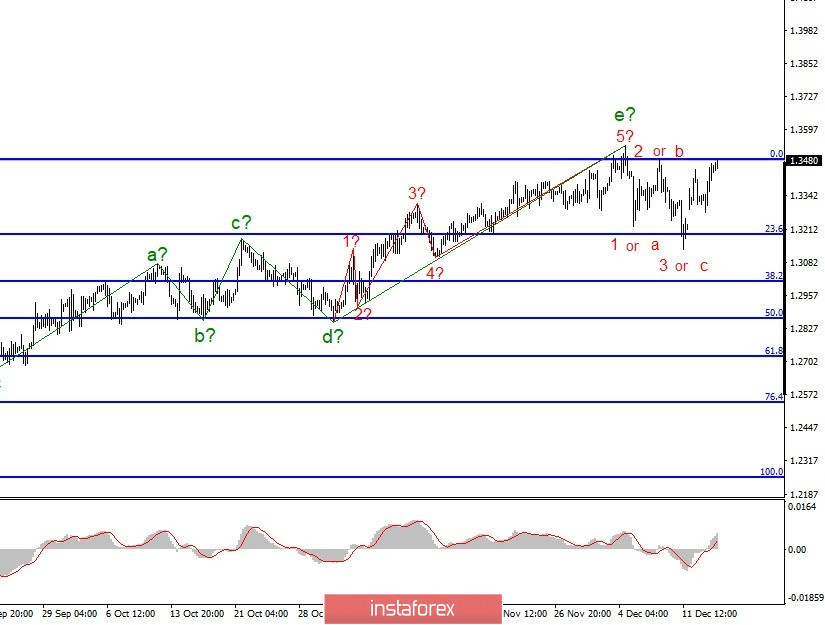

General conclusions and recommendations:

The pound/dollar pair has supposedly completed the formation of the upward trend section. I recommend that you sell the instrument following each new MACD sell signal with targets located near the levels of 1.3190 and 1.3008, which corresponds to the 23.6% and 38.2% Fibonacci levels, before a successful attempt to break through the 0.0% Fibonacci level or the high of wave "e". A successful attempt to break through the 0.0% Fibonacci level will indicate another complexity in the upward trend section, which will negate the scenario of selling the instrument. In this case, this will lead to a more complicated wave pattern.