To open long positions on EURUSD, you need to:

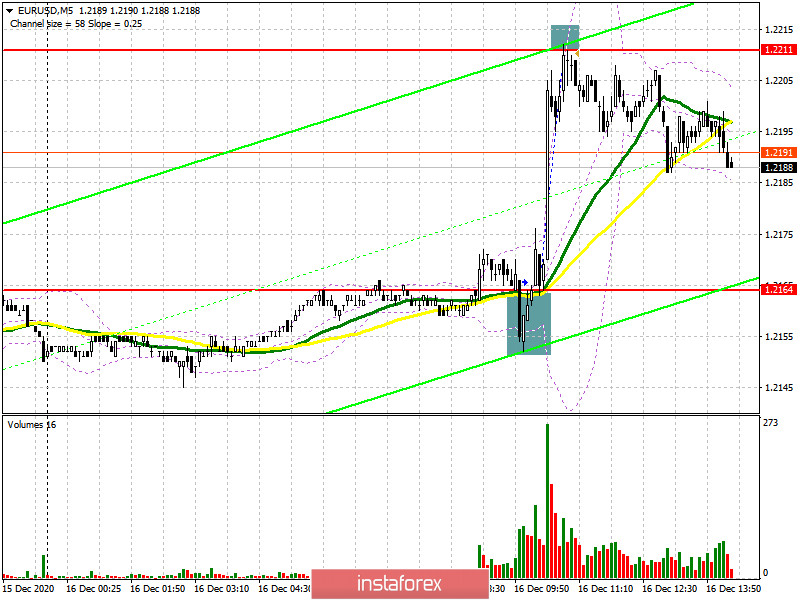

This week, we waited for signals to buy the euro and update the next annual high. Let's look at the 5-minute chart and figure out where you should have entered the market. In my morning forecast, I paid attention to purchases above the level of 1.2164, which happened. A breakout and test of this range from top to bottom formed a signal to open long positions, the target of which was a maximum of 1.2211, where the bulls actually pulled the pair. The sharp increase came after good data on the Eurozone services sector, as well as against the background of the demolition of a number of stop orders of speculative sellers, which were found above the level of 1.2164.

In the afternoon, the entire focus will shift to data on the United States service sector, as well as on manufacturing activity. However, the reports are unlikely to have much impact on the market, as the Federal Reserve's interest rate decision lies ahead. All that is required for euro buyers is not to let the resistance of 1.2211 go far. A repeated test of this level can lead to a breakdown and consolidation above. A test of this level from top to bottom will open a direct road to a new high of 1.2255, with the prospect of updating 1.2339, where I recommend fixing the profits. In the scenario of a return of pressure on EUR/USD before the publication of the Fed's monetary policy decision, it is best to postpone purchases until the support update of 1.2164. If there is no activity on the part of buyers, and good data on the US economy, it is possible to open long positions in EUR/USD only after testing the minimum of 1.2110 with the aim of a rebound of 20-25 points within the day.

To open short positions on EURUSD, you need to:

At the moment, sellers of the pound are focused on protecting the level of 1.2211, where the upward movement of the euro stopped today. Only the formation of a false breakout in the second half of the day will form a signal to open short positions, the main purpose of which will be to return EUR/USD to the level of 1.2164, for which buyers will actively fight. Fixing and testing this level from the bottom up on volume will lead to a larger sale of the euro to a minimum of 1.2110. It will be possible to talk about a breakdown of this range only after the publication of the Federal Reserve's decision on monetary policy. If it remains unchanged, it will give strength to the dollar and put pressure on the euro. In the scenario of a breakout and consolidation above 1.2211 in the second half of the day, which may be facilitated by weak data on activity in the US, it is best to postpone new short positions until the test of a larger resistance of 1.2255. I recommend selling EUR/USD immediately for a rebound from the maximum of 1.2339, based on a downward correction of 15-20 points within the day.

Let me remind you that the COT report (Commitment of Traders) for December 8 recorded an increase in long and a reduction in short positions. Buyers of risky assets believe in the continuation of the bull market, and in the further growth of the euro after breaking the psychological mark in the area of the 20th figure. Thus, long non-profit positions rose from the level of 207,302 to the level of 222,521, while short non-profit positions decreased to the level of 66,092 from the level of 67,407. Total non-commercial net position rose to the level of 156,139 against 894,429 a week earlier. It is worth paying attention to the growth of the delta, observed for the third week in a row, which completely negates the bearish trend observed in the early autumn of this year. Talk of a larger recovery will only be possible after European leaders agree with the UK on a new trade agreement.

Signals of indicators:

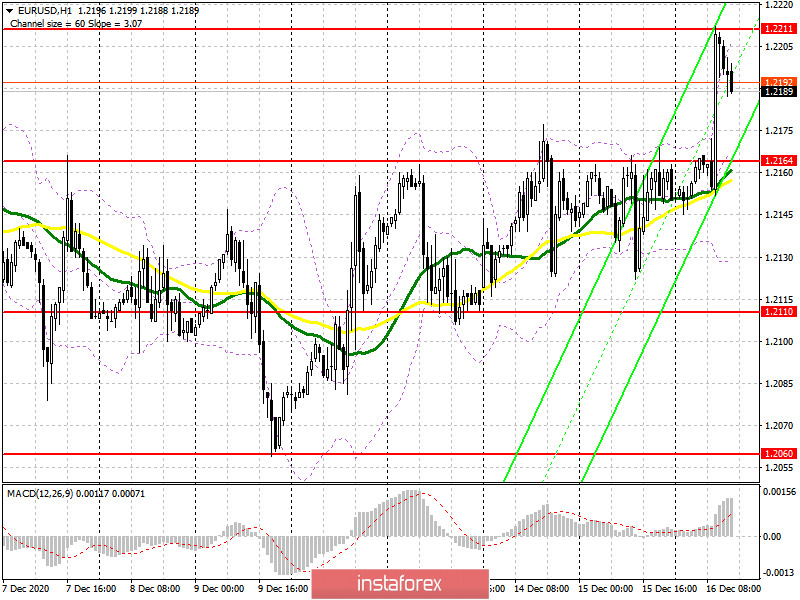

Moving averages

Trading is conducted above 30 and 50 daily moving averages, which indicates an attempt by buyers to take control of the market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break of the upper limit of the indicator in the area of 1.2211 will lead to a new wave of growth of the euro. If the pair declines, the lower limit of the indicator in the area of 1.2135 will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.