The European currency resumed its strengthening against the dollar, and the EURUSD pair itself broke through to new highs of the year, which indicates the preservation of a fairly high desire of investors to buy risky assets. Today's data on activity in the eurozone services sector, which, although declining in December this year, clearly indicates that growth in January can be expected, as the preliminary service sector index has rebounded very strongly in many eurozone countries. The data helped offset the IFO's revised 2021 growth forecast for Germany.

EUR: The euro ignored the Ifo forecast that German GDP will grow by only 4.2% in 2021, and not by 5.1%, as previously predicted. The revision of the forecast occurred due to the rather high probability of further economic lockdown against the background of a record number of coronavirus infections. The forecast for 2022 was revised upwards. According to the report, Germany's GDP will increase by 2.5% in 2022, and not by 1.7%, as previously expected. The institute believes that the production of goods and services is unlikely to return to pre-crisis levels until the end of 2021. By the way, this is one of the restraining factors for the growth of the euro. This forecast will be valid only if the next lockdown of the European economy, which began in November this year, is completed in March 2021.

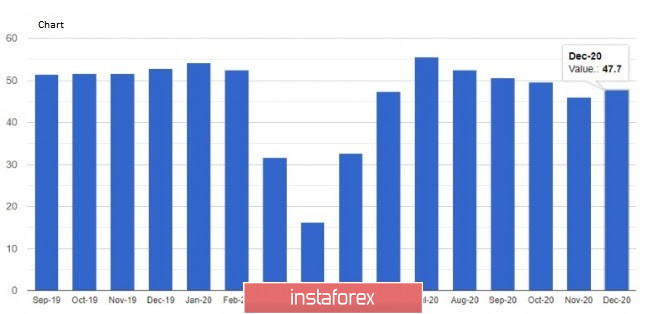

Now let's talk about the good stuff. In today's report, the Eurozone composite PMI index was much better than economists' forecasts, and both indices showed growth, especially in the service sector. This suggests that news about the vaccine can revive the economy much faster and have a positive impact on the recovery of the service sector, however, the short-term prospects remain problematic.

Preliminary purchasing managers' indices for the Eurozone, France, and Germany rose in December. Thus, the composite PMI for the Eurozone rose to 49.8 points from 45.3 in November. The German composite index remains above the 50-point mark at 52.5.

Special attention is drawn to data on activity in the service sector. And although quarantine measures will not be lifted during the Christmas holidays in many European countries, we can say for sure that the indices show stability in the conditions of the second lockdown. The PMI for the Eurozone services sector jumped to 47.3 points, although it was expected to decline even more. As noted above, the increase is mainly due to news about the coronavirus vaccine. The PMI for the manufacturing sector rose to 56.6 points from 55.3.

As for the technical picture of the EURUSD pair, after the breakout of the level of 1.2165, there was a large increase in the euro, which is gradually deflated, as few are willing to buy risky assets at current highs without a final decision of the Federal Reserve on monetary policy. The nearest target of the bulls remains the maximum of 1.2250, the test of which will only strengthen the position of buyers and open a direct road to the level of 1.2340. It will be possible to talk about the resumption of pressure on risky assets only after a breakout and consolidation below the support of 1.2110, which will push the pair to the lows of 1.2060 and 1.1980.

Let me remind you that the results of the Federal Reserve meeting will be published in the afternoon. Keeping the current monetary policy unchanged will have a positive impact on the US dollar, however, it is unlikely that this will lead to its serious strengthening against the euro and several other world currencies. Investors' risk appetite will prevail early next year as the coronavirus vaccine spreads in European countries. If the Federal Reserve decides today to increase the volume of bond repurchases, this will seriously hit the positions of the US dollar and lead to a new wave of strengthening of the EURUSD pair in the short term.

GBP: The British pound is doing quite well even in the face of a less active index recovery. Today's statements by the President of the European Commission, Ursula von der Leyen, that although the probability of failure of the trade agreement is quite high, there is still minimal hope for reaching a consensus. The main problem now is the UK's fishing area of responsibility, which is claimed by the European Union.

Today's UK PMI report points to the weakness of the recovery. According to statistics agency IHS Markit, in December, the PMI index for the manufacturing sector rose to 57.3 points against 55.6 in November. However, the PMI for the services sector fell short of the 50-point mark, while economists were already counting on a resumption of growth in the activity. According to the data, the index was 49.9 points against 47.6 points in November of this year.

Given that no one will give up on strict restrictions in the next few months, it will be quite difficult to count on an increase in the activity. Also, additional pressure comes from the disruption of supplies or prolongation of terms. The report indicates that about 45% of manufacturers face an increase in the delivery time, which indicates existing problems before the end of this year. What will happen on January 1, when the trade relations between the UK and the EU completely change?

Inflation data allows the Bank of England to act without much caution. According to today's report from the National Bureau of Statistics, the UK consumer price index in November 2020 increased by 0.3% compared to the same period of the previous year, after an increase of 0.7% in October. Economists had expected the index to rise by 0.6%. Compared to October, the indicator decreased by 0.1%. The drop in inflation was mainly due to the closure of the retail sector, which led to lower prices for clothing and food. Let me remind you that the inflation target set by the Bank of England is 2%.

As for the technical picture of the GBPUSD pair, the bulls do not intend to give up. A confident consolidation above the high of 1.3535 will give buyers of the pound strength, which will open a direct path to the base of the 36th figure and lead to an update of the areas of 1.3650 and 1.3699. Only negative news on the Brexit trade negotiations will increase pressure on the pound and lead to the return of the trading instrument to the lows of 1.3475 and 1.3405.