New attacks on Saudi oil tankers are returning fears of instability in the Persian Gulf.

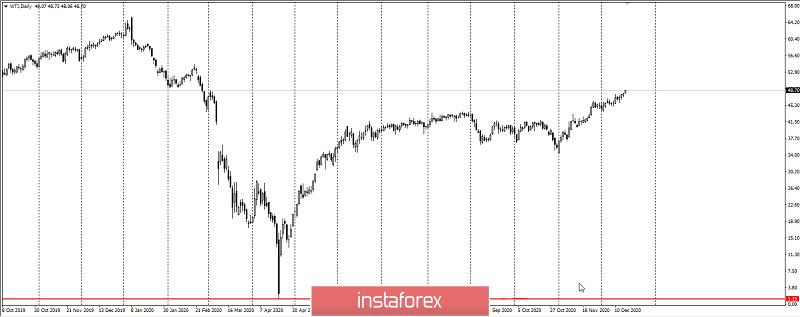

The recent explosion in the port of Jeddah has pushed Brent futures above $ 50 a barrel.

The attack came at a time of rising tensions between Iran and Saudi Arabia, both of which are members of the OPEC. Although the association, as a single force, already largely influences global oil prices, member states are still making regular attempts to undermine or get away from the cartel's production rules.

At the moment, Iran is experiencing a shortage of funds, therefore, it was seeking ways on how to raise oil prices and increase its own exports even in the face of a mandatory reduction of supply.

The attacks on Saudi oil assets serve several purposes. First, they drive up oil prices, thereby damaging Saudi, who is Iran's main geopolitical rival. The attacks also act as a "send-off" to outgoing US President Donald Trump and a threat to President-elect Joe Biden, who has pledged to return to the Joint Comprehensive Plan of Action.

Biden has previously announced his desire to renew the Iran nuclear deal, which was canceled by Trump in 2018. However, re-entry may not be easy.

To date, Iran possesses roughly one-tenth of the world's oil reserves and believes that possible easing of sanctions by Biden could allow them to regain market share and thereby rebuild their economy, which will respectively fund long-term support for terrorism, violent Islamic extremism, an ambitious nuclear program, and program ballistic missiles.

Trump's withdrawal from the original deal and tougher sanctions have caused significant damage to Iran, dropping the country's total oil production by half to 1.9 million barrels per day. Exports, meanwhile, have collapsed from 2.6 million barrels per day in 2017 to just 133,000 in 2020.