Overview :

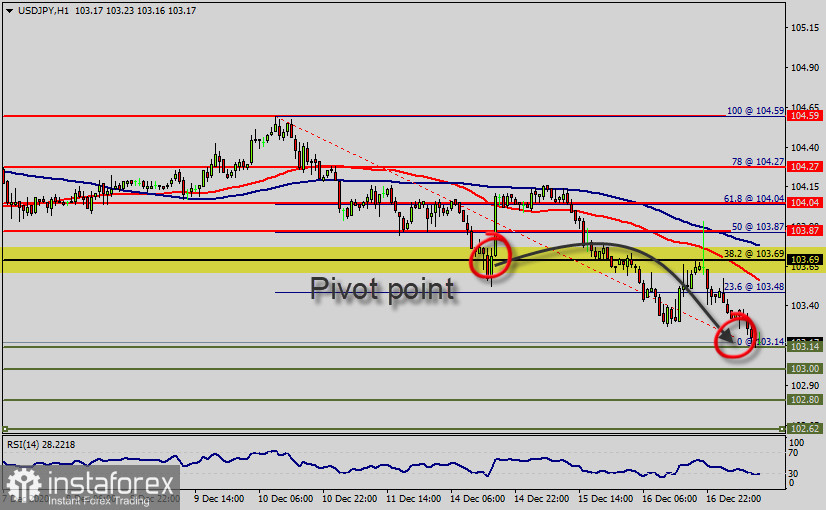

USD/JPY : The market opened below the weekly pivot point (103.69). It continued to move downwards from the level of 103.69 to the bottom around 103.14.

Few days ago, the level of 103.69 was broken to the downside, constituting a considerable supply level.

The USD/JPY pair has faced strong resistance at the level of 103.69 because resistance became support. So, the strong resistance has already faced at the level of 103.69 and the pair is likely to try to approach it in order to test it again.

Today, the first resistance level is seen at 103.69 followed by 104.04, while daily support 1 is seen at 102.80.

The USD/JPY pair broke support which turned to strong resistance at 103.69. Right now, the pair is trading below this level. It is likely to trade in a lower range as long as it remains below the resistance (103.69) which is expected to act as major resistance today.

The bias remains bearish in the nearest term testing 103.14 and 103.00 . Immediate resistance is seen around 103.69 levels, which coincides with the weekly pivot.

This would suggest a bearish market because the moving average (100) is still in a negative area and does not show any signs of a trend reversal at the moment.

Amid the previous events, the USD/JPY pair is still moving between the levels of 103.69 and 102.62, for that we expect a range of 107 pips in coming hours.

Therefore, the major resistance can be found at 103.69 (pivot point, 38.2 of Fibonacci retracement levels) providing a clear signal to sell with a target seen at 102.80.

If the trend breaks the minor support at 102.80, the pair will move downwards continuing the bearish trend development to the level of 102.62 in order to test the daily support 2.

Overall, we still prefer the bearish scenario which suggests that the pair will stay below the zone of 103.69 this week.

Conlcusion :

The moving average (100) starts signaling a downward trend; therefore, the market is indicating a bearish opportunity below 103.69. Hence, it will be good to sell at 103.69 with the first target of 102.80. It will also call for a downtrend in order to continue towards 102.69. The strong weekly support is seen at 102.69. However, if a breakout happens at the resistance level of 104.04, then this scenario may be invalidated.

Daily key levels :

- Major resistance: 104.04

- Minor resistance: 103.87

- Pivot point: 103.69

- Minor support: 102.80

- Major support: 102.62

Comment :

- The trend is still calling for a strong bearish market from the spot of 103.69 - 104.04.

- Sellers are asking for a high price.

- Please check out the market volatility before investing, because the sight price may have already been reached and scenarios might have become invalidated.