As expected in yesterday's EUR/USD review, following the results of its two-day meeting, the US Federal Reserve (FRS) kept its key interest rate in the range of 0.00-0.25%. The purchase of securities with a minimum volume of $ 120 billion per month will also continue. This decision of the Fed was made unanimously, and all ten members of the Open Market Committee (FOMC) voted for it. At the same time, rates at current low levels will remain at least until the end of 2021, and the prospects for raising rates will become possible only in 2023.

As for economic forecasts, according to Fed officials, the COVID-19 pandemic poses significant risks to the recovery of the world's largest economy. Nevertheless, the unemployment rate in the United States will decline. Regarding the growth rate of US GDP, it will grow by 4.2% next year and by 3.2% in 2022. As for the current year, GDP will not reach 2.4%. Naturally, this situation became possible due to the negative impact of COVID-19 on the world's leading economy.

If we evaluate the press conference of Fed chairman Jerome Powell, it was held in relatively positive tones. The Chairman of the Federal Reserve believes that economic activity continues to recover. Nevertheless, the labor market has become more stable and consumer prices remain weak, especially in the sectors most affected by the pandemic. The situation regarding vaccination is still extremely uncertain. In general, such results of the last Fed meeting this year were quite expected and did not bring any surprises to market participants. In my personal opinion, yesterday's results of the Fed meeting could both support the US dollar and put pressure on the US currency.

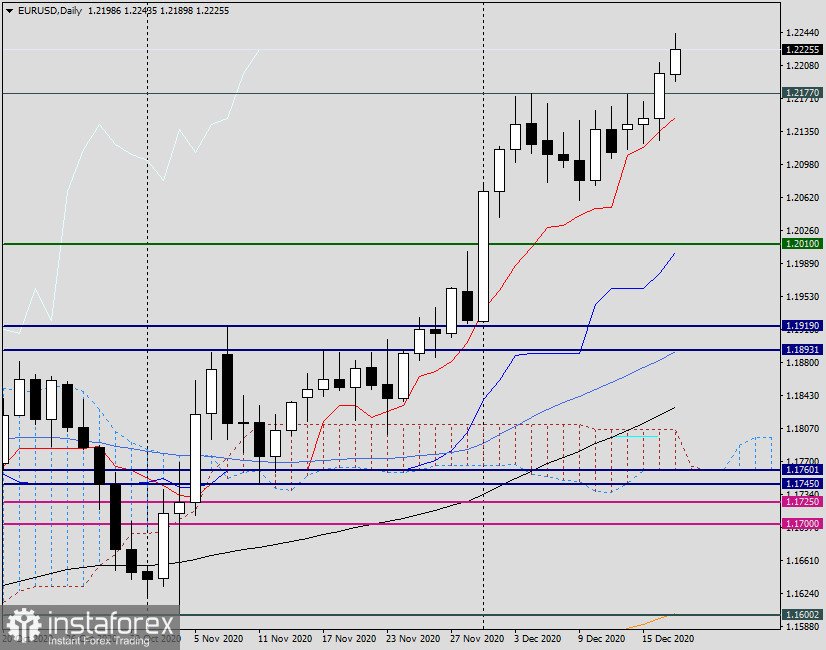

Daily

Since the dollar is in a downward trend with the single European currency, yesterday's news from the Fed was used by investors to continue the pressure on the "American". In yesterday's trading, the EUR/USD pair broke through the upper limit of the range of 1.2058-1.2177 and closed trading at 1.2199, that is, right below the important and significant level of 1.2200. At the same time, the breakdown of 1.2177 began long before the announcement of the decision of the two-day Fed meeting, which indicates that the fate of the dollar was predetermined in advance. At the time of writing, the pair is already trading above 1.2200, near 1.2230. At the moment, there is every reason to expect the continuation of the upward trend. This means that the main trading idea for the euro/dollar continues to be purchases after corrective pullbacks to the levels: 1.2225, 1.2215, 1.2200, and 1.2180. If no rollbacks occur, you can aggressively try to buy from current prices.

Today's macroeconomic statistics can have an impact on the price dynamics of the main currency pairs. I recommend paying attention to the Eurozone CPI, which will be published at 11:00 (GMT), and data from the US investors may be interested in the report on initial claims for unemployment benefits, building permits and housing starts, and industrial index FRB of Philadelphia. All these data will be published at 14:30 London time.