Hi dear traders!

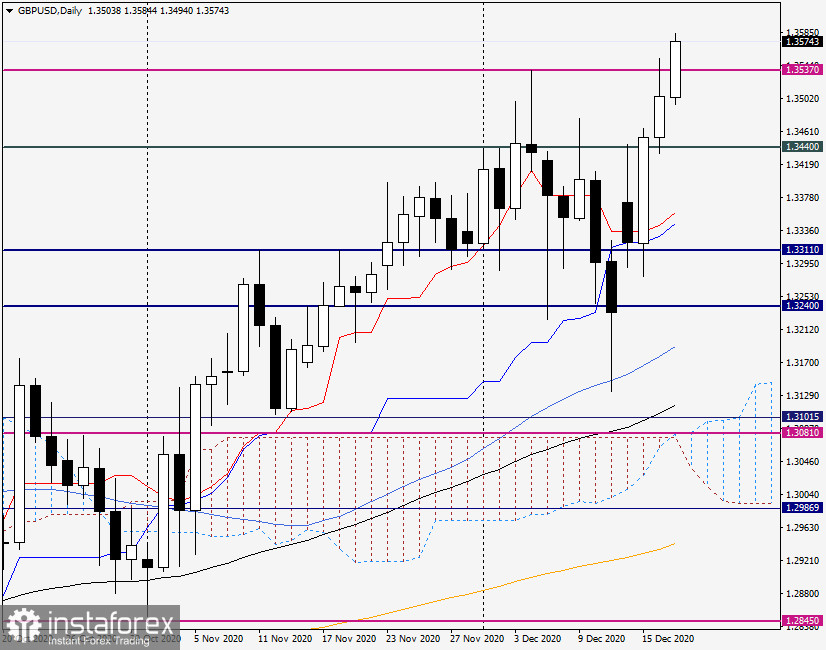

Daily chart of GBP/USD

GBP/USD is still following the upward trajectory. Remarkably, the GBP uptrend is unfolding despite the lack of progress in the talks on the trade deal before the UK exits the EU. The Brexit negotiators have got stuck in gridlock, unable to come to the common denominator about fisheries. It means the odds are that the Kingdom will leave the EU without a trade deal. Nevertheless, the pound sterling is taking advantage of the dollar's broad-based weakness. So, GBP/USD is still trading higher.

Yesterday, the Federal Open Market Committee made policy updates following the two-day policy meeting. After the press conference, GBP/USD made efforts to break resistance at 1.3537. The price actually spiked briefly above this level and closed below it on Wednesday. At the moment of writing this review, the currency pair is trading above 1.3537 that is at near 1.3582. So, it has prospects for a further advance.

It would be a good idea to take notice of the Bank of England's policy meeting. Its decisions could be a market catalyst today. At 02:00 GMT, the British regulator is due to unveil its policy decision on interest rates and the asset purchase facility. Besides, the Monetary Policy Committee is to publish the minutes of the policy meeting. Experts say the policymakers will hardly spring a surprise. The key policy rate is expected to remain at a record low of 0.10%. The regulator is likely to extend bond purchases at the same volume of £875 billion per month.

All these factors have been already priced in, so the pound sterling will hardly respond with a sharp move. Anyway, comments from the BoE policymakers could trigger higher volatility of the sterling. Nevertheless, experts assume that GBP/USD is on track to continue its advance. Thus, the pair is likely to close above the level of 1.3537 today. If this happens in practice and resistance is broken, it would be a good idea to plan long GBP deals at a retracement. In case of a correctional decline, an interesting zone for opening long deals would be an area of 1.3555-1.3530.

When it comes for COVID-19 developments in the UK, the state of affairs is far from any improvement. The authorities decided to tighten restrictions ahead of Christmas holidays. Across the Atlantic, the US also reports soaring numbers of new cases on a daily basis. From the technical viewpoint, long deals on GBP/USD seem to be a preferable trading idea.

So, traders are recommended to plan opening long positions after correctional retracements to the levels of 1.3555, 1.3540, and 1.3530. If closing today, the daily chart reveals a reversal bearish pattern with candlesticks, we will revise our strategy tomorrow, shifting focus towards short deals for the pound sterling. Meanwhile, there are preconditions for GBP/USD to continue moving upwards today. Importantly, the Bank of England policy decisions today could disrupt this forecast and impact on the GBP trajectory across the board.

Trade at a profit!