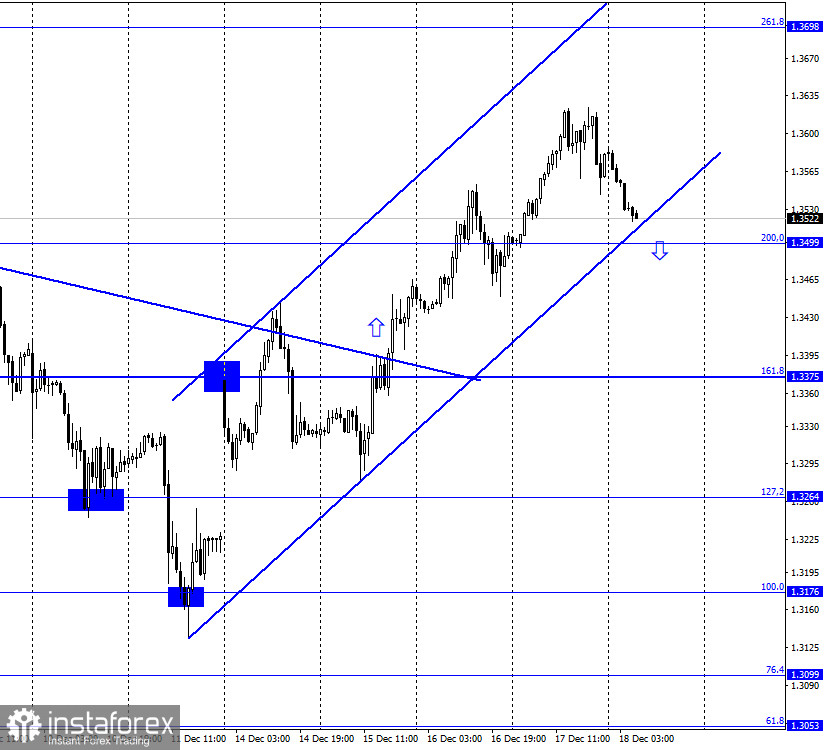

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair performed a reversal in favor of the US currency and began the process of falling in the direction of the corrective level of 200.0% (1.3499), as well as the lower border of the upward trend corridor. A rebound of the pair's rate from any of these lines will work in favor of the British dollar and resume growth in the direction of the corrective level of 261.8% (1.3698). Fixing quotes under the Fibo level of 200.0% and the corridor will work in favor of the US currency and continue to fall in the direction of the corrective level of 161.8% (1.3375). Meanwhile, while the British dollar has been growing for 2.5 months (only its last call), Boris Johnson again made a statement according to which there is an extremely low probability that a deal will be concluded with the European Union. The Prime Minister of Great Britain noted that "negotiations are in a difficult situation", and the main disagreement between the parties is the issue of fishing. Should we conclude from this that other issues have already been resolved? If so, then the chances of making a deal grow. It's only a matter of time. If London and Brussels do manage to agree on a deal in the coming week, then I think the leaders of the EU and Britain will find a way to have time to ratify it. The question is also what are the prospects for the pound if an agreement is concluded? After all, in recent months, the Briton is growing for a reason. Are traders waiting for an agreement, or are the reasons for the dollar's fall different? In general, theoretically, if Michel Barnier and David Frost come to a consensus, the pound may still grow, but the option of a fall in the British dollar is not excluded, since the current exchange rate already has an agreement.

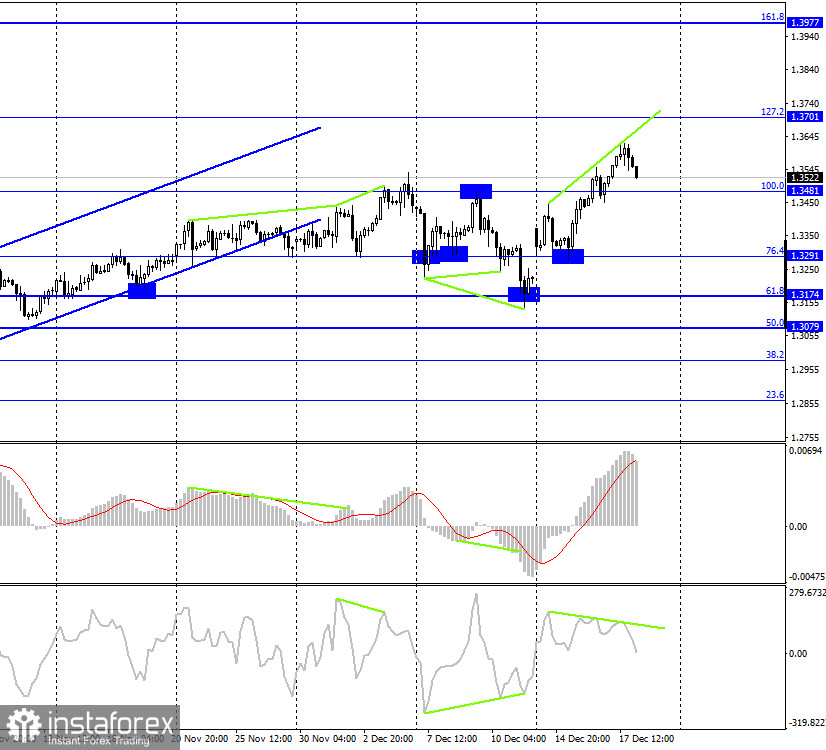

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair to consolidate above the corrective level of 100.0% (1.3481), however, after the formation of the bearish divergence at the CCI indicator, performed a turn in favor of the US dollar and began the process of falling towards the corrective level of 100.0%. Nevertheless, the upward corridor on the hourly chart is now a priority and keeps the current mood of traders "bullish".

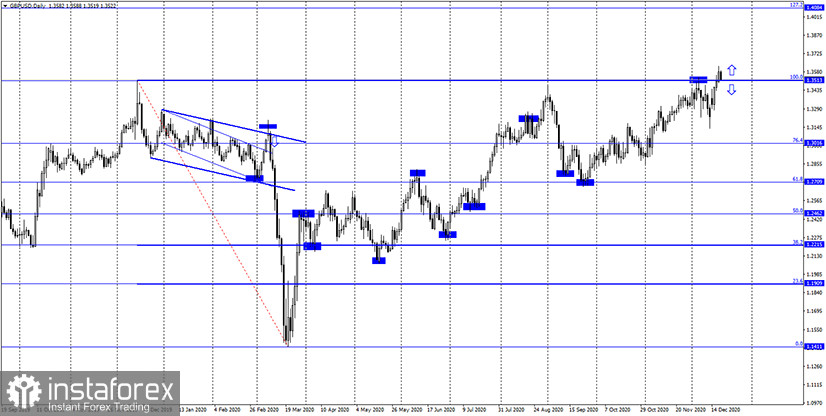

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a consolidation above the corrective level of 100.0% (1.3513), which increases the chances of further growth in the direction of the next Fibo level of 127.2% (1.4084). However, fixing under the level of 100.0% will work in favor of the beginning of the fall in quotes.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes.

Overview of fundamentals:

On Thursday, the results of the Bank of England meeting were summed up in the UK, however, the regulator did not make any important decisions, and its governor, Andrew Bailey, did not make loud and important statements.

News calendar for the United States and the United Kingdom:

UK - retail trade volume change (07:00 GMT).

On December 18, there will be one secondary report in the UK, so the information background will be very weak.

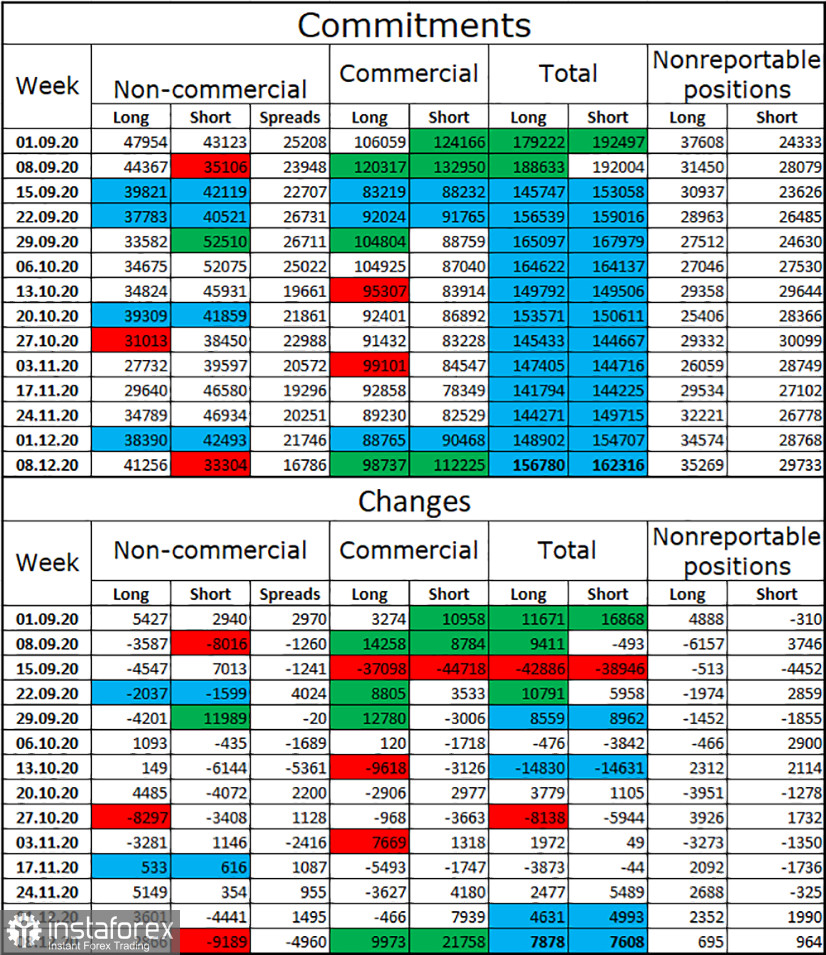

COT (Commitments of Traders) report:

The latest COT report showed a new increase in the number of long contracts in the hands of speculators. This time, their total number increased by 2,866 contracts, and the number of short-contracts decreased by 9,189 units. Thus, the mood of speculators has become much more "bullish" and is becoming so for the third week in a row. Given this fact, the growth of the British dollar is quite understandable, although the information background is not entirely on the side of the British currency. However, given that speculators have again taken up quite large purchases of the pound sterling, we can assume its new growth. The total number of open long and short contracts for all groups of traders remains approximately the same.

GBP/USD forecast and recommendations for traders:

I recommend buying the British dollar when the quotes rebound from the lower border of the ascending corridor on the hourly chart with the target level of 1.3698. It will be possible to sell the pound sterling when it is fixed under the ascending corridor on the hourly chart with the target level of 1.3375.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.