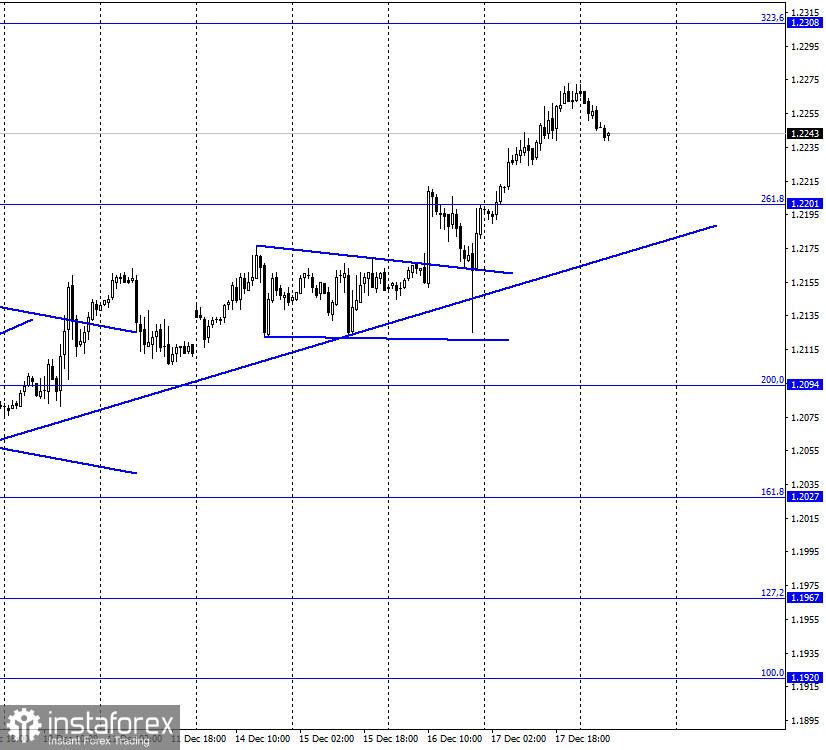

EUR/USD – 1H.

On December 17, the EUR/USD pair continued the growth process in the direction of the corrective level of 323.6% (1.2308). The most important event of the week for the euro/dollar pair (the Fed meeting) ended without any major changes in monetary policy and loud statements from FOMC representatives. Thus, there is nothing to prevent the European currency to continue the growth process. However, this week, there may be another important event that can be reflected in the chart of the pair. After four months of negotiations, Democrats and Republicans may finally pass a new financial aid package that will focus on additional unemployment benefits and support for small businesses (mostly). Also, the authorities of each state and city will receive funds to counter the effects of the pandemic. On the one hand, this is good for the US economy. Jerome Powell has repeatedly noted that the pace of economic recovery is slowing, thus, new incentives are needed. The economy will receive these $ 900 billion incentives. But will they be enough? And what will happen to the dollar itself? In 2020, since March, the US currency has fallen very much in price, which is just in the hands of the United States. Donald Trump has never hidden that America benefits from a cheap dollar. Now, at the end of his presidential term, he can be said to have achieved this goal. It is thanks to the cheap dollar that inflation in the United States remains afloat (unlike in Europe). Another 900 billion dollars in the economy will increase the supply of the currency on the market, which can further lower its rate.

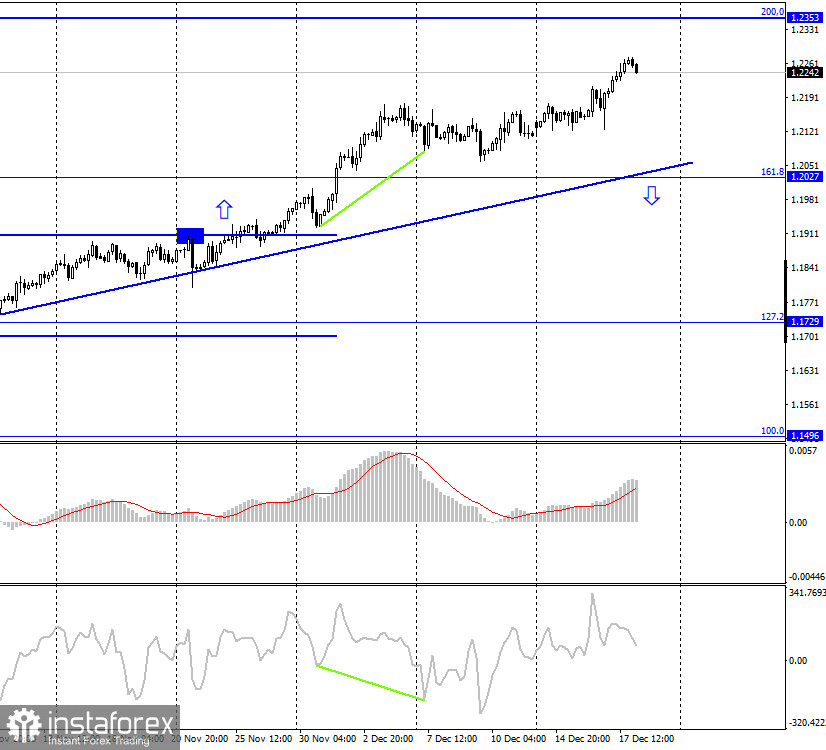

EUR/USD – 4H.

On the 4-hour chart, the pair's quotes continue to grow slightly in the direction of the corrective level of 200.0% (1.2353). The upward trend line still characterizes the current mood of traders as "bullish" and increases the probability of further growth. As long as the quotes do not consolidate under the trend line, you should not expect the pair to fall.

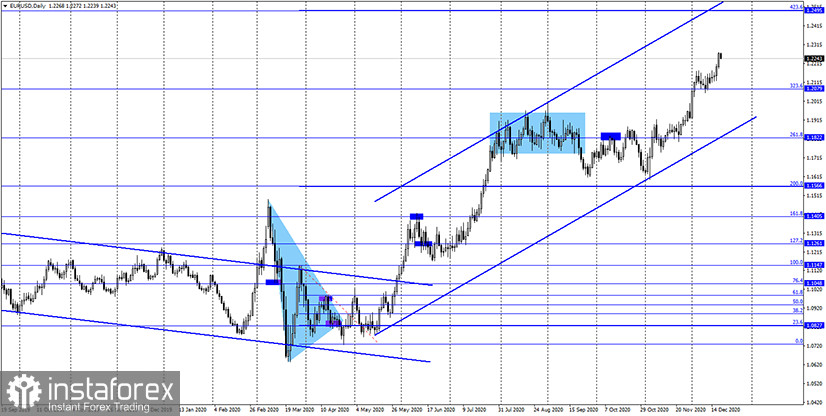

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair also continue the process of growth, in the direction of the corrective level of 423.6% (1.2495). Until the moment when the pair performs consolidation under the level of 323.6%, there are still high chances of growth.

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair performed a consolidation above the "narrowing triangle", which preserves the prospects for further growth of the pair in the long term.

Overview of fundamentals:

On December 17, the European Union released the consumer price index, which remained at an extremely low level, however, the euro currency did not experience much pressure and frustration due to this report. The number of applications for unemployment benefits in the United States is growing, but so far at a low pace.

News calendar for the United States and the European Union:

On December 18, the calendars of US and EU economic events are almost empty. Thus, the information background today will be extremely weak or absent.

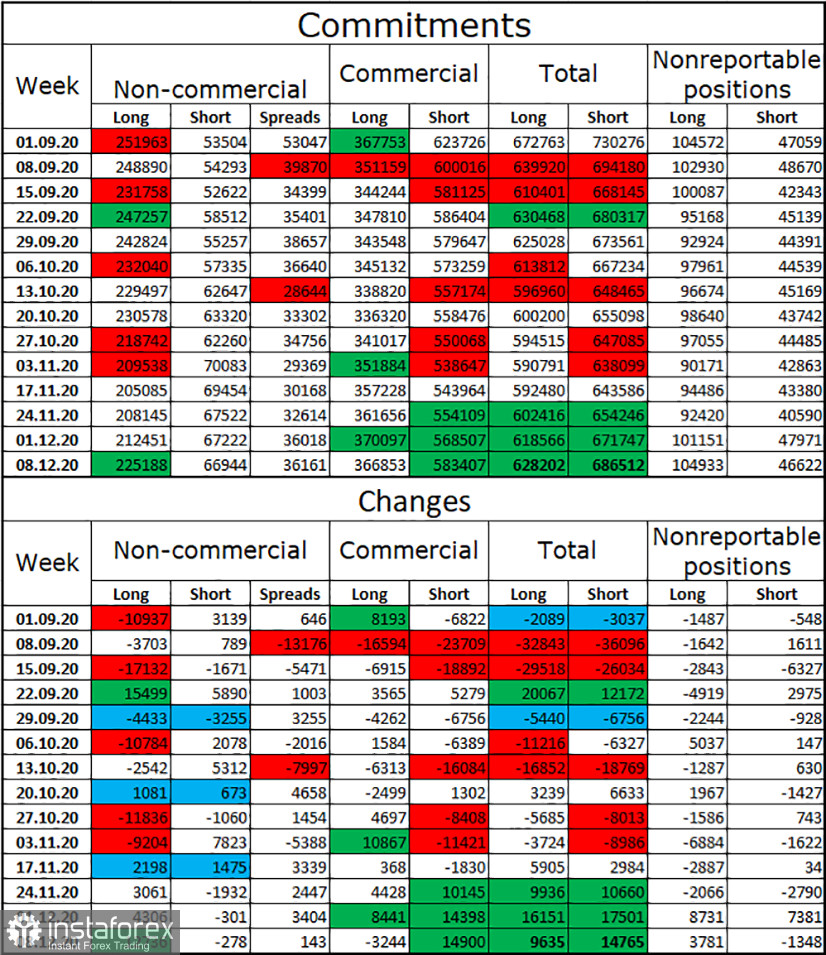

COT (Commitments of Traders) report:

For the fourth week in a row, the mood of the "non-commercial" category of traders has become more "bullish". This is indicated by COT reports and it coincides with what is happening now for the euro/dollar pair. In the reporting week, speculators opened as many as 13 thousand new long-contracts (more than in the previous three weeks), and also got rid of 300 short-contracts. Thus, they significantly increased their "bullish" mood. The gap between the total number of long and short contracts in the hands of the "Non-commercial" category is growing again. Therefore, the European currency now continues to maintain high chances of continuing growth, although a month ago it was preparing for a powerful fall. The "Commercial" category of traders, on the contrary, opened short contracts, but it always trades against speculators. And we pay attention first of all to them.

EUR/USD forecast and recommendations for traders:

Today, I recommend selling the euro with a target of 1.2094, if the consolidation is made under the trend line on the hourly chart. New purchases of the pair can be opened with a target of 1.2308 after a pullback and its completion. Or with the help of the trend and fast indicators.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.