Demand for the US dollar is expected to increase soon, especially since news emerged that over the weekend, Senate officials have finally come to an agreement on a new package of economic stimulus. The congressional vote is expected to take place shortly.

EUR: As mentioned above, the Republicans and the Democrats finally managed to agree on a new aid package, and it amounts to just over $ 900 billion. Included in the program is an increase in unemployment benefits by $ 300 per week, and additional payments to individuals in the amount of $ 600. A separate amount will be allocated for US airlines.

A vote on the interim US budget will also be held soon, which will help prevent economic shutdown.

Meanwhile in Europe, a surprising economic report was released, and it helped the euro keep its positions in the market. The rather strong data from Germany indicates that its economy is doing quite well even amid a partial lockdown.

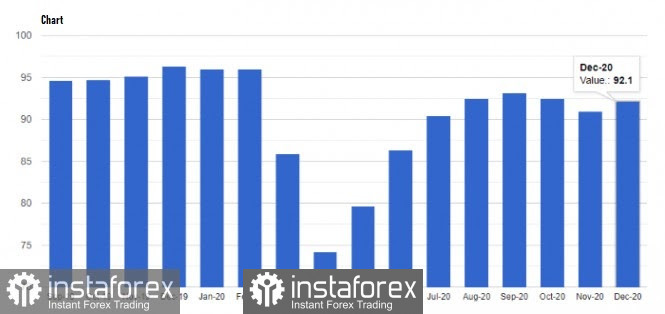

According to the report, the index for business conditions rose to 92.1 in December, while the index for current conditions grew to 91.3 points. The index for economic expectations, meanwhile, increased to 92.8 points.

Today, the EUR / USD pair dropped sharply, and it seems that it will continue doing so in the coming days. Euro bears will work for a breakout at 1.2180, as such will make it easier for the quote to decline to 1.2130 and 1.2080. But if the euro returns to 1.2225 and consolidates above it, the quote will increase to 1.2275, and possibly move towards the 23rd figure.

GBP: The British pound declined on Friday amid news that the UK and the EU again failed to sign a trade deal. Negotiations continued over the weekend, but so far there has been no result.

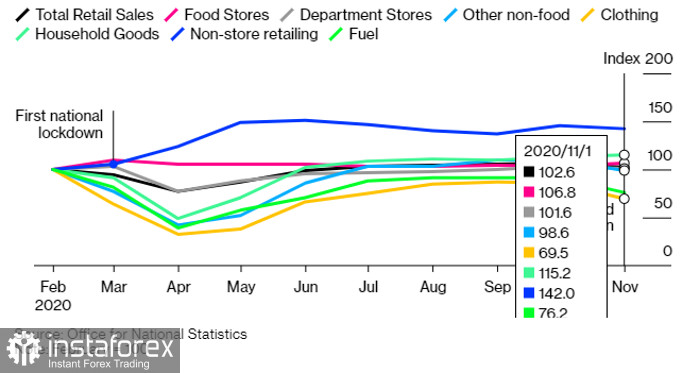

At the same time, the data on UK retail sales came out weak, which put additional pressure on the pound. The report said sales dropped by 3.8%, mainly due to the quarantine restrictions.

Another terrible news was the discovery of a new strain of coronavirus, which, to date, has started to spread in the UK. Authorities have decided to toughen the quarantine restrictions because of this.

With regards to the COVID-19, more than 350,000 people had been vaccinated as of Saturday morning. Initially, the UK planned to soften the restrictive measures for the Christmas holidays, but later changed it after the rapid spread of a new virus. Scientific evidence suggests that this strain could spread significantly faster than the current COVID-19.

Going back to Brexit, UK Prime Minister Boris Johnson announced that the parties need to find a compromise within a few days. According to the latest rumors, negotiations will continue this week. Chief negotiator Michel Barnier said he will continue to work hard with David Frost and his team to reach an agreement, and noted that both the EU and the UK should have the right to make their own laws and control their waters however they want.

All this news seems to have shocked the pound, as the currency dropped by nearly 200 pips this morning, as soon as the trading session started. Pound bears will surely take this opportunity to break the quote out of 1.3350, as such will make it easier for the pound to reach 1.3240. Their next targets will be 1.2190 and 1.2135. But if the quote returns to 1.3435, the GBP / USD pair will increase again to 1.3525.