Following the results of the last five-day trading session, the British pound became the leader among all major currencies that strengthened against the US dollar. The growth of the GBP/USD currency pair at the auction on December 14-18 was 2.10%. Now to the events that have had and will still have an impact on the price dynamics of the British pound. As you know, by the end of this year, the UK must leave the European Union, and this will most likely happen without signing a trade agreement or the so-called Brexit deal. The main stumbling block is still the issue of fishing. The waters in which European and British fishermen have fished (and still do) will be protected from the beginning of next year by ships of the British Navy, to protect the fishing of their recent European partners in the designated waters, which are rightfully British. The problem is different. There is too much fish for British domestic consumption and it will have to be exported. And where, if not to Europe? However, the EU authorities intend to impose such duties on British fish that it simply will not be competitive, and residents of European countries are unlikely to be willing to buy it. It is first and foremost about the cod species of fish. So it will turn out: "I myself will not give it to others." In this regard, it is worth noting that the British budget does not count a significant amount of funds from fishing. London understands all this, and also understands that prices for European goods will rise significantly from the new year. It is not for nothing that British Prime Minister Boris Johnson in his recent speech called on the citizens of the United Kingdom to stock up on European cheeses and other products, as well as medicines since from next year the entire range of goods and services from Europe will become much more expensive for the British.

And then, as if by order, there was another opportunity. Just before the end of the time allotted for the conclusion of a trade agreement between London and Brussels, a new strain of COVID-19 was discovered in the UK, which is much more dangerous in terms of infection than the usual strain. Here, somehow everything "miraculously" coincided with the withdrawal of the United Kingdom from the European Union. It is not enough to believe that this is a mere coincidence. EU countries have already surrounded the UK with a cordon sanitaire and cut off from mainland Europe. Several European countries have already stopped transport links with the UK, and this primarily applies to countries with the first and second European economies, Germany and France, respectively. And it's also hardly a coincidence. By the way, a new strain of coronavirus, in addition to the UK, was detected in the Netherlands, Denmark, and Italy. In the UK itself, the situation is close to panic, residents of London began to leave the city in a hurry, as the strictest quarantine regime came into force on Sunday, and all easing on the occasion of the Christmas holidays had to be canceled. Here's the deal. Needless to say, you will not envy the British, but with the "light hand" of former Prime Minister Cameron, as a result of the vote, they chose this path for themselves, namely secession from the European Union.

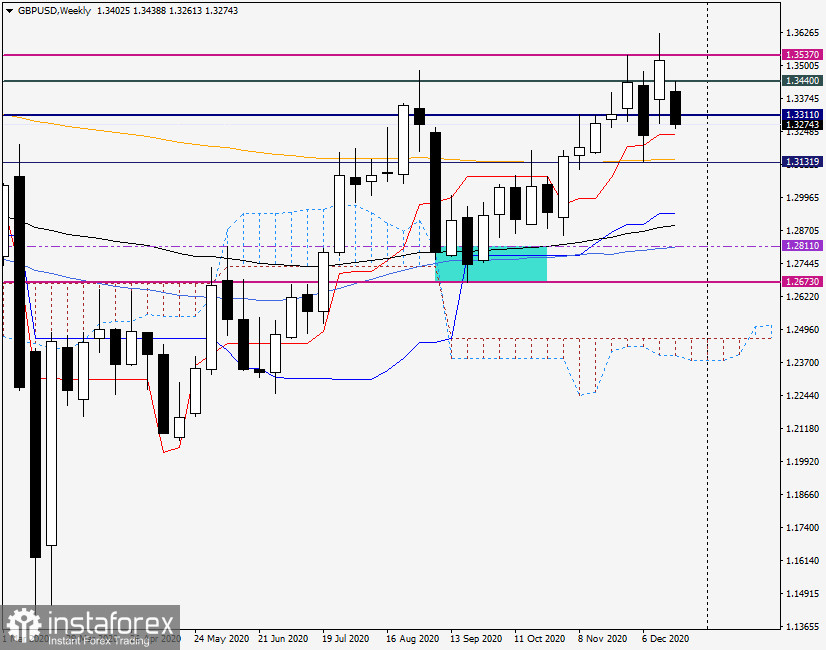

Weekly

Despite the lead in growth against the US dollar, the situation for the pound is extremely difficult and largely uncertain. Reports of a new strain of COVID-19 could not pass without a trace, and the beginning of the week opened for the pound/dollar pair with a bearish gap. The complexity of the position of the British currency is also indicated by prices. If the last trading week ended at 1.3519, the GBP/USD pair is trading near 1.3280. The difference is significant and such price jumps do not occur. As you know, in times of aggravation or deterioration of the situation with the spread of coronavirus, the US dollar is used by investors as a safe asset. This is exactly what is happening now.

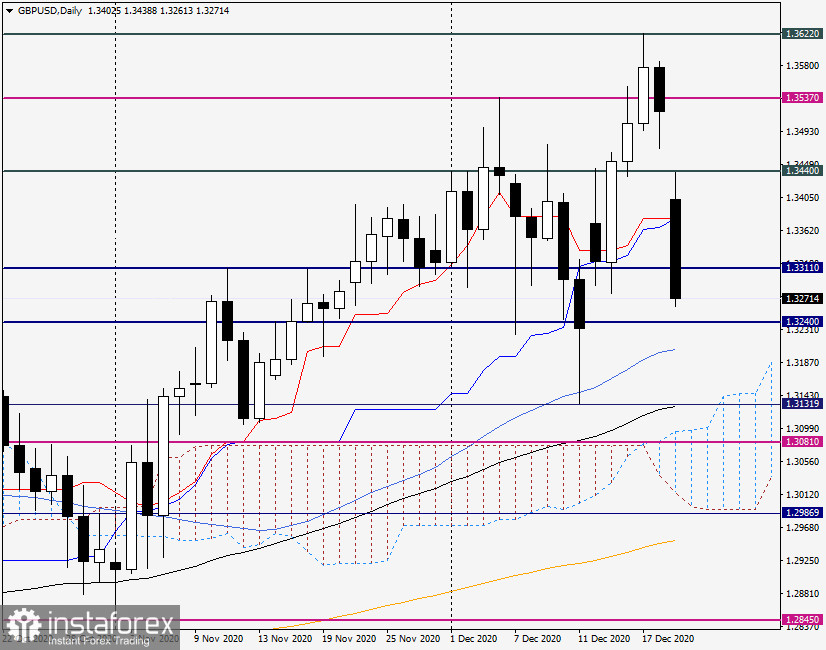

Daily

On the daily chart, the price gap is particularly clear, as a result of the fall, the pair is already trading below the Tenkan and Kijun lines of the Ichimoku indicator. If trading ends under these lines, it will be possible to try selling the British currency on a pullback to them. In truth, given the current situation, buying pounds is risky or even dangerous. At least, if you open long positions, then from the depth, after a decline to the levels of 1.3200 and (or) 1.3145. However, sales do not look particularly attractive. For those who are bearish and want to sell the GBP/USD pair, I recommend waiting for a pullback to the price zone of 1.3400-1.3430 and from there consider opening short positions. It's not a bad idea to be patient and stay out of the market for now. The current situation is quite difficult for making trading decisions. Perhaps it makes sense to wait a bit and see what will be the reaction of market participants.