Well, it's time to consider a rather interesting and much-loved currency pair USD/JPY. It is characteristic that both currencies, depending on the situation, are used by market participants as protective assets. Recently, investors prefer the Japanese yen, however, the technical picture for this instrument can not be called completely unambiguous. Before proceeding to the USD/JPY price charts, it is worth noting that the Central Banks of Japan and the United States continue to pursue a fairly soft monetary policy, aimed primarily at restoring their economies from the effects of COVID-19. Thus, market participants keep waiting for the adoption by the US Congress of a new package of fiscal incentives for $ 900 billion, however, the adoption of this bill is still being postponed, because Democrats and Republicans can not find all the necessary compromises for the adoption of this program. It should be noted here that this factor puts pressure on the US dollar in a pair with the Japanese yen.

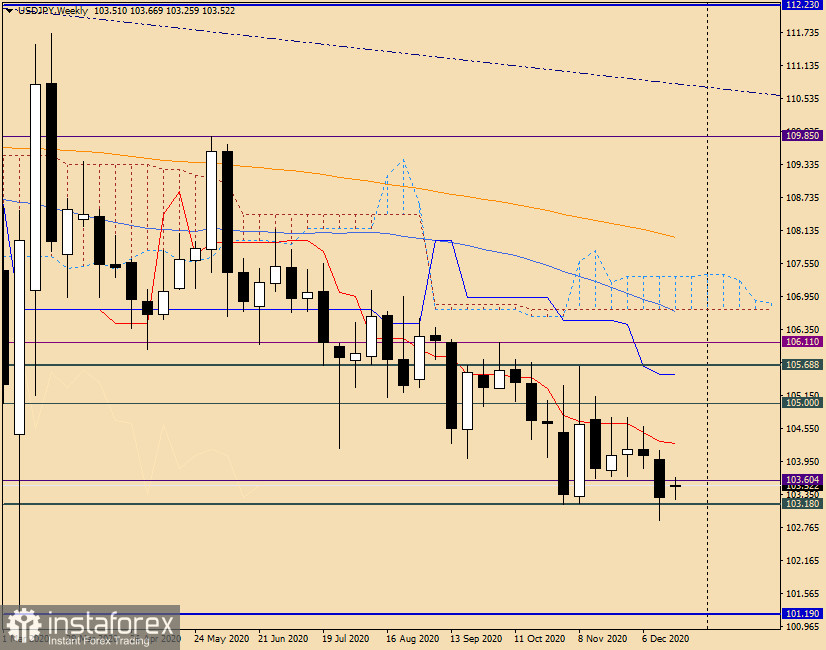

Weekly

Turning to the technical nuances of USD/JPY, first of all, it is necessary to note the strength of support at the level of 103.18. It is significant that this mark was tested for a breakdown in November, but resisted, after which the price rebounded to 105.68. Here, the further upward movement lost its strength and the quote again turned to decline. And here at the auction of the last five days, the bears on the instrument again tried to break through the support at 103.18 - and again failed. During the pressure, this level was only punctured, but not broken, as the closing price of weekly trading was above 103.18 and was fixed at 103.30. At the same time, the lows of the weekly session, shown at 102.88, allow us to hope that the barrier in the form of the support level of 103.18 is quite capable of overcoming. This assumption is supported by the last weekly candle, which has a fairly full bearish body and not so long lower shadow to consider the last candle a reversal. So, the key support zone in the current situation is 103.18-102.88. If the designated area is overcome and this week's trading ends at 102.88, the road will open to the next significant support level of 101.20, where the March lows of the outgoing year were shown. To change the market sentiment for this currency pair in favor of the US dollar, players on the exchange rate increase need to return the quote above the red line of the Tenkan indicator Ichimoku and especially above the psychological level of 105.00 and fix trading above this mark. To further indicate a change in sentiment, a breakout of the sellers' resistance at 105.86 is needed.

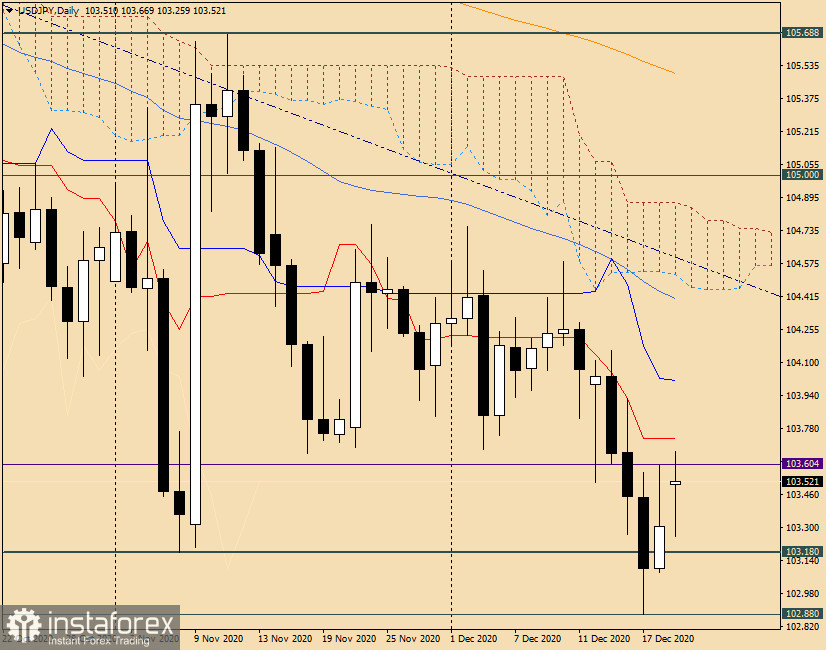

Daily

Although the candle for December 17 closed below the support level of 103.18, it was not enough for the breakdown of this mark to be true. As you can see, the very next day, the USD/JPY bulls started up and made attempts to seize the initiative. And everything would be fine, but the very long upper shadow of the Friday bullish candle, which exceeds the size of the body itself, indicates a lack of strength in the bulls on the instrument. The highs of December 18 at 103.60 and the Tenkan line at 103.73 represent serious resistance to change the trend. In my opinion, if the USD/JPY bulls manage to overcome both of these levels, we can expect a subsequent rise in the price zone of 104.00-104.15. In the event of continued bearish pressure and an alternate breakdown of 103.18, 103.00, and 102.88, the downward scenario for this currency pair will continue to remain relevant.

According to the trading recommendations, I will give preference to sales, which are better to open after corrective pullbacks up and attempts to overcome the price zone of 103.60-103.80. If there are reversal patterns of candle analysis, a signal will be received to open sales transactions. By the same tactic, it is worth observing the price behavior in the area of 104.00-104.15, and after the appearance of bearish patterns of Japanese candlesticks on the daily, four-hour, and hourly charts, open deals for sale. this week we will return to the consideration of the USD/JPY currency pair, and if necessary, we will make adjustments to this trading plan.