Good day!

Today, I would like to consider another major currency pair - the dollar/franc. Since both currencies are used by market participants depending on the situation as safe-haven currencies, we will take a closer look at the technical picture for this instrument, and taking into account the end of weekly trading on Friday, we will start with the corresponding timeframe.

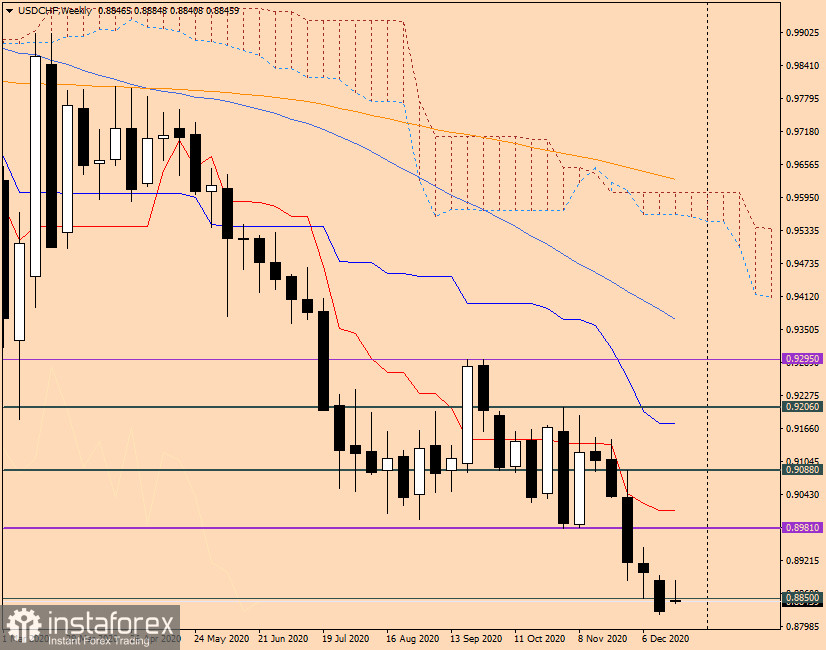

Weekly

At the end of trading last December 14 - 18, the Swiss franc strengthened against the US dollar by 0.61%. Based on the weekly chart of USD/CHF, you should pay attention to two important points. First, the strong support of 0.8981 was broken the week before last. Second, last week's trading ended below the previous lows of 0.8850. Both of these factors allow us to count on the subsequent movement of the quote in a downward direction. I would also like to draw your attention to the fact that the doji candle, which could be considered as a reversal candle, was ignored by the market participants who did not want to work out this signal. In my opinion, this indicates the strength of bearish sentiment for the USD/CHF and with a high degree of probability suggests a further decline in the quote. But the trading of the starting week opened with a price gap in favor of the US currency across a wide range of the market. I believe that such a reaction of market participants became possible due to the discovery of a new strain of coronavirus infection in the UK, Germany, France, Italy and Australia. As you know, in times of aggravation of the epidemiological situation, it is the US dollar that investors give their preference as a safe haven currency. If the trading of the week that has begun is held under the dollar sign, and the pair of USD/CHF ends trading with growth, then the breakdown of support at 0.8850 will have to be recognized as false and it will be possible to count on a change in the trend. In this case, the growth of the dollar/franc pair to the levels of 0.8900, 0.8945, 0.9000 and higher is not excluded towards the red Tenkan Line, which passes at 0.9013. If the situation stabilizes and the US dollar returns to its previous weakening, the USD/CHF pair will have every chance to update the previous lows of 0.8821 and end the week trading under the important mark of 0.8800.

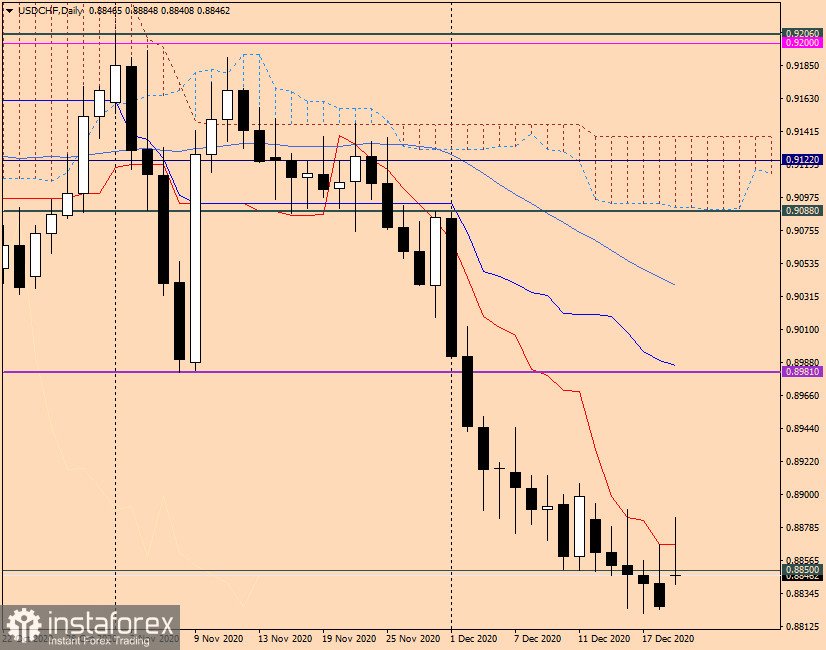

Daily

As you can see on the daily chart, at the time of writing, the pair was already rising to 0.8885, but could not continue the rise and stalled at the Daily Tenkan Line. As of this moment, today's candle has a fairly long upper shadow and much will be answered by the closing price of today's trading relative to the Tenkan Line. Closing today's session above this line will create prerequisites for further growth, which we will consider corrective for the time being. However, Friday's candle in the form of an inverted bear hammer can be interpreted as a reversal signal. But whether it will be worked out by the market will become clear in the course of further development of the situation in the Forex currency market. Based on the current situation, the probability remains for both effective purchases and profitable sales. The only thing I would like to pay attention to is that you should not set high prices now, because the situation is far from obvious. I propose to consider purchases after the pair rises above 0.8885 and (or) 0.8900, with mandatory consolidation above the last mark. If bearish candlestick patterns appear near the indicated prices on the four-hour and/or hourly charts, this will be the basis for opening short positions on USD/CHF. That's all for now.

Have a successful bidding!