The euro and pound recovered slightly against the US dollar, however, the overall trading remained mostly in the side channel. Support for risky assets was provided by today's statements of the CEO of BioNTech, who noted that he does not yet know whether the vaccine can protect against a new strain of coronavirus, however, he did not rule out such a possibility. In two weeks, after all the tests have been completed, it will be known for sure whether the developed vaccine can resist the new strain. But, even despite this, BioNTech noted that they will be able to develop a new vaccine that will protect against the next strains in just the same few weeks. These statements reassured investors, which led to the strengthening of the euro and the pound in the first half of the day.

It is also worth recalling that the first deliveries of the vaccine to the EU will begin tomorrow.

Meanwhile, the German National Institute of Health RKI noted that, despite the emergency isolation that was introduced in London this weekend, it is likely that a new strain of coronavirus is already in Germany. RKI President Lothar Wieler is convinced that the identification of a new virus is only a matter of time. Approximately the same statement was made today by the French Health Minister, who noted that at present, although there is no information about infection with a new strain of coronavirus, however, it is likely to happen in the near future.

However, Germany's ban on travelers from the UK and South Africa will come into force from today. France will join similar measures in the near future. The ban will be in effect until January 6, 2021, and is aimed at preventing the spread of coronavirus mutations in Europe.

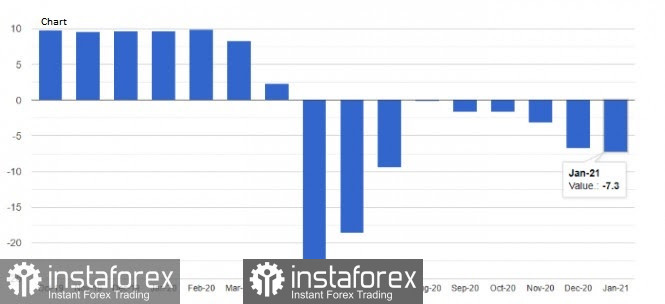

Now let's talk about numbers. Today's GfK report can be interpreted in different ways. On the one hand, the consumer confidence index in Germany in January worsened compared to December, and on the other hand, it turned out to be better than economists' forecasts. According to the data, consumer sentiment in Germany in January next year should worsen due to an increase in the number of cases of COVID-19 infections. It also worsens the outlook for the economy. A report by research group GfK noted that the leading index of consumer confidence in Germany for January fell to -7.3 points from -6.8 in December. Economists predicted that the January indicator will be at the level of -9.5 points.

In all likelihood, the final value will be even better than the preliminary one, as expectations about the economy and the propensity to buy will continue to recover against the background of the spread of the coronavirus vaccine in the EU.

As for the technical picture of the EURUSD pair, it remained unchanged. Sellers of risky assets need a breakdown of the support of 1.2180, which will very quickly dump the trading instrument to new lows in the area of 1.2130 and 1.2080. It will be possible to talk about the resumption of the upward trend after buyers regain control of the resistance of 1.2225, for which the main struggle is now underway. Only a real consolidation above this level will lead to an update of local highs in the area of 1.2275 and, quite likely, will allow you to update the area at the base of the 23rd figure, which is the key target of the bulls for this week.

GBP: The British pound continues to push in the side channel, having failed to overcome the morning levels. The immediate target of the bears is to break through the support of 1.3350, which will lead to a new major sale of GBPUSD already in the area of the minimum of 1.3240. The longer-term target of the bears will be the area of 1.2190 and the minimum of December this year - 1.2135. It will be possible to talk about the suspension of the bear market only after buyers regain the resistance of 1.3435, from which it will be possible to observe a sharp jump in the pound to the opening level of the day of 1.3525.

The data released today on the UK GDP for the 3rd quarter of this year, which were revised for the better, supported the pound. The revision was due to stronger growth in consumer spending than previously expected. According to the data, in the 3rd quarter of 2020, compared to the 2nd quarter, UK GDP grew by 16%. The initial estimate was 15.5%. However, despite this, at the end of the 3rd quarter, the UK economy is still 8.6% smaller than at the end of 2019.

As for the state of the UK budget, it continued to deteriorate in November this year. The impact of the coronavirus pandemic and restrictive measures have had a negative impact on the budget, as net borrowing by the public sector has increased strongly again. The report shows that the increase in borrowing amounted to 31.6 billion pounds against 22.3 billion pounds in October. Economists had expected borrowing to reach 28 billion pounds in November. The budget deficit will continue to grow further due to serious spending to support the economy during the coronavirus period. The measures taken by the government to support companies affected by COVID-19 will only increase spending in the future.

As for Brexit, everything is still in limbo. Let me remind you that yesterday, British Prime Minister Boris Johnson made a proposal to the EU, which should reduce the catch of fish in UK waters by about a third. Last week, the UK insisted that the EU agree to a 60% cut in production. Let me remind you that the last of the EU conditions was only a 25% reduction, but even such a proposal did not suit France and Denmark, which can easily block the trade agreement since initially it was only about 18%. The European Commission said that before giving a response to the UK's proposal, it is necessary to discuss this with the heads of those European governments that have a large fishing industry.