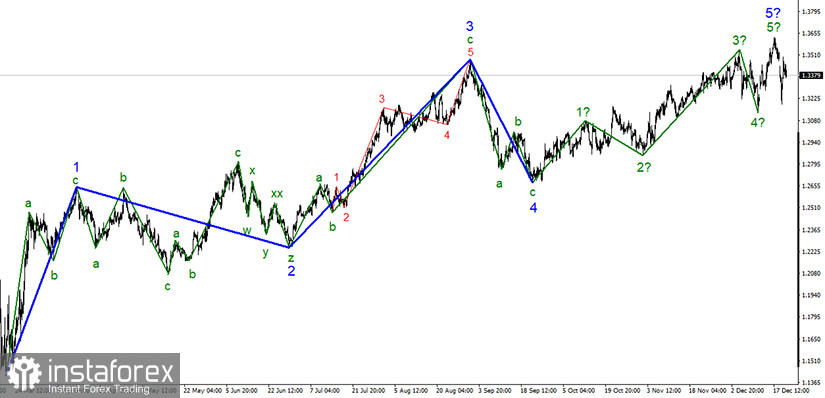

The section of the trend, which originates on September 23, finally took a five-wave form. With that, the view is quite complete. Of course, the wave layout can become more complicated once again, as it has done more than once. However, at the moment, everything looks like a complete wave structure. If this is indeed the case, then the decline in quotes will continue within the new downward trend section with targets located near the 30th figure, and possibly lower.

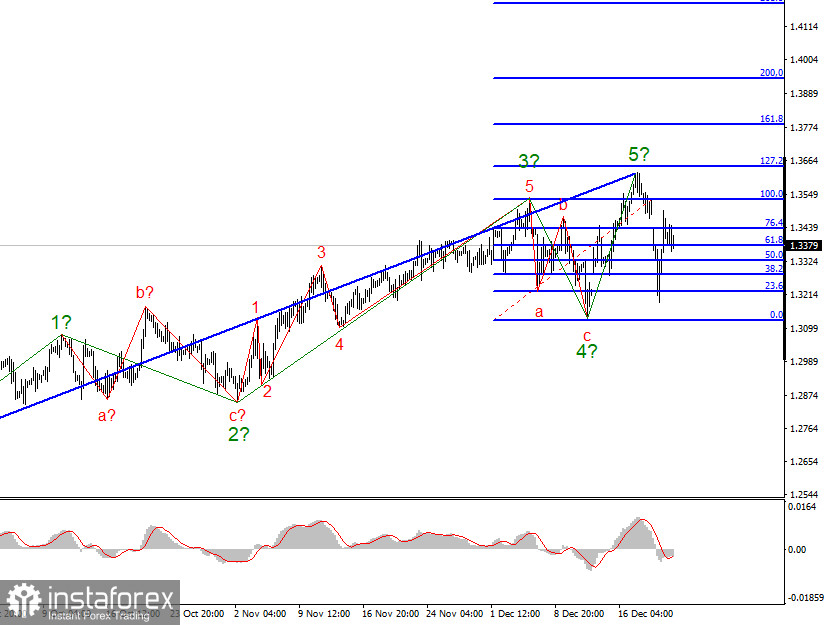

The lower chart clearly shows the wave 5-5 of the upward trend section, which updated the maximum of the previous wave 3.Thus, the construction of the upward trend section can be completed. If this assumption is correct, then the decline in quotes will continue within the expected wave a. Until a successful attempt to break the maximum of the current wave 5-5, the working option will be the option with the construction of a downward trend section.

The British pound is again under market pressure due to the lack of progress in trade negotiations between London and Brussels. And at the moment, the news background and wave markup coincide. The wave pattern assumes the construction of a downward section of the trend since the upward one looks complete, and the news background suggests a decline in the British dollar since there are no reasons for its increase for a long time. Nevertheless, the pound has been in high demand lately. But what can you do if Britain and the EU are unwilling to make significant concessions to each other for the sake of more – for the sake of a trade agreement that will allow them to trade without duties. After all, the trade turnover between them is almost 1 trillion dollars a year. If duties and tariffs start to take effect from January 1, it will decrease very significantly, which will be a blow to both European and British businesses. According to the latest information, the UK yesterday proposed to Michel Barnier and the European Union to reduce the volume of fish caught under quotas by 30%. However, the European Union refused, so there is still little chance of reaching an agreement. The parties seem to be moving towards each other, however, they do not have time. The markets understand this and are no longer buying the pound simply because they are waiting for an agreement to be concluded. Well, the latest news about a new strain of coronavirus can not but affect the exchange rate of the British currency, as this means a new fall in the British economy. Also today, the UK released a report on GDP, which also turned out to be better than the markets expected. In the morning, the pound rose slightly, in the afternoon - the dollar, which received support from its GDP report. Everything is logical.

General conclusions and recommendations:

The pound/dollar instrument has presumably started building a new downward trend section. Thus, I currently recommend selling the pound/dollar instrument on each MACD signal "down" with targets located around 31st and 30th figures, within the expected first wave of a new downward trend section. A successful attempt to break the maximum of the wave 5-5 will indicate the readiness of traders for new purchases of the British and cancel the option of building a new downward trend.