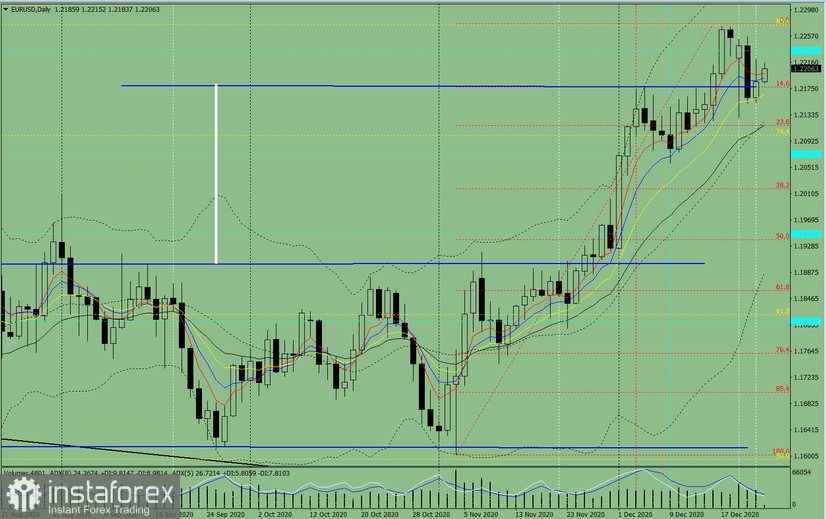

Trend analysis (Fig. 1)

Today, the market from the level of 1.2186 (closing of yesterday's daily candle) will try to continue moving upwards to the target of 1.2234 – the historical resistance level (blue dotted line). After testing this level, the upward movement may continue to the next target of 1.2274 – the pullback level of 85.4% (yellow dashed line).

Figure 1 (daily chart)

Comprehensive analysis:

- Indicator analysis - up

- Fibonacci levels - up

- Volumes - up

- Candlestick analysis - down

- Trend analysis - up

- Bollinger lines - up

- Weekly chart - up

General conclusion:

Today, the market from the level of 1.2186 (closing of yesterday's daily candle) will likely continue rising to the target of 1.2234 – the historical resistance level (blue dotted line). Upon testing this level, the upward movement may continue to the next target of 1.2274 – the pullback level of 85.4% (yellow dashed line).

An alternative scenario: the market from the level of 1.2198 (closing of yesterday's daily candle) may continue to move upwards and reach the target of 1.2234 – the historical resistance level (blue dotted line). After testing this level, a downward pullback is possible towards the target of 1.2177 – a pullback level of 14.6% (red dotted line).